Tasman District

Council

Agenda – 27 May 2025

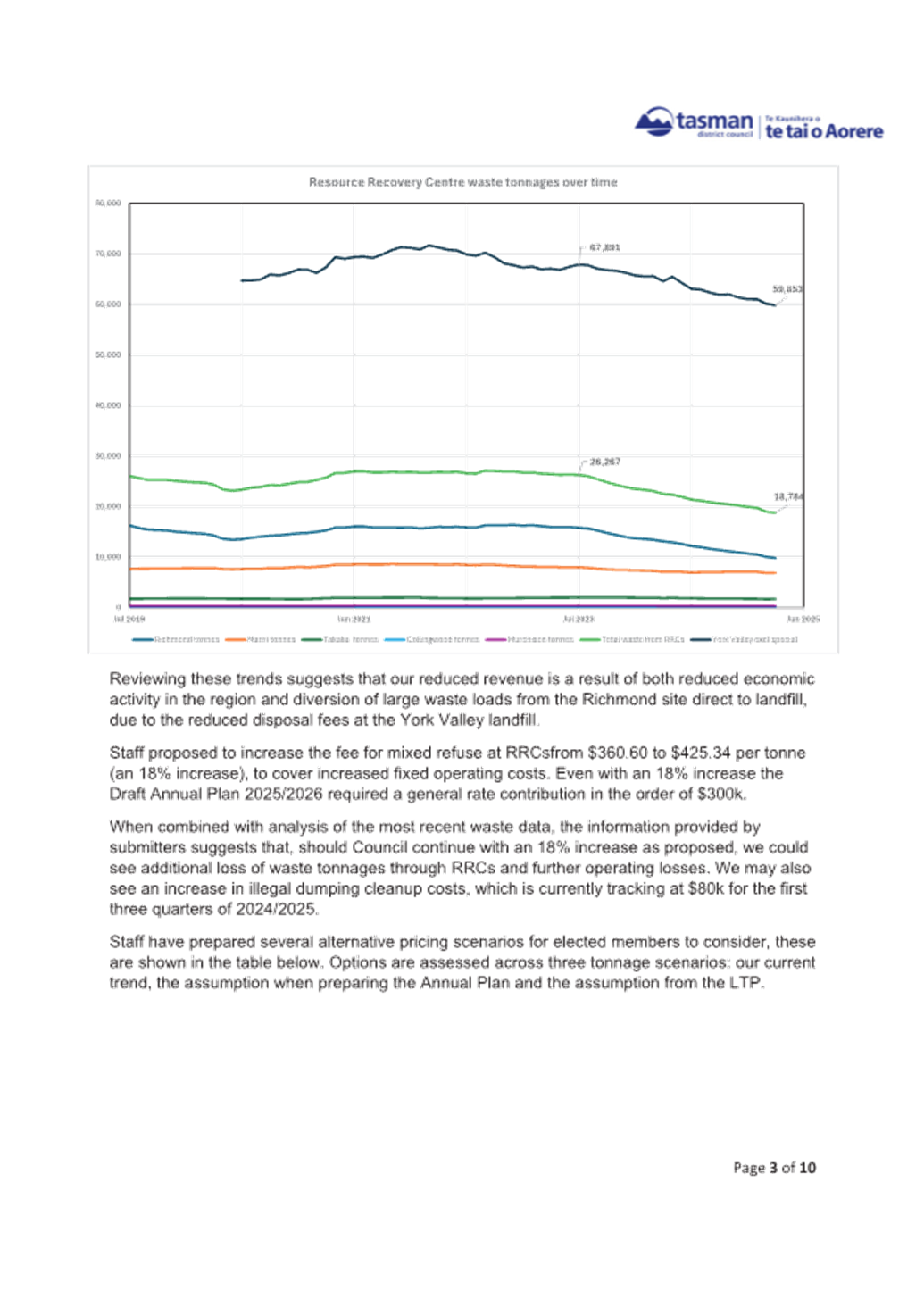

7 Reports

7.1

Draft Development and Financial

Contributions Policy Deliberations

Decision Required

|

Report

To:

|

Tasman

District Council

|

|

Meeting

Date:

|

27

May 2025

|

|

Report

Author:

|

Brylee

Wayman, Senior Community Policy Advisor - Data Analyst; Dwayne Fletcher,

Strategic Policy Manager

|

|

Report

Authorisers:

|

John

Ridd, Group Manager - Service and Strategy

|

|

Report

Number:

|

RCN25-05-21

|

1. Purpose

of the Report / Te Take mō te Pūrongo

1.1 The

purpose of the report is to assist the Council in deliberating on the feedback

received during public consultation on the Draft Development and Financial

Contributions Policy 2024-2034 (2025 Review) (the Policy).

1.2 This

report is also to enable the Council to make decisions on changes to the

Policy.

2. Summary

/ Te Tuhinga Whakarāpoto

2.1 The Development and Financial

Contributions Policy outlines the Council’s approach to funding

development infrastructure via development contributions under the Local

Government Act 2002 (LGA) and financial contributions under the Tasman Resource

Management Plan. During deliberations on the Development and

Financial Contributions Policy 2024-2034, the Council resolved to conduct a

further review of the Policy in 2025. The 2025 review proposed two notable

changes for the Policy, regarding stormwater detention discounts and remissions

for developments on Māori land, and several minor administrative

amendments to the Policy.

2.2 Public

consultation on the 2025 Review of the Policy was open from 24 March to 28

April 2025. A total of 13 submissions were received. There were no late

submissions.

2.3 At

the public hearing on 16 May 2025, seven submitters verbally presented their

submissions on the Policy to the Council.

2.4 In

this report, staff summarise the feedback received and provide advice on

specific issues raised by submitters.

2.5 The

majority of submitters gave feedback on the two notable changes.

2.6 Staff have considered public feedback and recommend

proceeding with the proposed changes.

2.7 Staff

will prepare the final Policy for adoption at the Council meeting on 25 June

2025.

3. Recommendation/s

/ Ngā Tūtohunga

That the Tasman District Council

1. receives

the Draft Development and Financial Contributions Policy Deliberations report, RCN25-05-21;

and

2. notes

the submissions received on the Draft Development and Financial Contributions

Policy 2024-2034 (2025 Review); and

3. agrees

to proceed with the proposed changes in the Draft Development and Financial

Contributions Policy 2024-2034 (2025 Review); and

4. notes

that the Council will be presented with the Development and Financial

Contributions Policy 2024-2034 (2025 Review) for adoption at its meeting on 25

June 2025 and the Policy will come into effect from 1 July 2025.

4.1 The

Development and Financial Contributions Policy outlines the Council’s

approach to funding development infrastructure via development contributions

under the LGA and financial contributions under the Tasman Resource Management

Plan.

4.2 Section 106(6) of the LGA requires the

Policy to be reviewed at least once every three years using a consultation

process that gives effect to the requirements of section 82.

4.3 Following consultation on the

Development and Financial Contributions Policy 2024-2034, the Council concluded

that there were matters raised that warranted further engagement and resolved

to conduct a further review of the Policy in 2025.

4.4 On 20 March 2025, the Council approved the Draft Development and

Financial Contributions Policy 2024-2034 (2025 Review) for consultation. The

2025 review of the Policy includes two notable changes proposed for the Policy,

which relate to the criteria for stormwater detention discounts and the

remissions for developments on Māori land. There are also some minor

administrative amendments to the Policy. There are no changes proposed to the

Development Contribution charges.

4.5 The Policy, including the charges, will

be reviewed again in 2026/2027, as part of the 2027 Long Term Plan, and will

also consider any changes to legislation, national policies, and the Tasman

Resource Management Plan. On 28 February 2025, the Government announced that

development contributions will be replaced by a new development levy system.

The timeline to finalise and implement these changes is not yet confirmed, but

implementation is likely to be two-five years away.

4.6 The

consultation period for the Draft Development and Financial Contributions

Policy 2024 – 2034 (2025 Review) was open between 24 March and 28 April

2005. We received 13 submissions.

4.7 At

the public hearing on 16 May 2025, seven submitters verbally presented their

submissions on the Policy to the Council.

5. Analysis

and Advice / Tātaritanga me ngā tohutohu

5.1 We received 13 submissions. The

majority of submitters gave feedback on the two notable changes proposed for

the Policy, which relate to the criteria for stormwater detention discounts and

the remissions for developments on Māori land (eight submissions each). Two submissions related to minor administrative changes and three

submissions related to the timing and need for the 2025 review of the Policy.

Two submissions also provided feedback on another aspect of the Policy.

Stormwater Detention Discounts

5.2 The proposed change is to limit the

provision of a discount on Stormwater Development Contributions to apply only

to development in the Richmond Intensive Development Area, for developments

which detain primary stormwater to the maximum allowed under Nelson Tasman Land

Development Manual (NTLDM) standards (25% discount would apply).

5.3 Several submitters (34712, 34718 and

34773) suggested a greater differential in development contributions be applied

between dispersed greenfield development and infill, intensive development,

particularly in Richmond.

Staff advice

5.3.1 The Council noted similar feedback during

consultation on the Policy in 2024 and recommended investigating this in

the next triennial review of the Development and Financial Contributions Policy

(scheduled for 2026/2027). That review will also consider a change to the

geographic area eligible for a discount to align with zoning changes in the Tasman

Resource Management Plan, such as the Medium Density Residential Zone which has

been proposed by Plan Change 81. A review of the catchment

boundaries for Development Contributions charges may also result in a

differential between greenfield and infill developments in Richmond.

5.4 Two submitters (34829 and

34830) opposed the change to the current stormwater discount policy. They

suggest developers who install and maintain their own permanent stormwater

detention systems should not have to pay full Development Contributions. They also

suggest that not all developments benefit equally from Council stormwater

networks and a blanket full charge is inappropriate.

Staff advice

5.4.1 As outlined in the consultation material,

the Council has significant investment for stormwater management that is

required to manage the effects of growth, including overland flows, even with

the provision of some on-site stormwater detention. Even with detention, total

run off still increases, which increases total flows downstream, and can still

result in cumulative peak flows increasing. The development areas served by the

Council’s stormwater upgrades are likely to require complimentary detention

to maximise the capacity for growth from these upgrades.

5.4.2 The LGA allows for a common charge to be set

across a grouped geographic area of development, provided the grouping is done

in a manner that balances practical and administrative efficiencies with

considerations of fairness and equity. However, subject to changes in central

government legislation, staff will review the current catchment boundaries as

part of the next review with the 2027 Long Term Plan to ensure the groupings

and charges are appropriate.

5.5 Submitter 34810 suggested the discount

should still apply if temporary or permanent detention was required due to a

delay in Council upgrades to the stormwater network.

Staff advice

5.5.1 Staff do not support this as the Council

would still incur the cost of the longer-term infrastructure solution but

without the full income from development contributions needed to fund that

investment. If a developer develops ahead of the Council’s infrastructure

programme, it will need to fund the infrastructure costs, unless the services

are covered by a development agreement.

5.6 Two

submitters (34802 and 34811) do not support any discount being provided as this

shifts the costs on to others and is not consistent with the fairness and

equity principle of Development Contributions.

Staff advice

5.6.1 Staff recommend investigating changes to the

Development Contributions model, when it is updated as part of the 2027 Long

Term Plan, to account for these discounts when setting the stormwater

development contributions charges.

Remissions for Development on Māori Land

5.7 In 2024, the current Policy introduced

remissions for some developments on Māori freehold land and Māori

customary land in order to meet an LGA requirement that development

contributions policies must support the principles set out in the Preamble to

Te Ture Whenua Māori Act 1993, namely removing or reducing the barriers to

development and full utilisation of the land for the benefit of Māori

landowners, their whānau, and their hapū.

5.8 The proposed change is to extend the

criteria to papakāinga developments on general land held in collective

Māori ownership, or land which has been transferred from the Crown to, and

is held by, a post settlement governance entity as a result of a treaty

settlement. However, the proposed remission is reduced to 50%, at the

Council’s discretion, rather than a full remission of development

contributions for those developments. We also proposed the removal of

the remission for developments on urupā or wāhi tapu sites, and for

any not-for-profit social, cultural, ora, or educational centre developments.

5.9 Three submitters expressed support for

the proposed changes. One of those submitters (34827) suggested the remission

for not-for-profit developments should be retained.

Staff advice

5.9.1 Staff recommend removing

not-for-profit developments, as proposed, as the extension of the criteria to

include developments on general land is a much broader criteria with a greater

risk of financial implications. At its meeting on 20 March 2025, the Council

resolved that no remissions will be provided to not-for-profit community

facilities in general. To be consistent with this approach, the remission has

also been removed for not-for-profit developments on general land in collective

Māori ownership.

5.10 One submitter (34802)

wanted to limit the remission to developments on Māori land, not

development on all land. The Te Ture Whenua Māori Act 1993 defines

Māori land as Māori freehold and customary land.

Staff advice

5.10.1 There is no

developable Māori customary land in the Tasman District and 21 Māori

freehold land titles, most of which is in rural

areas and not likely to be developed or be subject to development contributions

charges (other than transportation). Limiting the criteria to these land

statuses is unlikely to facilitate actual development. Staff recommend proceeding

with the proposed change to extend the criteria to other types of land.

5.11 Submitter 34810 recommended using the Te Ture

Whenua Māori Act 1993 definition of general land owned by Māori. This

means “General land that is owned for a beneficial estate in fee simple

by a Māori or by a group of persons of whom a majority are

Māori.”

Staff advice

5.11.1 Staff recommend keeping the criteria as

general land held in collective Māori ownership to keep consistency with

the remissions provided for other community housing developments. These

remissions are not available for developments on land owned by an individual.

5.12 Submitter 34773 requested the remission be extended

to community housing providers. Submitter 34811 opposef the changes to the

Policy, noting that Development Contributions are a financial barrier for all

residents, and the provision of remissions for papakāinga developments on

Māori land undermines the principles of fairness and equity.

Staff advice

5.12.1 The current Policy provides full remissions

for a list of community housing providers, and any community housing provider

registered with the Community Housing Regulatory Authority.

5.12.2 Staff note that the current Policy provides

a full 100% remission to these developments, meaning there is some

inconsistency with the remission for papakāinga developments.

5.12.3 The remission for community housing

providers is an area that could be reviewed during the next review in

2026/2027. It is out of scope for the changes we have consulted on in this

review.

5.13 Submitter 34818 raised concerns about the remission

applying to the Wakatū Motueka West Development.

Staff advice

5.13.1 This development is not proposed to be a

papakāinga development. The proposed remission for development of

Māori land will not apply to this development. However, parts of the

development may be undertaken by registered community housing providers, and

they will be able to apply for the existing community housing remission.

5.14 Staff note that central government intends to consult soon on a National Environmental Standard (NES)

on papakāinga. The NES will introduce a nationally consistent definition

for papakāinga development. For now, the proposed remissions in the DC

Policy will apply to papakāinga using the current TRMP definition,

although the Council has discretion to consider other factors. We will look to

align with the NES definition in the next review of the Policy. The intention

is that the remissions will apply to papakāinga developments that have

been permitted or consented under national and district planning rules (and

subject to the other remission criteria and considerations in the Policy).

5.15 Overall, staff consider that the proposed changes

strike a balance between supporting the principles set out in the Preamble to

Te Ture Whenua Māori Act 1993, to reduce the barriers to development, and

supporting the LGA principles of fairness and equity for development

contributions on different types of developments.

Other Minor Amendments

5.16 Submitter 34809 expressed support for the change to

clarify which version of the Policy applies when a consent is varied. They also

suggested changes to the Policy in terms of the timing for payments (to be

after the relevant consent/authorisation is exercised) and refunds (to be paid

immediately if the consent is surrendered).

Staff advice

5.16.1 Section 198 of the LGA states the Council

may require a development contribution when a resource or building consent is

granted. Table 4 of the current Policy specifies the timing of invoices for

each type of consent/authorisation. Invoices for development contributions for

subdivision resource consents are not issued until the time of a section 224

application, when any necessary physical works have usually been completed in

exercising the consent. Invoices for building consents and land use resource

consents are issued at the time the consent is granted. The Council previously

tried timing the payment of building consent development contributions to be

closer to the issuing of Code Compliance Certificate (CCC) but found this

process was administratively complex and risked missing some consents. Clauses

76-79 of the Policy provide options for postponing the payment of development

contributions.

5.16.2 The Council can change its payment terms,

but this change will need to be made as part of a subsequent review as it is

out of scope for the changes we have consulted on in this review.

5.16.3 Clause 75 of the current Policy already

notes that Section 209 of the LGA states the circumstances where development

contributions will be refunded, or land returned.

Timing and Need for 2025 Review

5.17 Several submitters questioned the need and timing

of the 2025 review.

Staff advice

5.17.1 Following consultation on the Development

and Financial Contributions Policy 2024-2034, the Council concluded that there

were matters raised that warranted further engagement and resolved to conduct a

further review of the Policy in 2025. This review gives effect to that.

5.17.2 On 20 March 2025, the Council approved the

Draft Development and Financial Contributions Policy 2024-2034 (2025 Review)

for consultation. The consultation has complied with

the LGA, using a consultation process that gives effect

to the requirements of section 82.

6. Financial

or Budgetary Implications / Ngā Ritenga ā-Pūtea

6.1 The proposed change to limit the

criteria for the stormwater detention discount is likely to have a favourable

impact on revenue from Development Contributions. This is estimated to amount

to at least $400,000 a year in extra revenue, assuming approximately 80 new

lots/dwellings per year in the Waimea catchment would have got a 25% discount

and 15 new lots/dwellings in the Motueka catchment.

6.2 The proposed change to the remissions

for papakāinga developments could potentially reduce the revenue from

Development Contributions but is not expected to be a significant amount on an

annual basis.

6.3 These changes have not been incorporated

in the 2025/2026 Annual Plan financial information. Staff recommend

investigating changes to the Development Contributions model, when it is

updated as part of the 2027 Long Term Plan, to account for these discounts and

remissions when modelling development contributions charges and revenue.

7.1 The options are outlined in the

following table:

|

Option

|

Advantage

|

Disadvantage

|

|

1.

|

Staff recommendation

Progress with the proposed changes to the policy and not

make any amendments in response to submissions. Staff will prepare the Development and Financial Contributions Policy 2024-2034 (2025

Review) for approval on 25 June 2025.

|

Consultation on the Policy has been undertaken in

accordance with the Local Government Act 2002, and the community’s

views were considered in the decision-making.

The new Policy can have effect from 1 July 2025.

|

This option does not allow the Council to request further

information on the Policy changes.

Some submitters may be aggrieved that

their views have not be reflected in the final policy.

|

|

2.

|

Progress with the proposed changes to the policy with

amendments in response to submissions. Staff will prepare the Development and Financial Contributions Policy 2024-2034 (2025

Review) for approval on 25 June 2025, including amendments.

|

Consultation on the Policy has been undertaken in

accordance with the Local Government Act 2002, and the community’s

views were considered in the decision-making.

The new Policy can have effect from 1 July 2025.

The other advantages with this option will depend on the

amendments proposed.

|

The public will not have an opportunity to be consulted on

any further changes made at this meeting.

If the changes are major or out of the scope of the

changes consulted on, this may breach the decision-making obligations of the

LGA.

The other disadvantages with this option will depend on

the amendments proposed.

|

|

3.

|

Seek further information from staff and/or carry out

additional consultation, which may result in further changes to the Policy.

|

Enables the Council to request more information on other

changes.

|

If substantive changes are made, the

Policy will require further public consultation.

This would mean the Final Policy would

not be adopted prior to the new financial year, and we would need to continue

providing the stormwater detention discount, resulting in a significant

funding reduction until the next Policy review.

|

|

4.

|

Make no changes to the Development and Financial Contributions Policy 2024-2034.

|

This would satisfy the requests of some

submitters who opposed changes to the Policy.

|

This could damage the Council’s

relationship with iwi as we made a commitment to review the remissions for

development on Māori land this year.

Stormwater detention discount would still

apply, resulting in a significant funding reduction until the next Policy

review.

|

7.2 Option 1 is recommended.

8.1 Section 106(6) of the LGA requires the

Policy to be reviewed at least once every three years using a consultation

process that gives effect to the requirements of section 82. Staff consider

that we have meet this obligation, having:

· consulted using a process similar to the

Special Consultative Procedure, making the consultation material as widely

available as is reasonably practicable and providing an opportunity for persons

to present their views to the Council; and

· notified parties we think have an interest in the matters consulted

on.

8.2 Section 201 of the LGA outlines the

matters which must be included in the Policy, including the conditions and

criteria (if any) that will apply in relation to the remission of development

contributions.

9. Iwi

Engagement / Whakawhitiwhiti ā-Hapori Māori

9.1 The changes to remissions for

developments on Māori land are partly in response to submissions from Iwi

that were received during consultation on the Policy in 2024.

9.2 The review and draft changes have been

communicated to Iwi Trusts at engagement hui in September and October 2024 and

by emails sent in October 2024, January 2025, and during the consultation

period.

10. Significance

and Engagement / Hiranga me te Whakawhitiwhiti ā-Hapori Whānui

10.1 At the Council meeting on 20 March 2025, the

decisions on the Policy as a whole were considered to be of low/moderate

significance.

10.2 Engagement was aligned with

the consultation on the Schedule of Fees and Charges which used a Special

Consultative Procedure. The consultation material was made as widely available

as is reasonably practicable and an opportunity was provided for persons to

present their views to the Council.

10.3 The decisions in this report are whether to

proceed with or amend the proposed changes to the Policy, as consulted on.

These decisions are considered to be of low/moderate significance overall.

|

|

Issue

|

Level of

Significance

|

Explanation of

Assessment

|

|

1.

|

Is there a high level

of public interest, or is decision likely to be controversial?

|

Low/moderate

|

The removal of

stormwater detention discounts is expected to be of high interest to the

development community.

The remission for papakāinga developments is expected to be of high interest to owners

of land in collective Māori ownership and Iwi.

|

|

2.

|

Are there impacts on

the social, economic, environmental or cultural aspects of well-being of the

community in the present or future?

|

Low/moderate

|

The retention of

stormwater detention discounts for developments in the Richmond Intensive

Development Area is expected to incentivise infill development, improving

housing supply and housing choice.

The remission for papakāinga developments will facilitate the development of papakāinga

on Māori land that has a positive impact on the social and cultural

wellbeing of residents.

|

|

3.

|

Is there a

significant impact arising from duration of the effects from the decision?

|

Low

|

The Policy is

reviewed at least every three years.

|

|

4.

|

Does the decision

relate to a strategic asset? (refer Significance and Engagement Policy for

list of strategic assets)

|

Low

|

|

|

5.

|

Does the decision

create a substantial change in the level of service provided by Council?

|

N/A

|

|

|

6.

|

Does the proposal,

activity or decision substantially affect debt, rates or Council finances in

any one year or more of the LTP?

|

Low

|

The proposed change

will have a minor or positive impact on the Councils finances.

|

|

7.

|

Does the decision

involve the sale of a substantial proportion or controlling interest in a CCO

or CCTO?

|

N/A

|

|

|

8.

|

Does the

proposal or decision involve entry into a private sector partnership or

contract to carry out the deliver on any Council group of activities?

|

N/A

|

|

|

9.

|

Does the proposal or

decision involve Council exiting from or entering into a group of

activities?

|

N/A

|

|

|

10.

|

Does the proposal

require particular consideration of the obligations of Te Mana O Te Wai

(TMOTW) relating to freshwater or particular consideration of current

legislation relating to water supply, wastewater and stormwater

infrastructure and services?

|

N/A

|

|

11. Communication

/ Whakawhitiwhiti Kōrero

11.1 The consultation material was communicated in the

usual Council channels (Shape Tasman, Newsline, social media) as well as in

newsletters to the development and building sector. Emails were sent directly

to developers, and stormwater and planning consultants.

11.2 Thirteen submissions were received, and these have

been published on our website. All submitters had the opportunity to speak to

their submission at the hearing which was held on 16 May 2025.

11.3 The

adopted Policy will be published on the Council’s website and publicised

via Newsline.

12.1 If the changes to the Policy are not approved, the

changes will be delayed until the next review in 2026/2027, as part of

developing the Long Term Plan 2027-2037.

12.2 The delay would have a financial risk as more

developments will continue to be eligible for the stormwater detention

discount.

12.3 There is a reputational risk if no changes are

made, as it may seem the review and consultation were a waste of Council

resources.

13. Climate

Change Considerations / Whakaaro

Whakaaweawe Āhuarangi

13.1 The proposed change to remove the stormwater

detention discount has considered the future impacts on the Council’s

stormwater networks from a changing climate. The proposed change aims to ensure

more funding is available for adequate investment in resilient stormwater

networks for future development.

14. Alignment

with Policy and Strategic Plans / Te Hangai ki ngā aupapa Here me ngā

Mahere Rautaki Tūraru

14.1 The proposed change to keep the stormwater

detention only for developments in the Richmond Intensive Development Area

recognises the Council’s strategic goal of intensification in

Tasman’s existing main centres, according to the Future Development

Strategy 2022-2052.

14.2 Plan Change 81 of the Tasman Resource Management

Plan (TRMP) is likely to change the areas zoned for intensification and for

papakāinga. The Policy reflects the current TRMP and will need to be

reviewed once Plan Change 81 has legal effect.

15. Conclusion

/ Kupu Whakatepe

15.1 The 2025 review of the Policy has identified

two notable changes, which relate to the criteria for stormwater detention

discounts and the remissions for developments on Māori land, as well as

several minor administrative amendments. Overall, these changes are expected to

have a favourable impact on the Council’s finances while also achieving a

positive impact on housing choice by incentivising intensification and papakāinga.

15.2 Public

consultation on the 2025 Review of the Policy was open from 24 March to 28

April 2025. A total of 13 submissions were received. There were no late

submissions.

15.3 The

majority of submitters gave feedback on the two notable changes.

15.4 Staff have considered public feedback and recommend

proceeding with the proposed changes.

16. Next

Steps and Timeline / Ngā Mahi Whai Ake

16.1 Staff

will prepare the policy for adoption on 25 June 2025, including any amendments

sought by the Council. The Policy will come into effect from 1 July 2025.

16.2 There are no changes proposed to the Development

Contribution charges, which were set on 1 July 2024 and were updated to reflect

the capital costs from the infrastructure programme in Tasman’s 10-Year

Plan 2024-2034. However, these charges will be adjusted for inflation from 1

July 2025.

16.3 The

adopted Policy and inflation-adjusted charges will be published on the

Council’s website and publicised via Newsline. The

adopted Policy and inflation-adjusted charges will be published on the

Council’s website and publicised via Newsline and newsletters to

the development and building sector. Staff will also email all submitters

with the outcomes of the Council’s decisions, and will

update developers and stormwater and planning consultants.

Nil

Tasman District

Council

Agenda – 27 May 2025

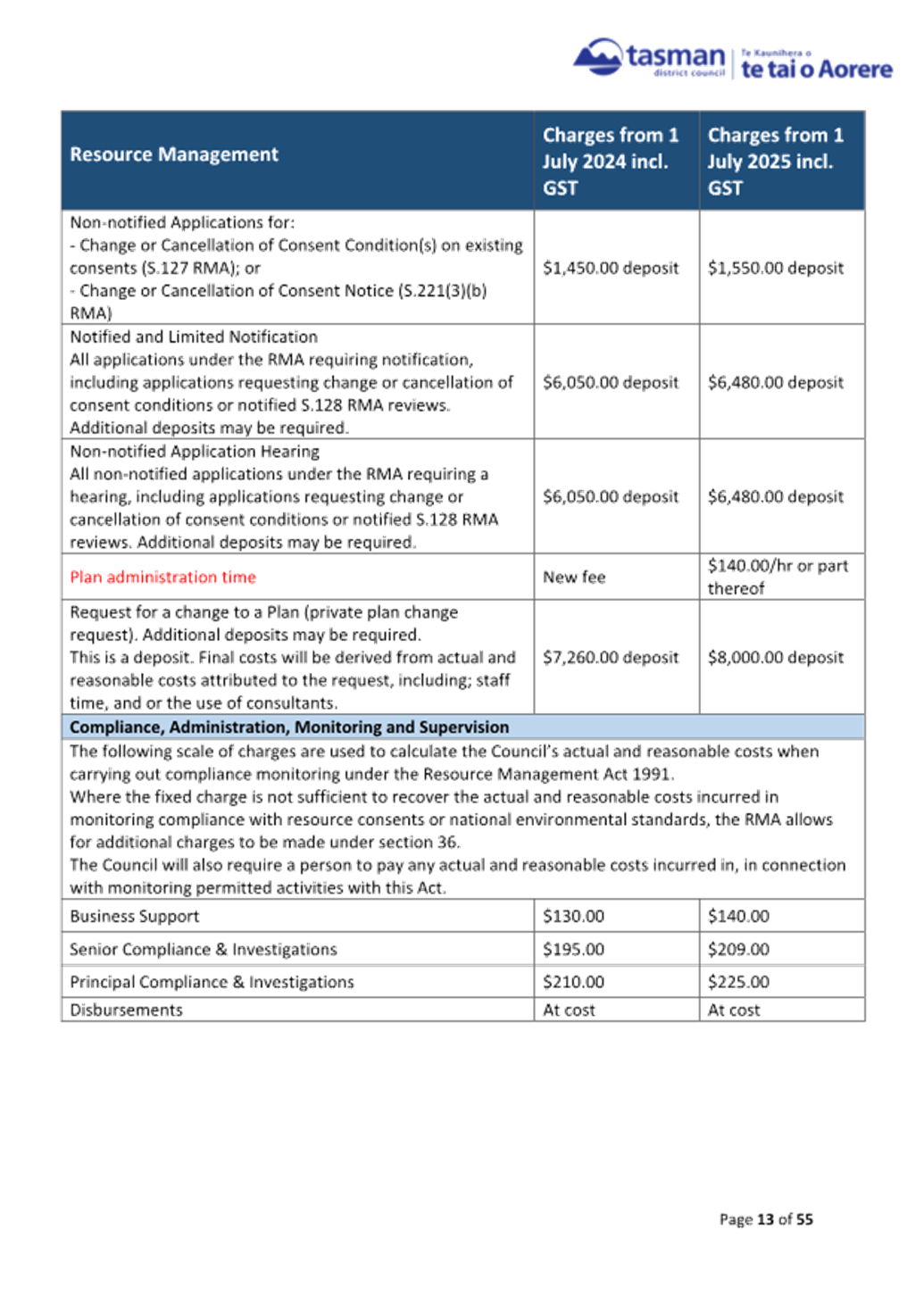

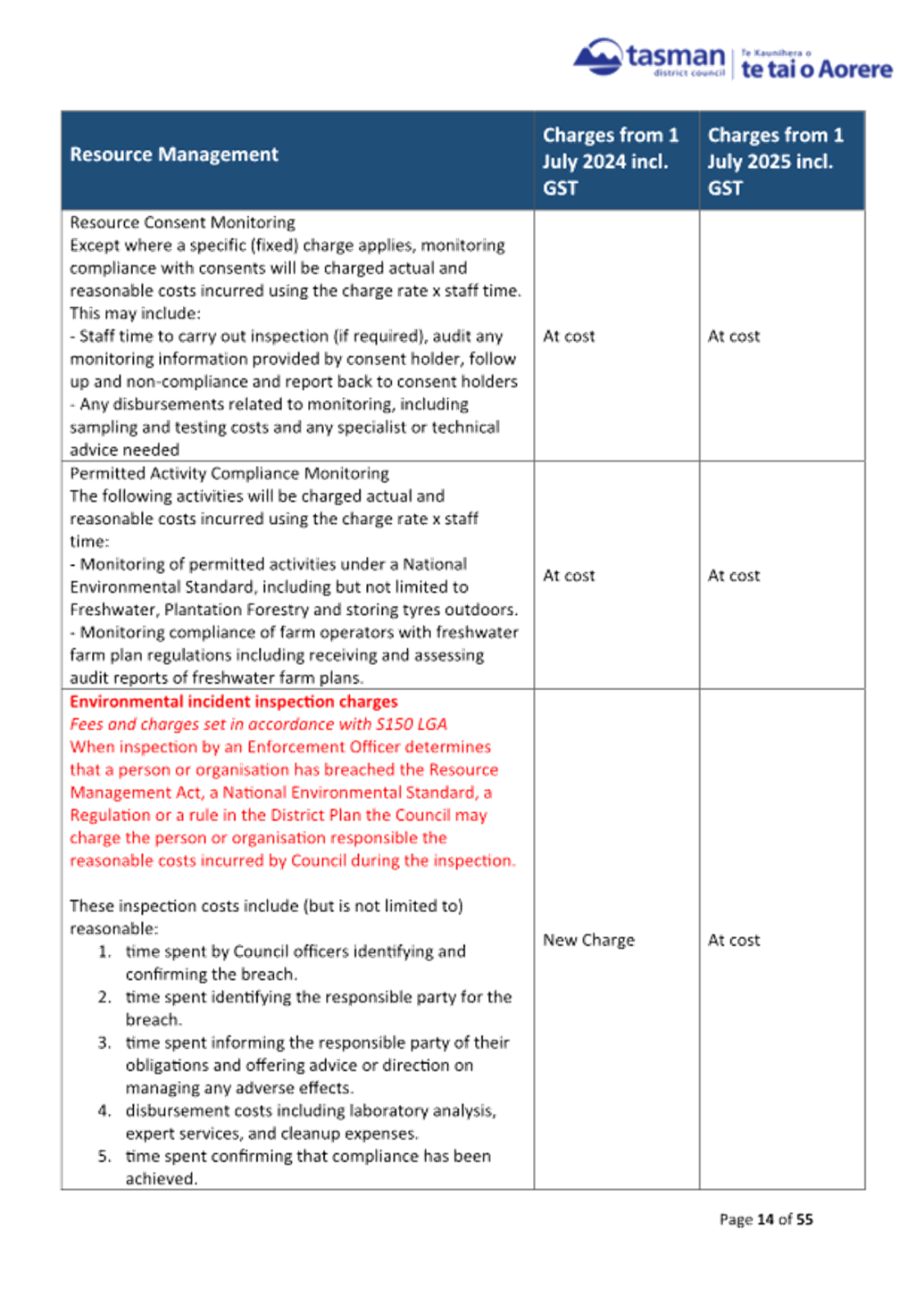

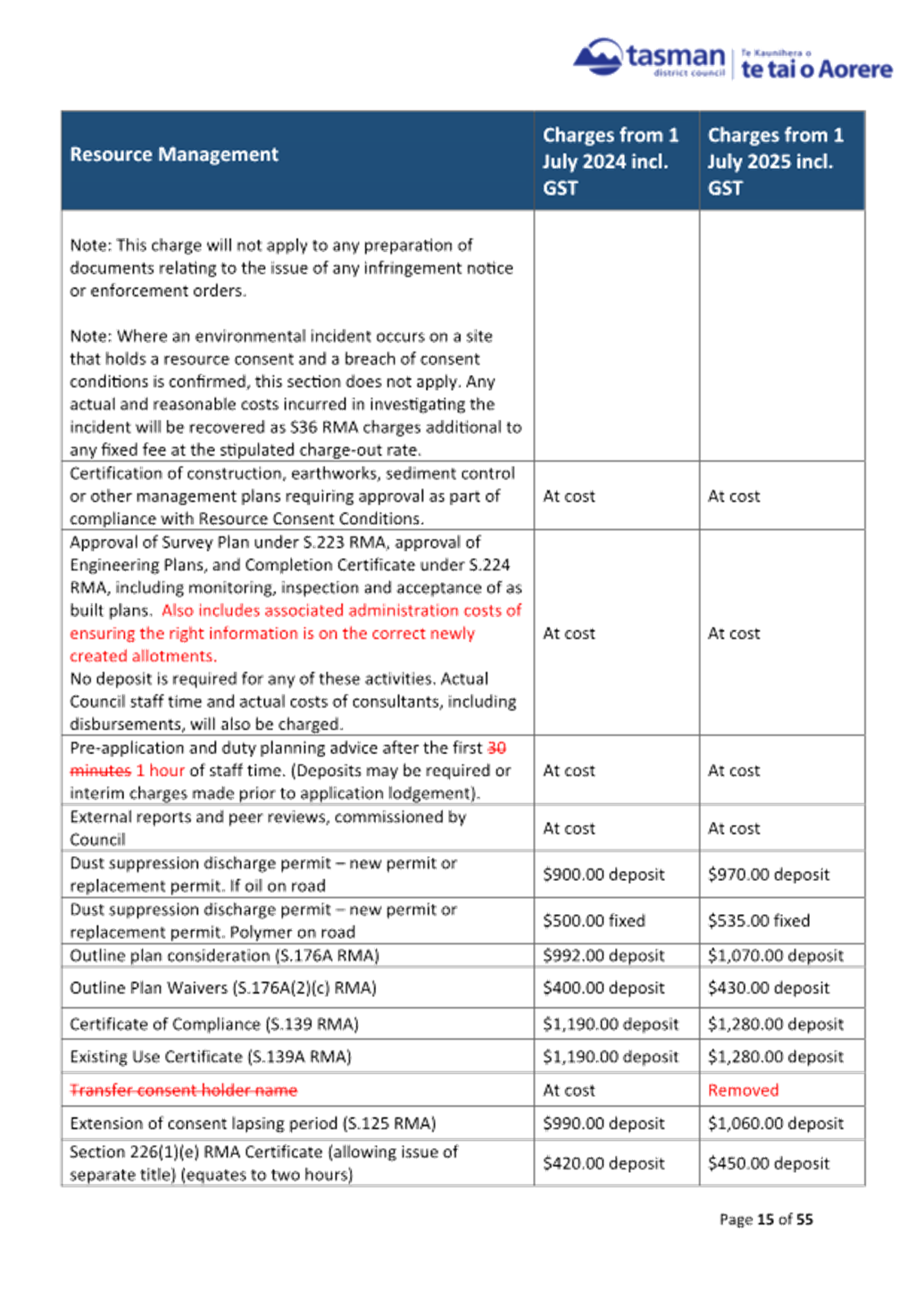

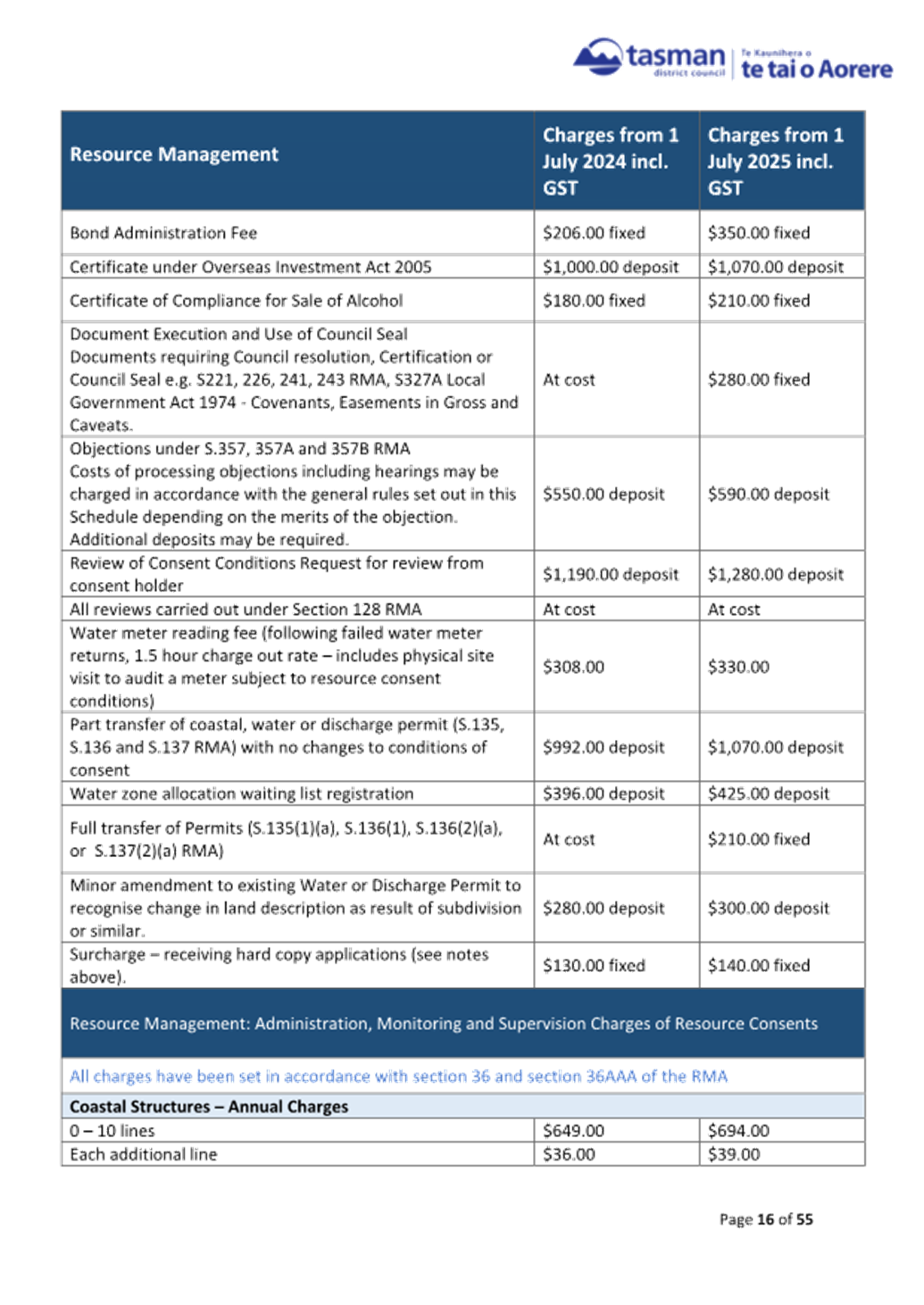

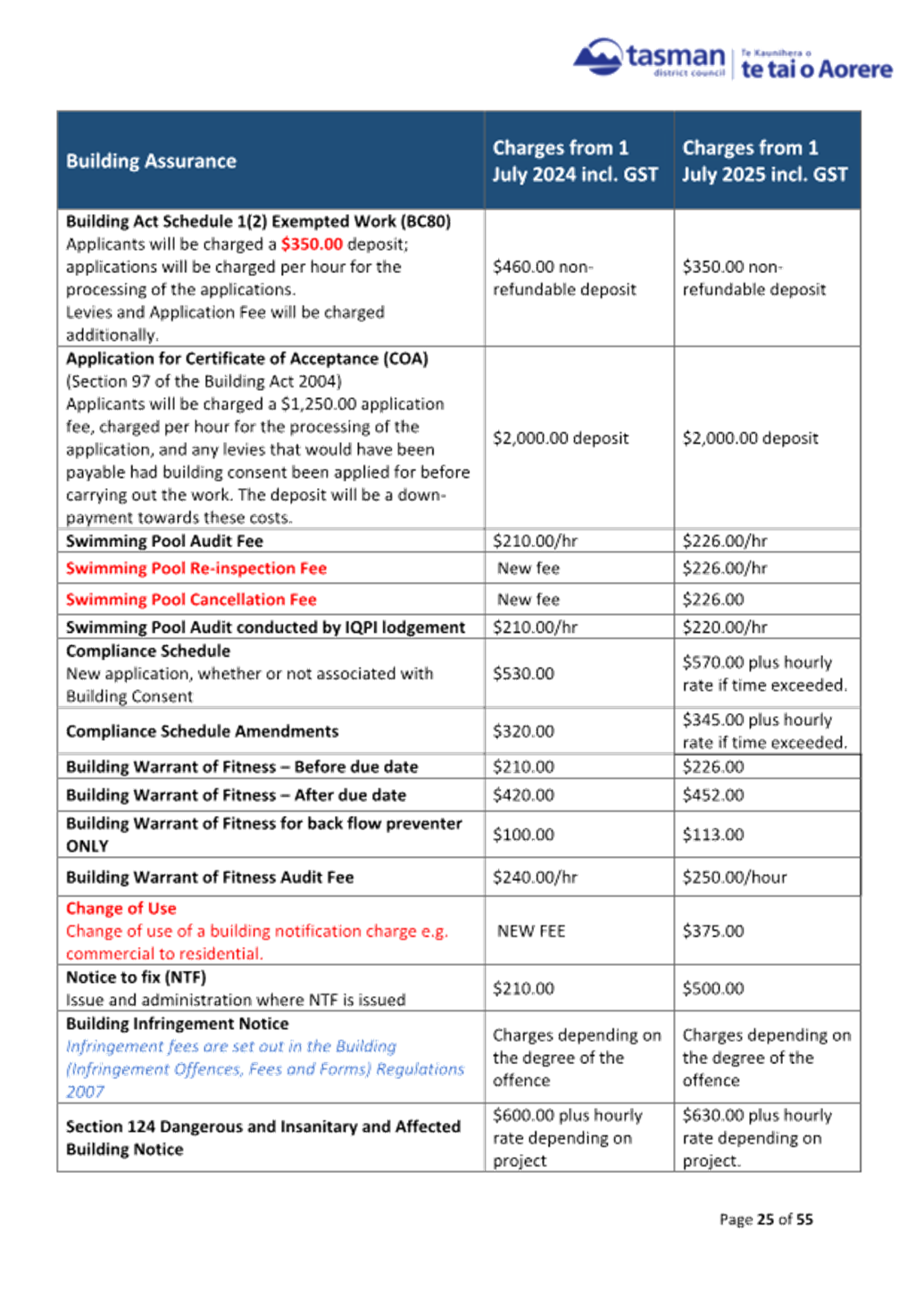

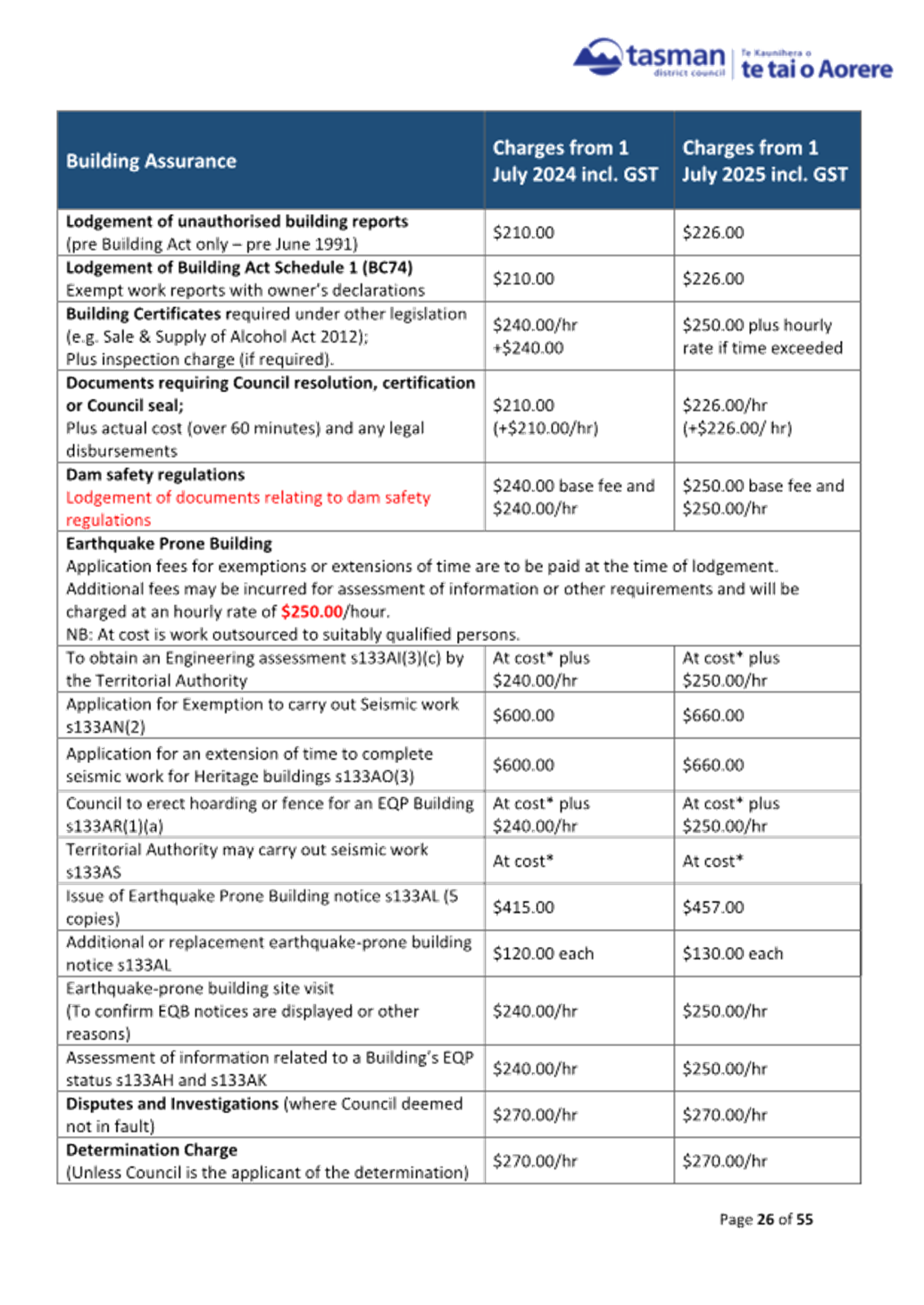

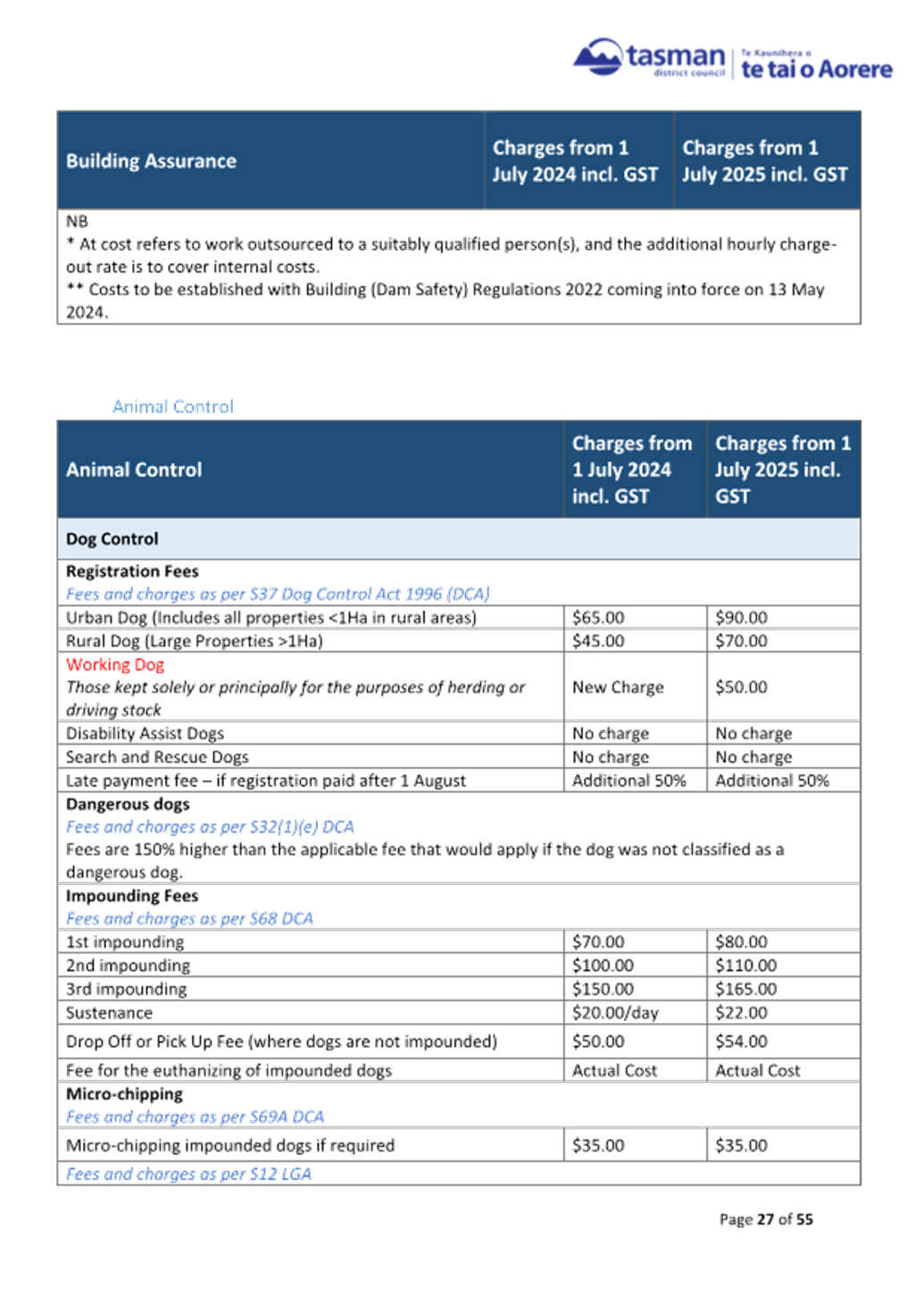

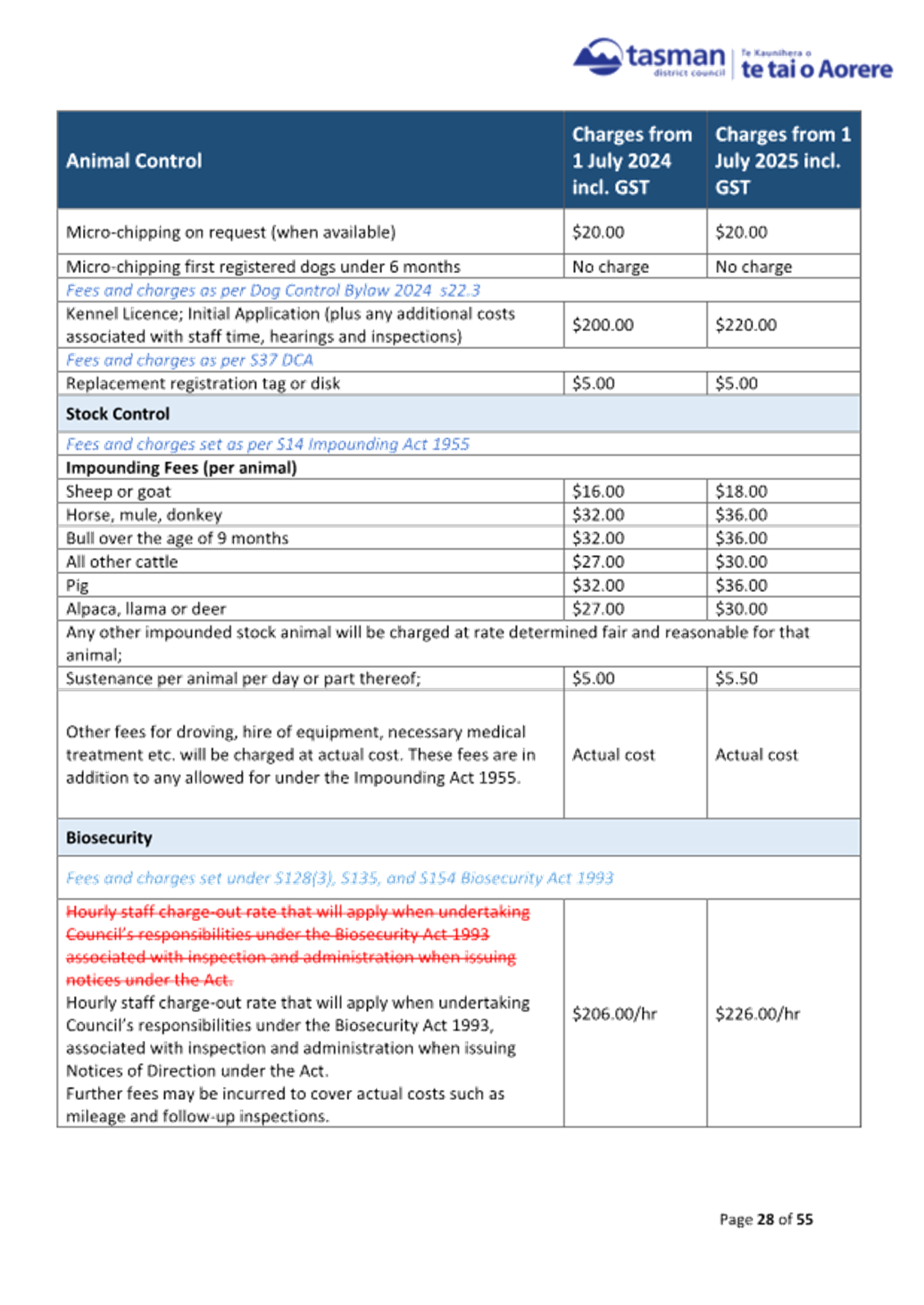

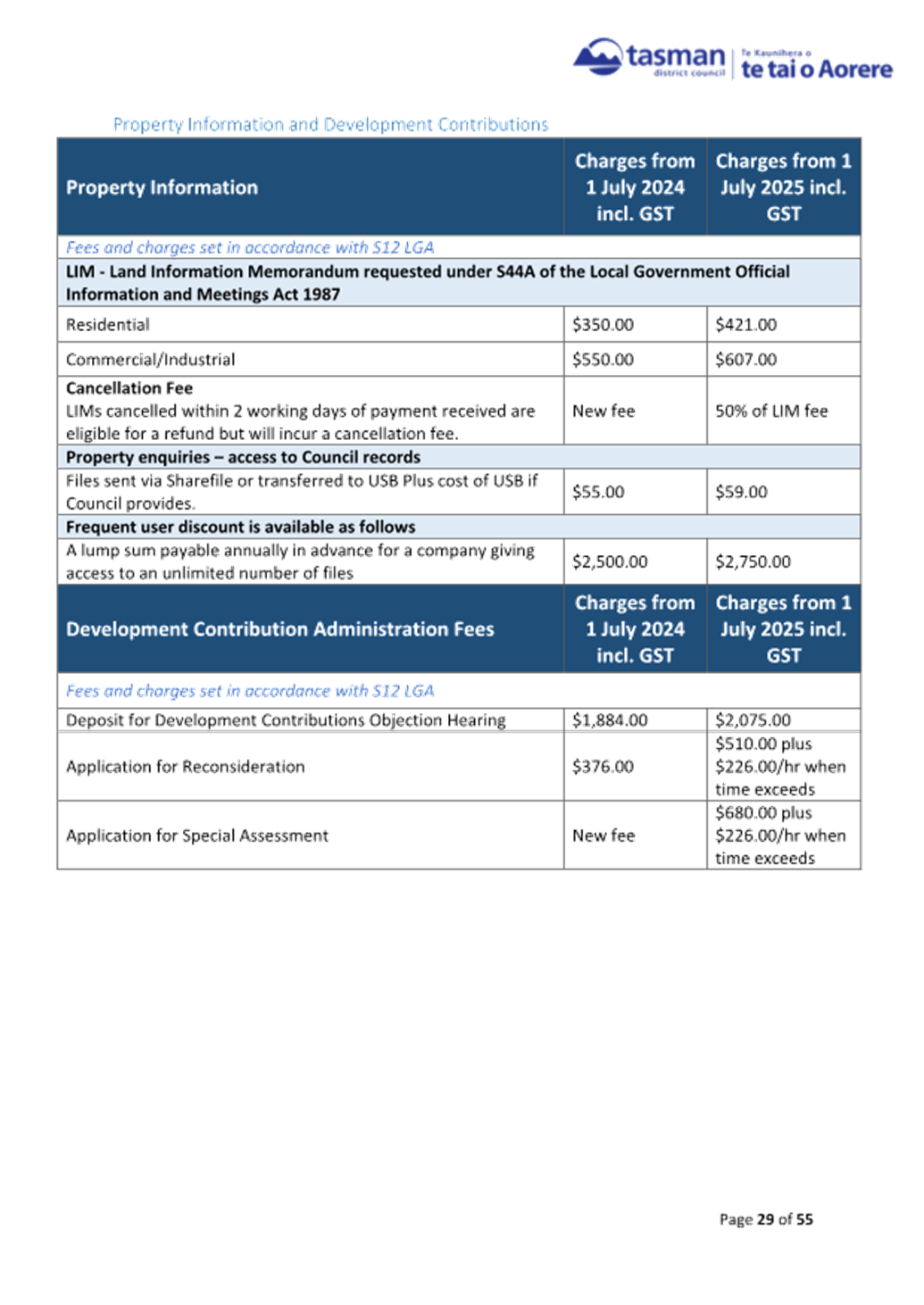

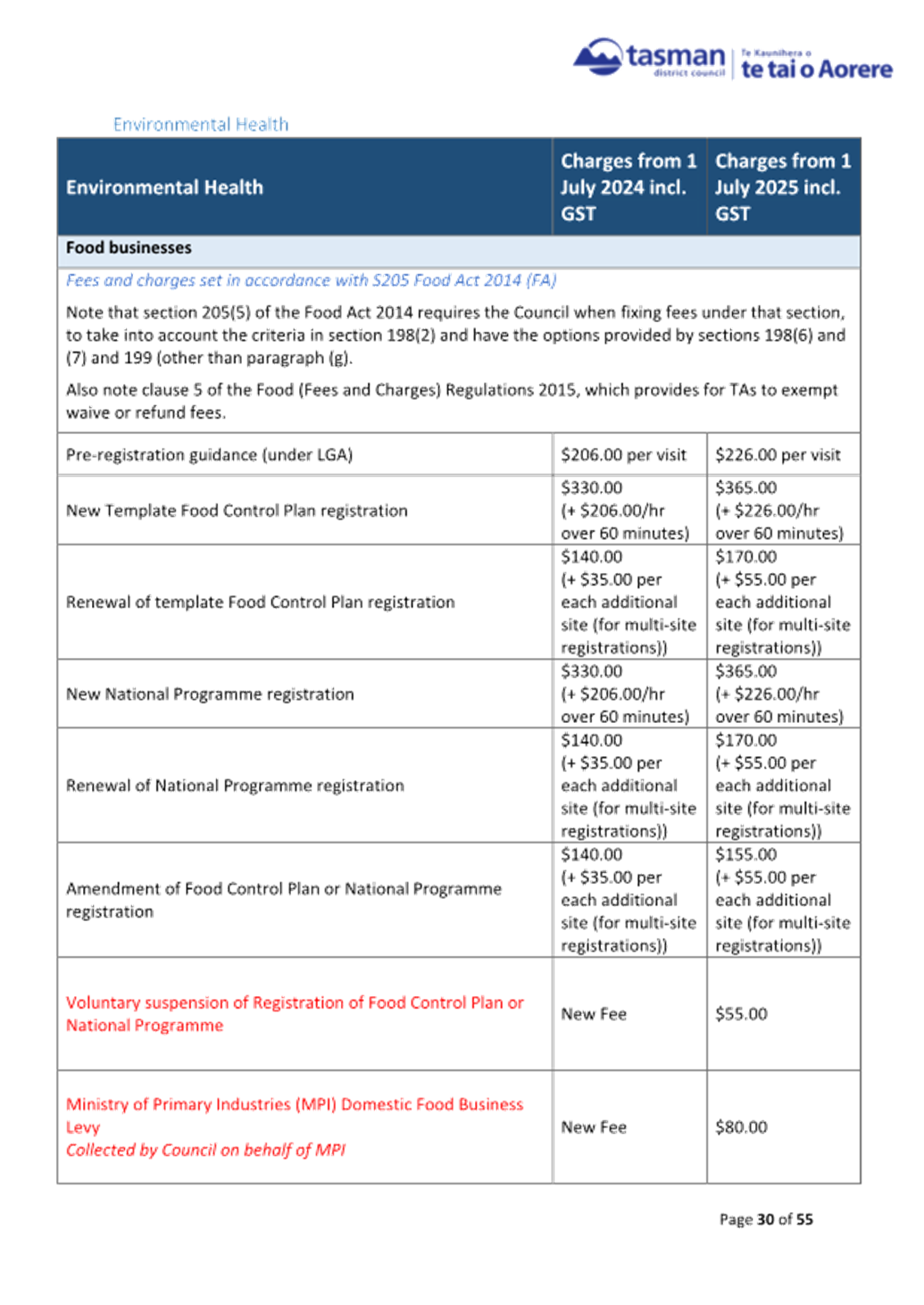

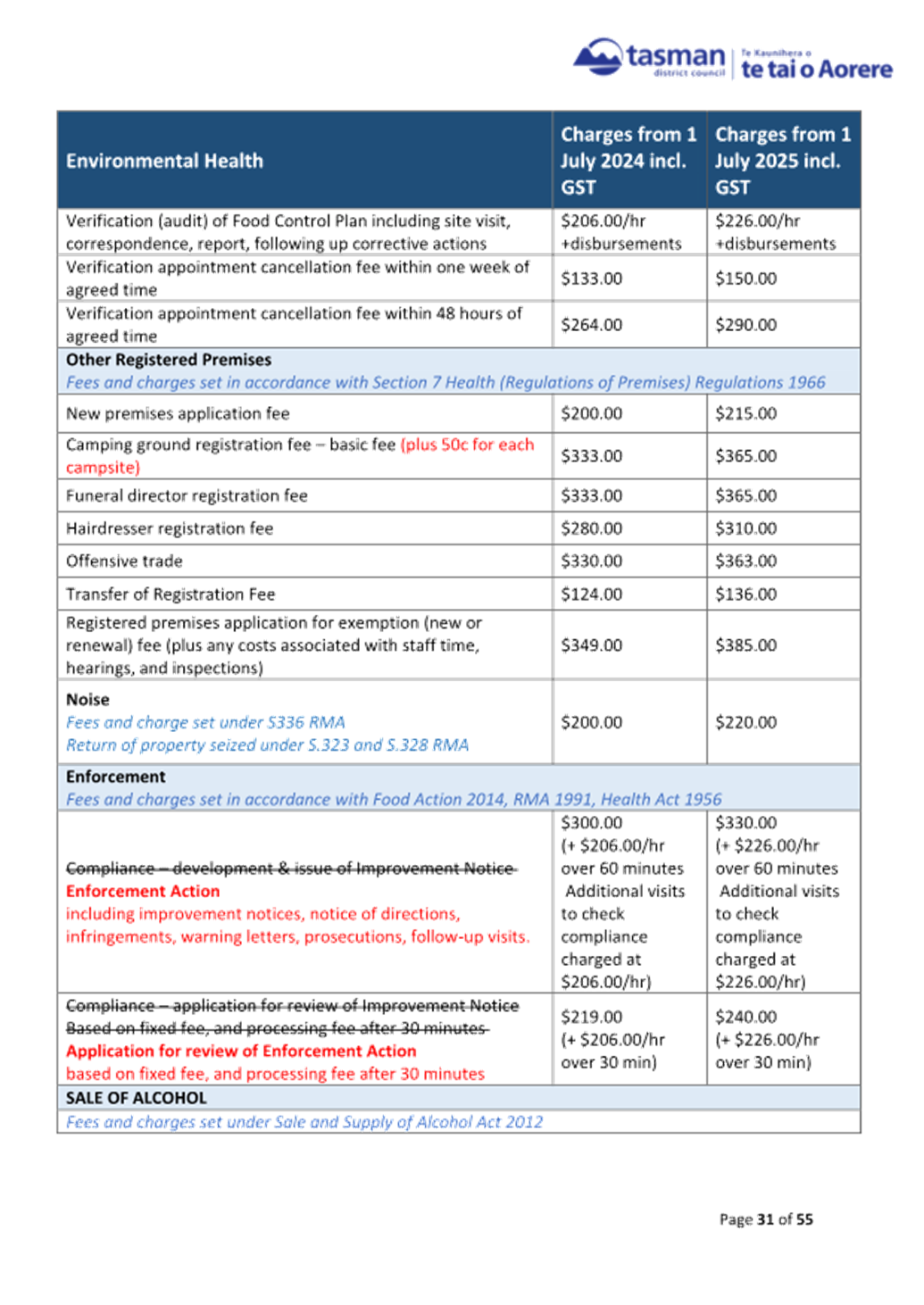

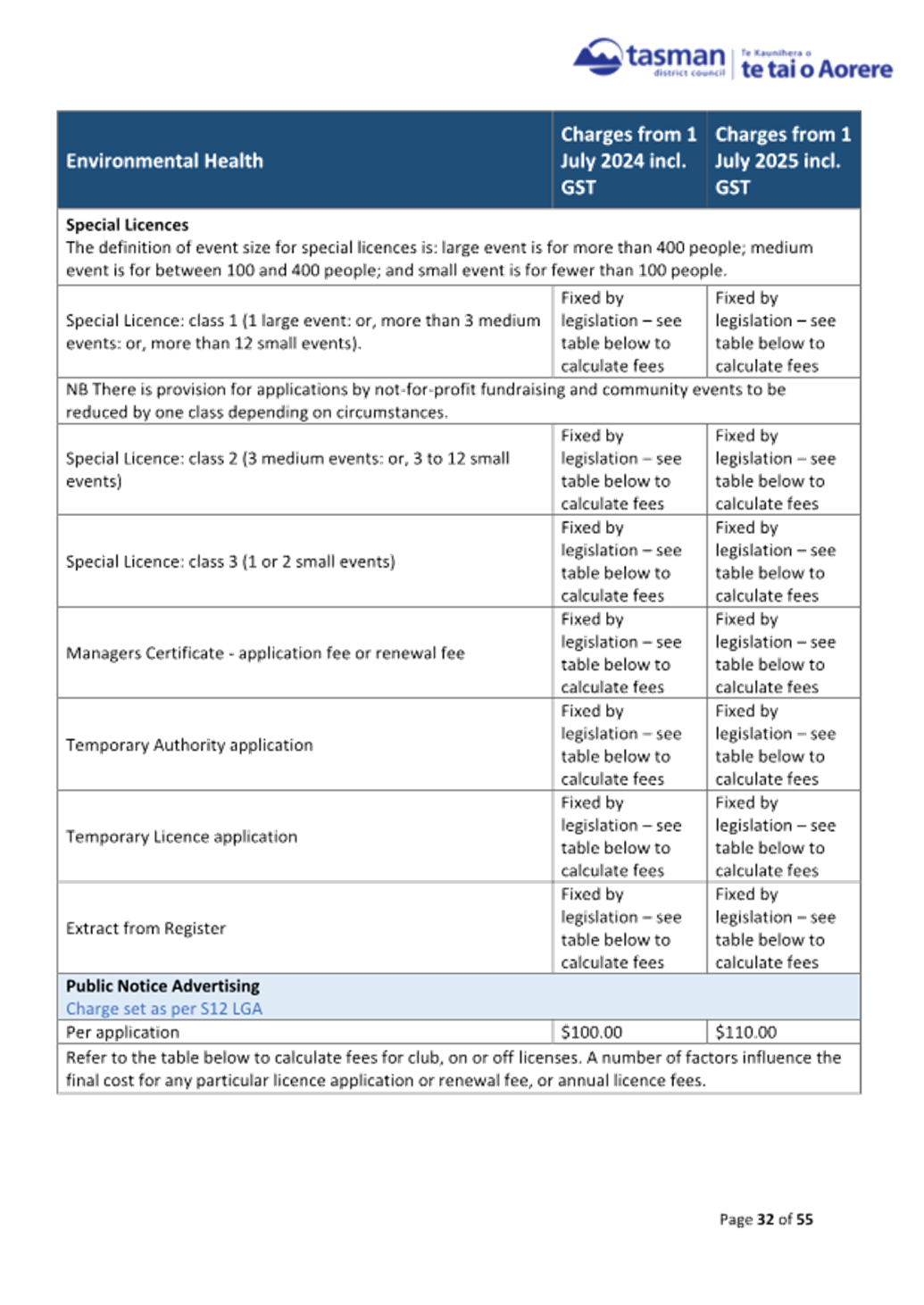

7.2 Schedule of Fees and Charges 2025/2026 -

Deliberations

Decision Required

|

Report

To:

|

Tasman

District Council

|

|

Meeting

Date:

|

27

May 2025

|

|

Report

Author:

|

Emily

Garland, Graduate Community Policy Advisor

|

|

Report

Authorisers:

|

Alan

Bywater, Team Leader - Community Policy; John Ridd, Group Manager - Service

and Strategy

|

|

Report

Number:

|

RCN25-05-22

|

1. Purpose

of the Report / Te Take mō te Pūrongo

1.1 The

purpose of the report is to assist the Council in deliberating on the feedback

received during public consultation on the Draft Schedule of Fees and Charges

2025/2026 (the Schedule).

1.2 This

report is also to enable the Council to make decisions on the Schedule.

2. Summary

/ Te Tuhinga Whakarāpoto

2.1 Public

consultation on the Schedule was open from 24 March to 28 April 2025. A total

of 63 submissions were received by the closing date. There was one late

submission received on 29 April 2025.

2.2 At

the public hearing on 16 May 2025, 13 submitters verbally presented their

submissions on the Schedule to the Council.

2.3 In

this report, staff summarise the feedback received and provide advice on

specific issues raised by submitters.

2.4 Overall,

submitters were concerned about the general increase of 10%, giving feedback

that the increase exceeds inflation, lacks justification, and

places undue strain on households and businesses.

2.5 Almost three-quarters of submitters provided feedback on the

proposed increases to dog registration fees. The majority opposed the increase,

stating it was unjustified and offered no additional benefit to dog owners.

2.6 Several

submitters opposed the proposed increases to waste disposal and recycling fees,

raising concerns about affordability and the risk of increased illegal dumping.

2.7 Six

submitters opposed the proposed Maritime fees, particularly to mooring licences

in the Māpua area, citing poor justification, lack of consultation, and

concerns about excessive costs and bureaucracy.

2.8 Submitters

gave feedback to other fee areas including Aerodrome fees and the new

environmental incident inspection charge. These are detailed, along with other

fee areas that received feedback, in the table in section 5.4 of this report.

2.9 Staff

have considered the feedback received through submissions and have made

recommendations concerning changes to the Draft Schedule.

2.10 Staff

recommend making changes to the:

· Waste disposal

charges in response to the feedback received through submissions. Staff advice

and recommended changes are detailed in Attachment 2. The recommended

change to the mixed refuse fees at Refuse Recycling Centres will require a

0.43% increase in rates revenue. This change is recommended to reverse revenue

losses at the Richmond and Māriri Resource Recovery Centres and avoid

increased instances of illegal dumping.

· The annual

monitoring and administration fee for Mooring Licences under the Maritime

section in response to submissions and to align the fee with the annual

monitoring charge for moorings under the coastal permit process.

· Removal of the

road stopping fee under the Community Infrastructure section as this fee is

already charged in the Property Services section of the Schedule.

· Description of the

property enquiry file fee as property files are not provided through USB for

security reasons.

· Gravel and Shingle

Extraction fees description, changing the mass to volume conversion from 1.8

tonne = 1 m3 to 2.0 tonne = 1 m3 as that is the value

used when invoicing contractors.

2.11 Water

supply charges to Nelson City Council and the Nelson Industrial Water Supply

Area are calculated from proposed rates in the Annual Plan process. Interested

and affected parties are being consulted and feedback will be available during

the Annual Plan 2025/2026 deliberations.

2.12 Staff

will prepare the final Schedule for adoption at the Council meeting on 25 June

2025.

3. Recommendation/s

/ Ngā Tūtohunga

That the Tasman

District Council

1. receives

the Schedule of Fees and Charges 2025/2026 - Deliberations report,

RCN25-05-22; and

2. notes

the submissions made on the Draft Schedule of Fees and Charges 2025/2026; and

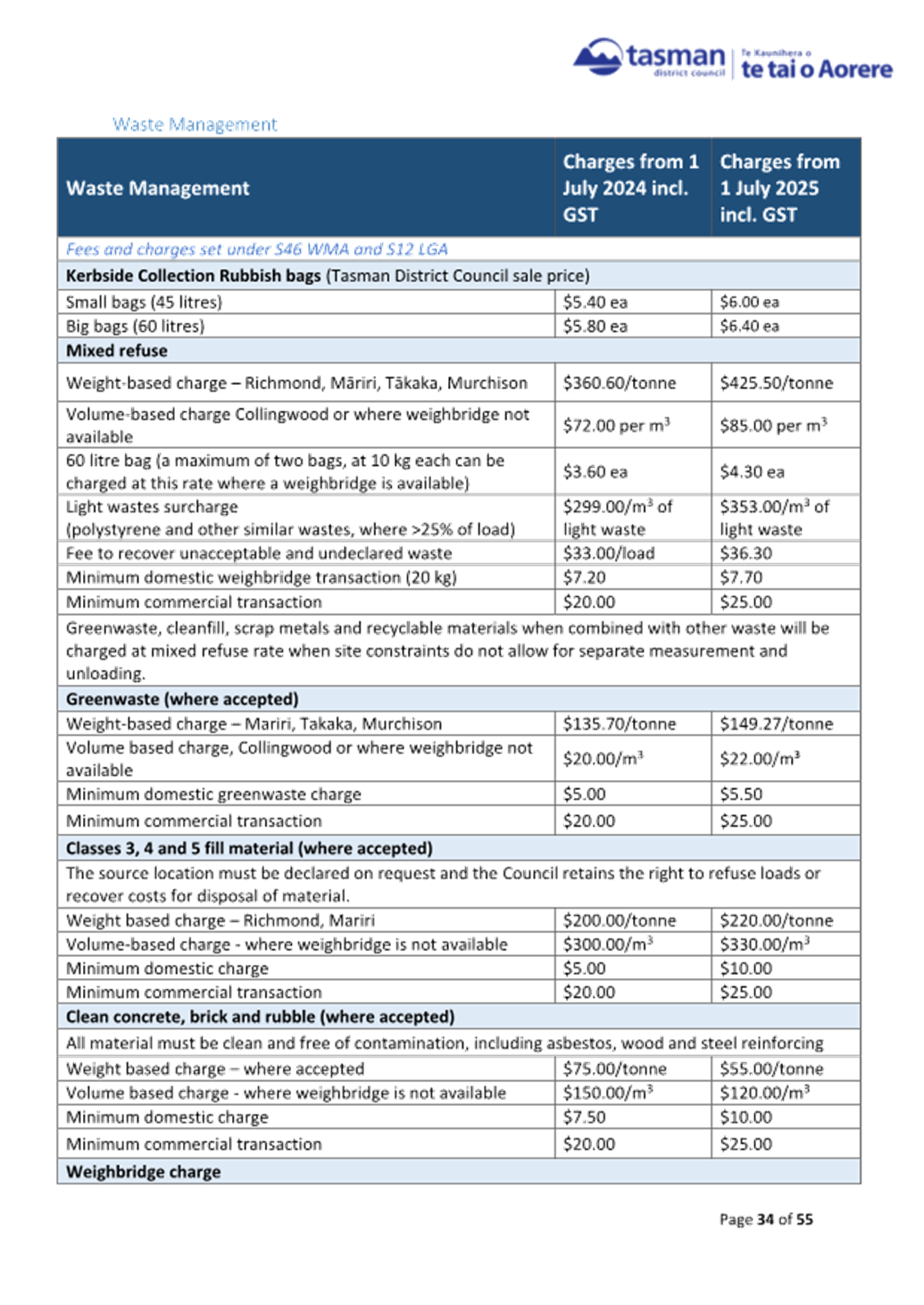

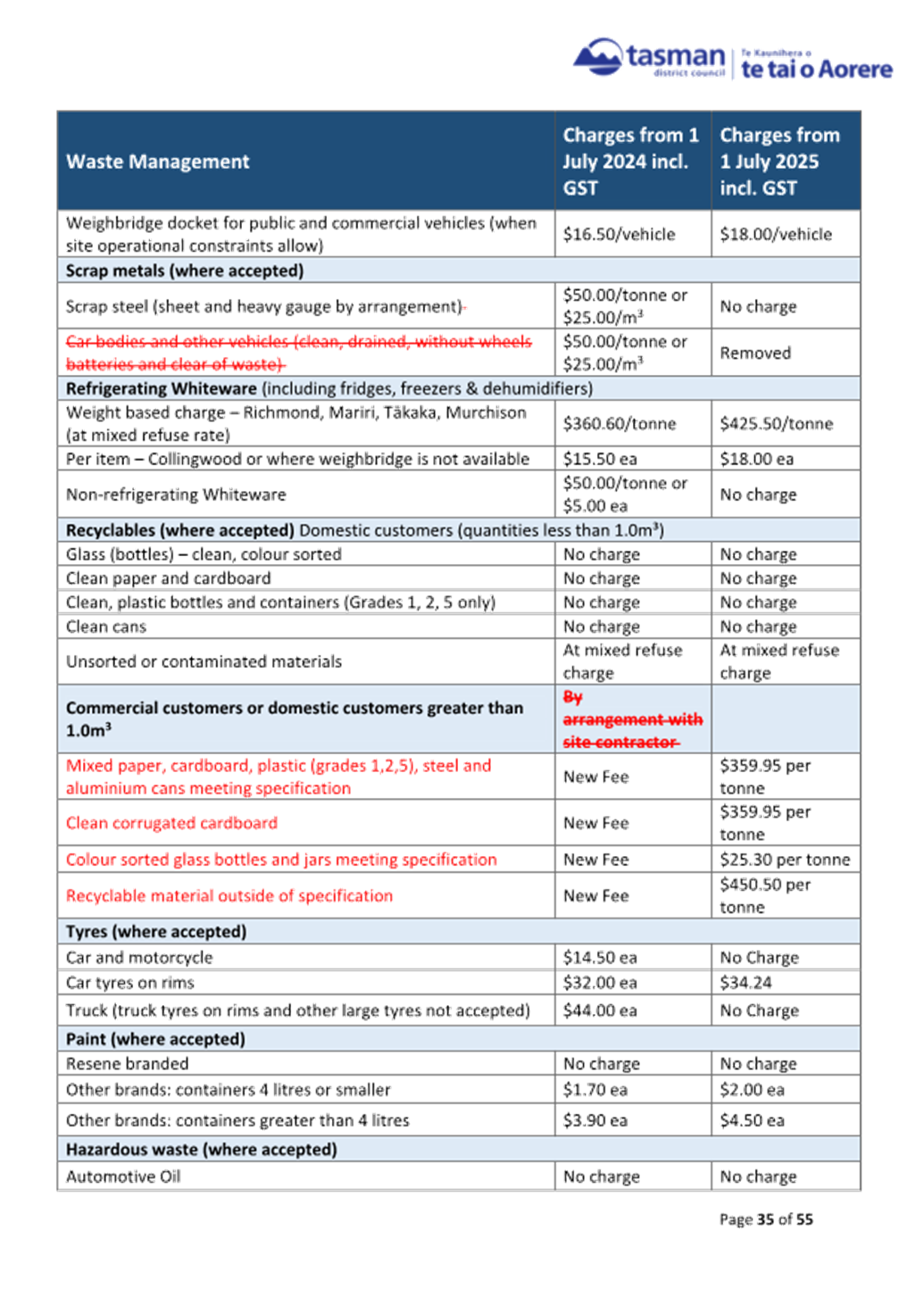

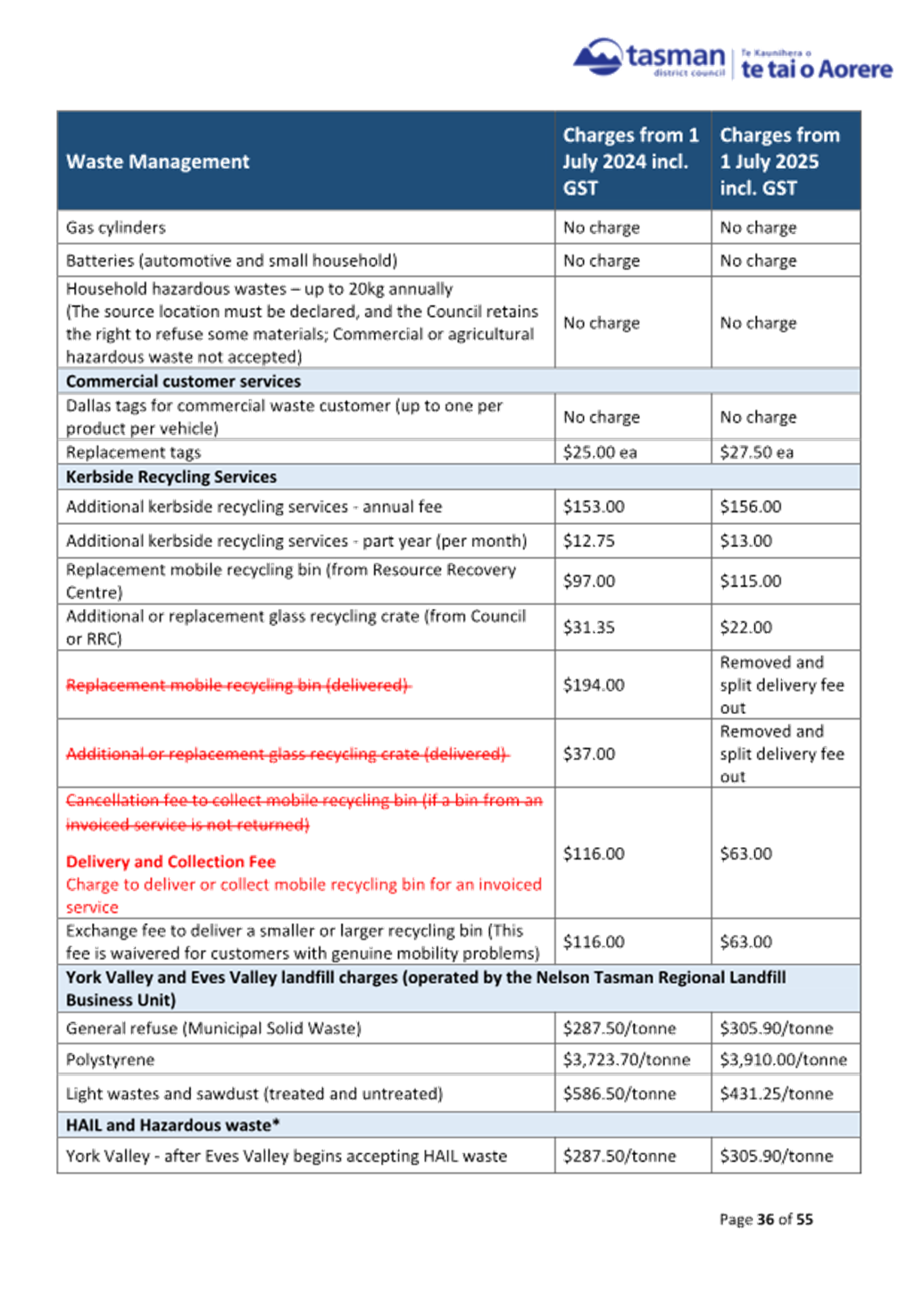

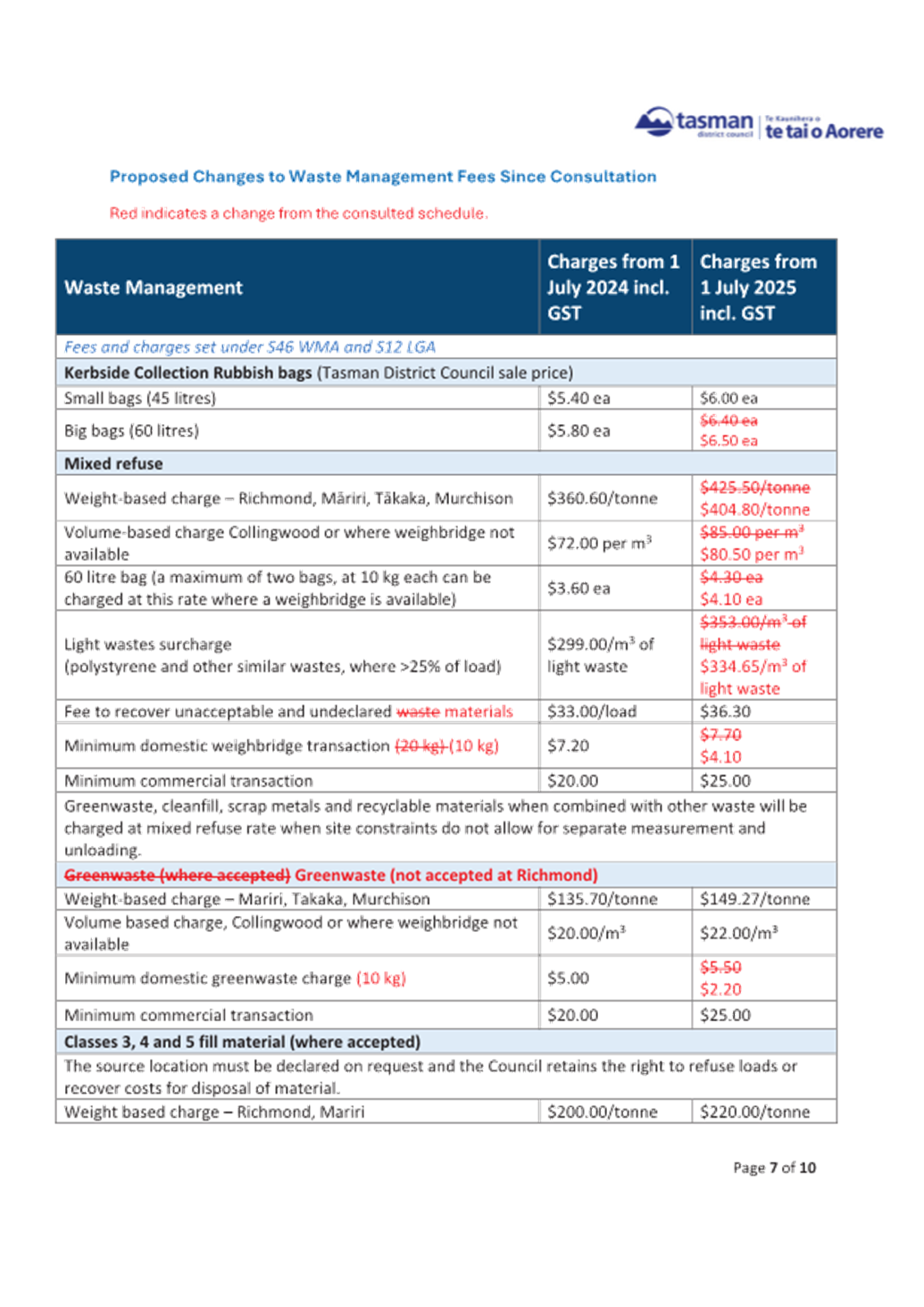

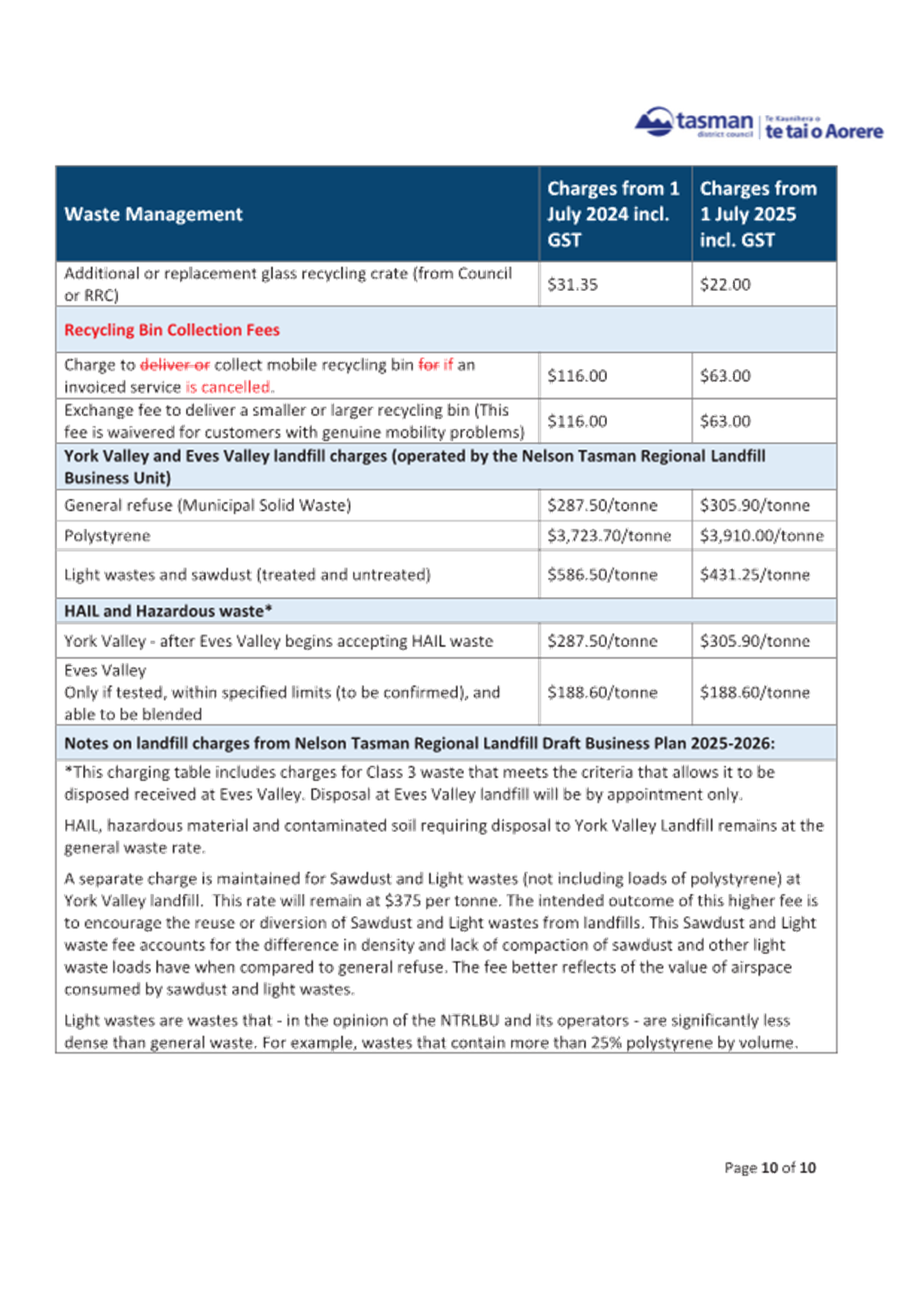

Waste Management Fees

3. notes

that resolutions 5. to 9. below will require an increase in rates revenue of

approximately 0.43%; and

4. notes

that resolutions 5. to 9. will result in a portion of Waste Management being

funded from rates, which is contrary to the Revenue and Financing Policy; and

5. agrees

to reduce the weight-based charge for mixed refuse at Refuse Recycling Centres

from the proposed $425.50/tonne to $404.80/tonne; and

6. agrees

to reduce the volume-based charge for mixed refuse from $85.00/m³ to

$80.50/m³; and

7. agrees

to reduce the mixed refuse ‘60 litre bag’ from $4.30 to $4.10; and

8. agrees

to reduce the light wastes surcharge for mixed refuse from $353/m³ to

$334.65/m³; and

9. agrees

to reduce the minimum domestic weighbridge transaction for mixed refuse from

$7.70/20kg to $4.10/10kg; and

10. in

accordance with section 80 of the Local Government Act 2002 the Council:

· agrees that in

adopting resolutions 5. to 9. it is acting inconsistently with the Revenue and

Financing Policy by partially funding waste disposal through rates to reduce

the increase for users; and

· agrees that the

reason for this inconsistency is to reduce the risk of more waste being

diverted from resource recovery centres directly to York Landfill and instances

of illegal dumping; and

· indicates its

intention to consider amending the Revenue and Financing Policy with regards

Waste Management as part of its Long Term Plan 2027-2037 process; and

11. agrees

to reduce the minimum domestic greenwaste charge from $5.50 to $2.20 and

specify in the fee description that this is for increments of 10kg; and

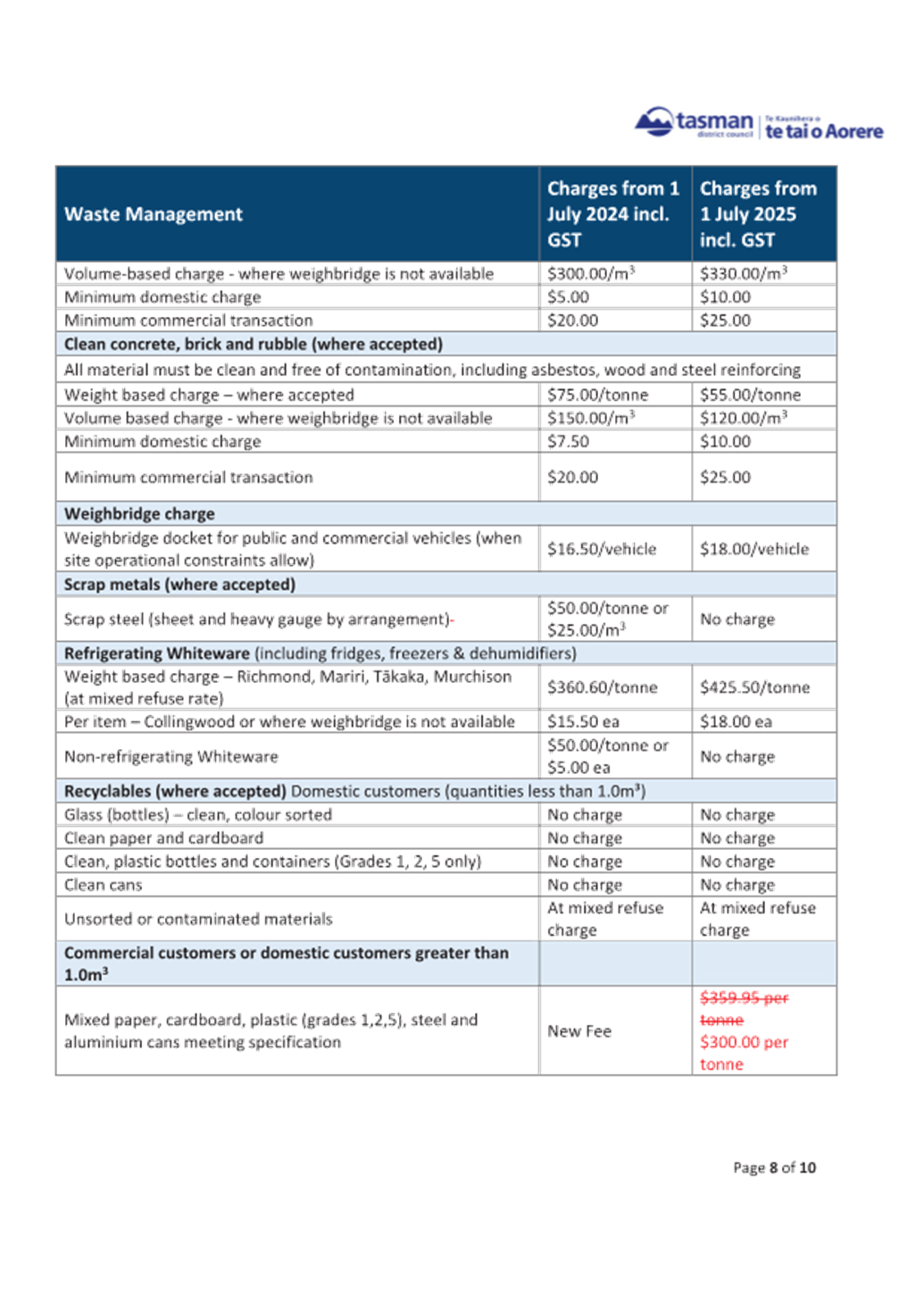

12. agrees

to reduce the charges for mixed recycling and for clean corrugated cardboard

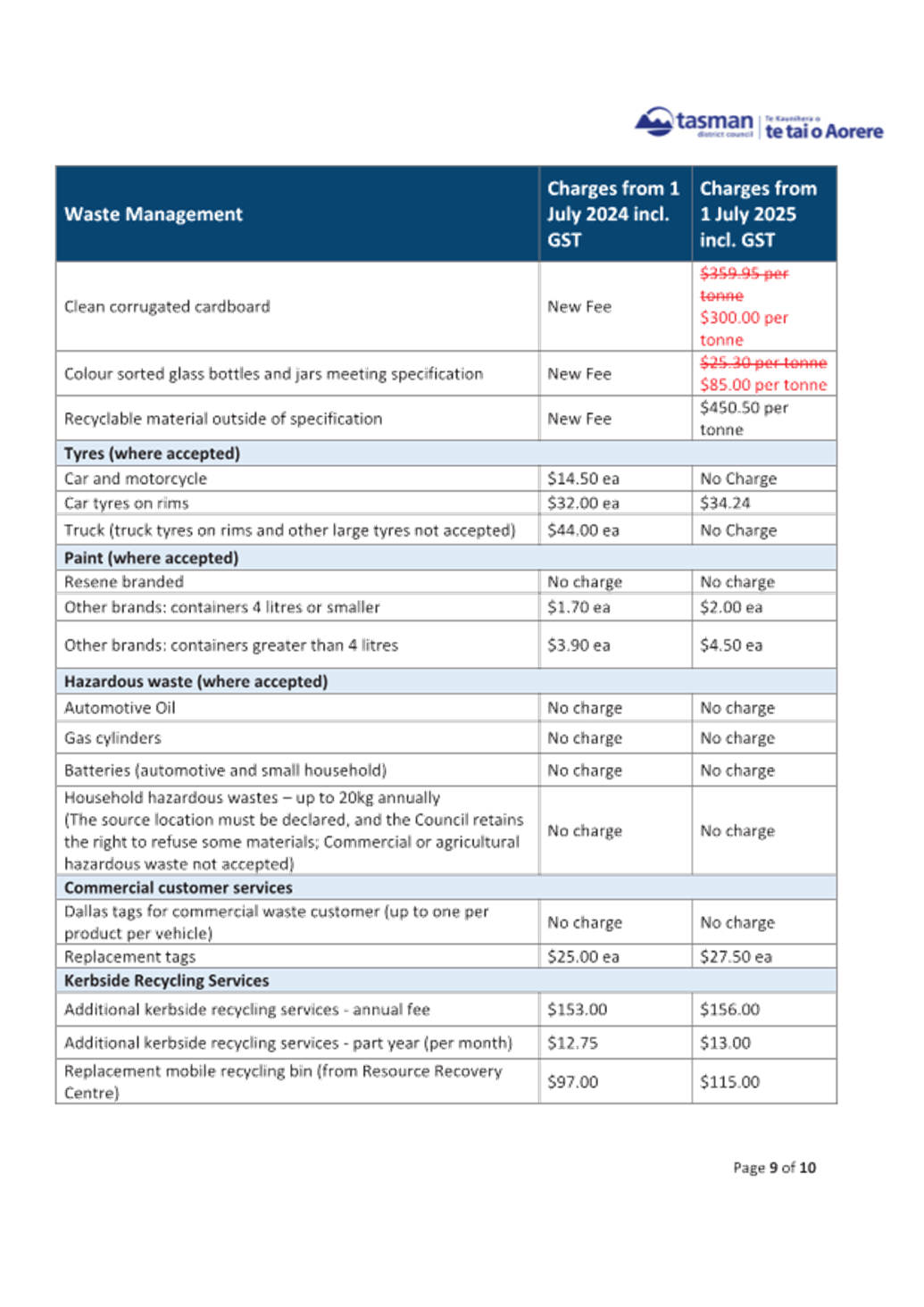

from $359.95/tonne to $300.00/tonne; and

13. agrees

to increase the fee for colour sorted glass recycling from $25.30/tonne to

$85.00 per tonne; and

14. agrees

to increase the Tasman District Council sale price of Kerbside Collection

Rubbish bags from $6.40 to $6.50 for big bags (60 litres); and

15. agrees

to retain the annual fee for additional kerbside recycling services at the

proposed $156 per annum to account for the cost of delivery and invoicing; and

16. agrees

to amend the delivery and collection fee to now be a collection fee (as

presented in the Waste Management table in Attachment 2 to this report), as the

delivery cost has been accounted for in the annual fee for additional kerbside

recycling services; and

17. agrees

to amend the ‘Fee to recover unacceptable and undeclared waste’ to

‘Fee to recover unacceptable and undeclared materials’; and

18. agrees

to amend the heading for greenwaste from ‘Greenwaste (where

accepted)’ to ‘Greenwaste (not accepted at Richmond)’; and

19. notes

staff intend to review waste disposal charges in November 2025 and that the

Chief Executive Officer has the delegation to amend these charges, as set out

in S3.11 of the Council’s Delegation Register; and

Other Fee Areas

20. confirms

the Dog Control fees as listed in the Draft Schedule of Fees and Charges

(Attachment 1 to the agenda report); and

21. agrees

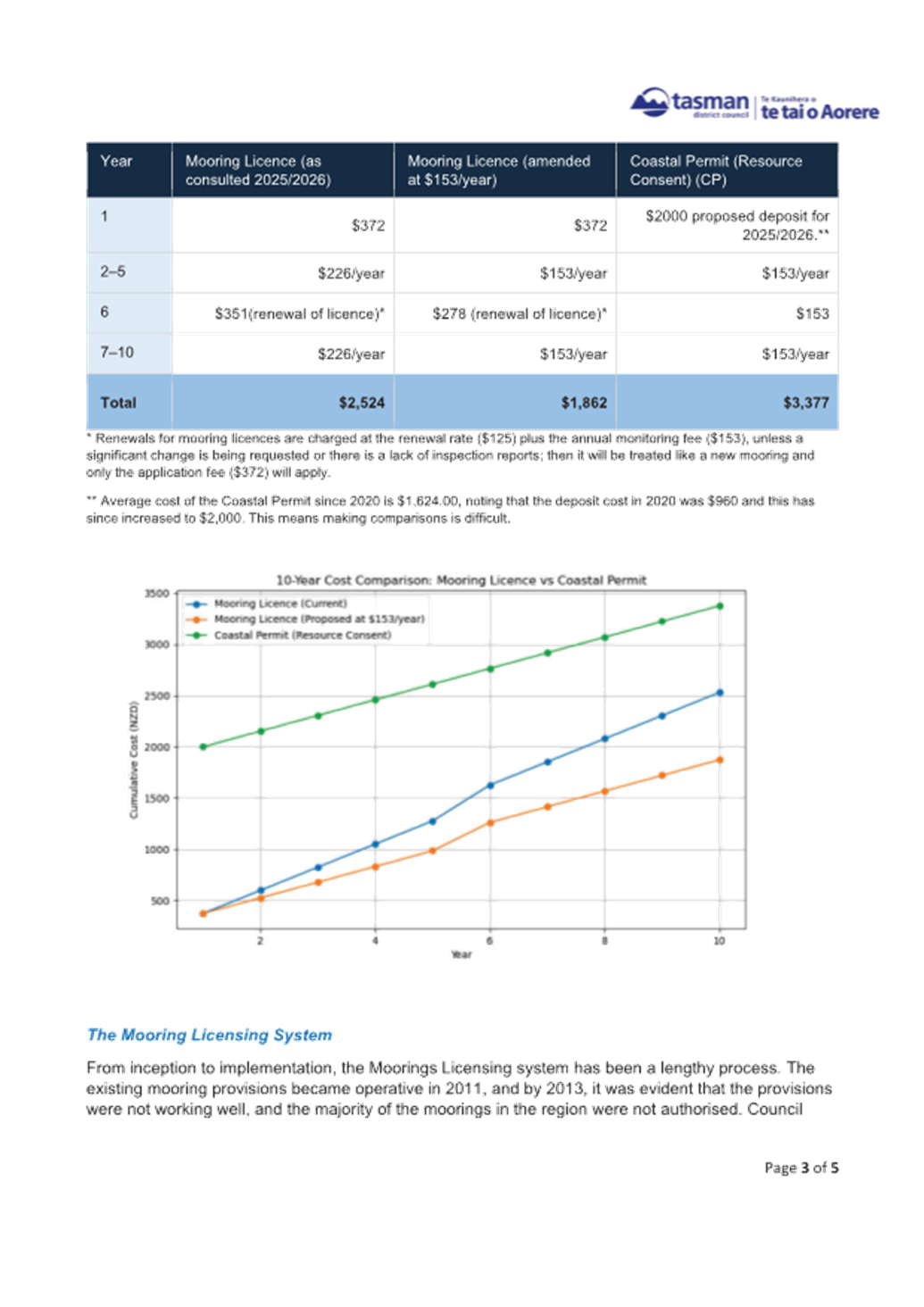

to reduce the annual monitoring and administration fee for mooring licences

from the proposed $226.00 to $153.00, in line with the annual charge for moorings

under coastal permits; and

22. confirms

the Building Assurance travel fee as listed in the Draft Schedule of Fees and

Charges (Attachment 1 to the agenda report); and

23. confirms

the Aerodrome fees as listed in the Draft Schedule of Fees and Charges

(Attachment 1 to the agenda report); and

24. confirms

the proposed environmental incident inspection charge as listed in the Draft

Schedule of Fees and Charges (Attachment 1 to the agenda report); and

25. confirms

the property file fees as listed in the Draft Schedule of Fees and Charges

(Attachment 1 to the agenda report); and

26. confirms

the official information requests fee (LGOIMA) as listed in the Draft Schedule

of Fees and Charges (Attachment 1 to the agenda report); and

27. confirms

the Cemetery fees as listed in the Draft Schedule of Fees and Charges

(Attachment 1 to the agenda report); and

28. notes

that Water Supply charges to Nelson City Council and the Nelson Industrial

Supply Area are being consulted on separately from this process and considered

as part of the Annual Plan 2025/2026 process; and

29. notes that the

property information file fee description will be revised to reflect that files

are shared via ShareFile links, not USB; and

30. notes that the Gravel and

Shingle Extraction fees description will be revised to change the

mass-to-volume conversion from 1.8 tonne = 1 m3 to 2.0

tonne = 1 m3; and

31. notes the removal

of the road stopping fee under the Community Infrastructure section as this fee

is duplicated in the Property Services section of the Draft Schedule of Fees

and Charges (Attachment 1 to the agenda report); and

32. notes the correct road

stopping fee is $825 as this better reflects the initial administrative costs

of considering road stopping applications; and.

33. subject

to resolutions 3. to 32. confirms the remaining fees in the Draft Schedule of

Fees and Charges published for consultation (Attachment 1 to the agenda

report); and

34. adopts the Dog Control fees set out in the Draft

Schedule (Attachment 1 to the agenda report), to allow for public notification in the month before

the fees take effect, in accordance with the Dog Control Act 1996.

4.1 The Council may set fees and charges to recover the costs associated

with providing its services. Staff review these fees and charges annually and

recommend changes, additions, or deletions through the Schedule of Fees and Charges.

4.2 This year, the Council proposed a 10% increase to most fees and

charges. This increase accounts for the significant rising costs of

delivering Council services and aligns with the proposed rates

revenue increase of 10.2% (including growth), for 2025/2026. The increase helps

maintain the ratio of funding from fees and charges, in line with the Revenue

and Financing Policy. Increasing fees and charges reduces the impact of

service cost increases on ratepayers but increases the costs to users of

Council services.

4.3 Staff prepared a Statement of Proposal for the Draft Schedule of

Fees and Charges 2025/2026, seeking Council approval to consult the public. The

proposal sets out the following changes, outside of the standard 10% increase:

4.3.1 Some fees are increasing above the 10% increase to adequately

recover service costs from users, such as dog registration charges, cemetery

interment charges, and the LGOIMA half hourly rate.

4.3.2 Some fees are increasing by less than 10% as the standard

increase was not necessary in order to sufficiently recover costs, including

Aerodrome fees, hourly charge-out rates for Resource Management fees, and some

Waste Management fees.

4.3.3 To improve cost recovery from users, several new charges are

proposed. These include a Building Assurance travel fee for Lakes-Murchison and

Golden Bay, a working dog registration fee, and a LIM cancellation fee.

4.3.4 Some fees are proposed to remain unchanged from last year’s

Schedule, as they are already recovering costs. These include Gravel and

Shingle Extraction fees (except for monitoring rates), Port Tarakohe penalty

charges, and most Maritime fees.

4.4 At

its meeting on 20 March 2025, the Council adopted the Statement of Proposal for

the Draft Schedule of Fees and Charges 2025/2026 (Attachment 1) and to

publicly consult on the Schedule.

4.5 The

consultation was open from 24 March to 28 April 2025. Copies of the Schedule

were made publicly available on Shape Tasman and at the Council’s

libraries and offices. Media releases were made via social media and Newsline.

Managers were asked to notify users of their service areas likely to be

affected of the consultation. Notice of the consultation was also included in

the April Resource Consents and Building Assurance newsletters.

5. Analysis

and Advice / Tātaritanga me ngā tohutohu

Schedule Of Fees and Charges 2025/2026.

5.1 There

were 64 submissions received to the Draft Schedule of Fees and Charges

2025/2026, including one late submission. The entirety of submissions has been

provided to the Mayor and Councillors on LG Hub and are also available for

viewing by the public on the Council’s website.

For comparison, we received 132 submissions in 2024/2025 (in conjunction with

Tasman’s 10-Year Plan), 20 submissions in 2023/2024 and 15 submissions in

2022/2023.

5.2 Thirteen

people spoke to their submission at the public hearing on 16 May 2025.

5.3 The

main topics, issues, and concerns of submitters were:

|

Theme/Specific

Mention

|

Number of

submissions

|

|

Disagree with the 10% increase to most

fees

|

16

|

|

Fees should only be increased by inflation/CPI

|

7

|

|

The Council should look for internal

efficiencies

|

13

|

|

Emphasis on the financial climate/cost of

living crisis

|

12

|

|

Oppose the dog registration increase

|

39

|

|

The removal of bins and dog bags

|

24

|

|

Dog registration fees provide nothing/ask

what they’re for

|

12

|

|

More dog education is needed

|

10

|

|

Want discounts for certain dog owners

|

4

|

|

Oppose the waste fees increases

|

7

|

|

Worry of increased fly-tipping

|

6

|

|

Pro user-pays

|

6

|

|

Oppose the Maritime fees

|

6

|

5.4 The

following table summarises the main points of feedback made by submitters with

associated staff advice and recommendations.

|

Key Submission Points

|

Staff Comment and

Recommendation

|

|

General Fee

Increases

|

|

Sixteen (16) submissions specifically

opposed the proposed 10% increase in fees and charges. Submitters argued the

increase exceeds inflation, lacks adequate justification, and unfairly

burdens households and businesses already facing economic pressure. Many call

for the Council to prioritise cost savings and internal efficiencies,

particularly in staffing and operations, before raising charges. The

“user pays” rationale is widely questioned, with concerns the

increases fund poorly managed or unnecessary projects. Overall, submitters

called for fee increases to be limited to inflation and for greater

transparency, accountability, and community engagement from the Council.

|

Staff acknowledge the concerns raised by submitters about the

proposed 10% increase in fees and charges. While the general increase is 10%,

this varies in some cases for specific reasons. The proposed increases align

with the Council’s Revenue and Financing Policy and Activity Management

Plans, which sets the level of funding to be sourced from user fees versus

rates for each activity. For example, the building activity is intended to be

funded 80–100% through user fees, with the remaining 0–20% from

rates. These funding bands are in place across all Council activities and

were adopted through prior Council decisions.

The cost base for many services has grown more than inflation due

to additional costs, such as increased depreciation with more of these costs

being funded from revenue, the new Water Services Levy, and sampling

obligations imposed by central government. To maintain the intended revenue

ratios and reduce pressure on rates, an increase above the Consumer Price

Index (CPI) for most fees is necessary. Without the 10% adjustment to fees,

the rates revenue increase for 2025/2026 would need to be higher to make up

the shortfall, undermining the user-pays principle.

While staff continue to seek internal efficiencies and cost

savings, many of the services funded by fees are subject to externally driven

and rising costs.

It is also important to note that CPI is not the most appropriate

cost inflation adjustor for local government. The CPI reflects household

goods rather than the cost pressures faced by councils (milk and bread versus

oil and earthworks). Instead, the Council uses the Local Government Cost

Index developed by BERL (Business and Economic Research Ltd), which more

accurately reflects inflation in the sector.

The Statement of Proposal for the Draft

Schedule of Fees and Charges 2025/2026 was drafted to be accessible and

easily understood. This meant that detailed explanations for each individual

fee could not be provided. With hundreds of fees across numerous activities,

it is not feasible to present a full justification for every line item. Under

current legislation, formal public consultation is not required for the

majority of fee changes.

However, we remain committed to

transparency and to providing the opportunity for community feedback on

matters that affect them. Further refinements to how fees are communicated

will be considered as part of ongoing improvement work.

Staff recommend proceeding with the

general 10% increase, noting that this increase is not universal and takes

pressure off rates.

|

|

Dog Registration Fees

|

|

Forty-one (41) submitters gave feedback

on the proposed dog registration fee increases. Most opposed the change,

saying it was unjustified, offered no clear benefits, and meant responsible

owners were subsidising irresponsible ones.

Concerns were raised that higher fees

could lead to more unregistered dogs, and that older residents might struggle

to afford registration for their companions.

About a quarter of submitters wanted more

focus on educating visitors about responsible dog ownership, especially in

peak season. Supporters of the increase argued that fees should reflect the

real cost of dog control and help fund safety and education efforts.

Many also criticised the planned removal

of rubbish bins and dog waste bag dispensers, saying these were the only

visible benefits of registration and their removal would lead to more mess.

Overall, submitters felt the increases,

and the shift to in-house services, were not well explained.

|

Staff proposed the second step of an

increase in dog registration fees to ensure the service is fully funded. Fees

have previously been kept low, but this does not cover the costs of

delivering dog control services, which include:

- Enforcement

- Responding to complaints

- Maintaining the National Dog Database

- Managing public safety

- Operating the animal shelter

- Rehoming dogs

- Delivering education initiatives

After the previous contract ended in

September 2024, the Council temporarily brought

additional elements of the dog control service in-house pending a review. The

review found that the comprehensive in-house model provides better service

but at a higher cost than the former contract. However, the contractor had

made it clear that maintaining a service at the price of the former contract

was not financially viable. Providing services in-house enables a more

proactive approach to compliance. It also offers greater flexibility in

responding to legislative or regulatory changes, without the limitations of a

contract. Full in-house delivery gives the Council more control over staff

training, performance, and accountability, helping to ensure the service

aligns with our policies and standards. In March 2025, the Council resolved

to continue with in-house delivery. The increased costs of providing

the service need to be funded.

The urban dog

registration fee increased by only $3 between 2011 and 2023. A larger

increase is now needed to keep the service as user-pays, in line with the

Public Health & Safety Activity Management Plan.

Staff acknowledge the particular service needs in different areas, which

is why they have proposed a new fee category for working dogs.

Some submitters raised concerns about the

removal of dog waste bins and bag dispensers. Staff note that the budget for

these does not come from dog registration fees but from the Reserves budget,

which is funded through rates. Under Section 9 of the Dog Control Act 1996,

revenue from registration fees can only be used for dog control activities

and not for general services like rubbish collection in reserves. The Council

rescinded the decision to remove the bins and dispensers on

8 May 2025.

Further information on options to change

dog control fees in response to submissions is contained in Section 6 of this

report.

Staff recommend proceeding with the

proposed increases to dog registration fees.

|

|

Working Dog

Fee

|

|

Six submitters mentioned the new working

dog registration fee. Many felt that working dogs, especially farm dogs,

receive little or no service from the Council and therefore should not be

subject to high registration fees.

Several submitters argue that the fees

are unfair, some suggested that farm dog owners were subsidising urban dogs,

while one submitter believes all dog owners should pay the same. The majority

support reduced fees for working dogs, with suggestions including halving the

standard fee and giving owners of multiple dogs a discount or capping the

total charge.

|

The Working Dog fee is a newly proposed

category within the schedule of fees and charges. This new fee, and the lower

rate compared to the urban and rural dog categories, recognises the lower

level of service typically required by working dogs. In previous years those

animals in the new working dog category would have been categorised as rural

or urban dogs and charged at a comparatively higher level.

While the proposed fee is lower than the

other categories, it is set to recover the cost of providing and maintaining

core dog control services, which must be available to all dog owners when

needed. The fee equitably balances the lower service demand with the need for

ongoing service availability and financial sustainability.

Staff recommend proceeding with the new

working dog fee at the proposed rate.

|

|

Waste Fees

|

|

Several submitters opposed the proposed

increases to waste disposal and recycling fees, raising concerns about

affordability and the risk of increased illegal dumping. They questioned the

size of the increases, especially where they exceed the general 10% rise, and

noted inconsistencies between transfer station and landfill fees. Some

submitters also suggested the changes could discourage recycling and called

for clearer justification and more competitive pricing.

|

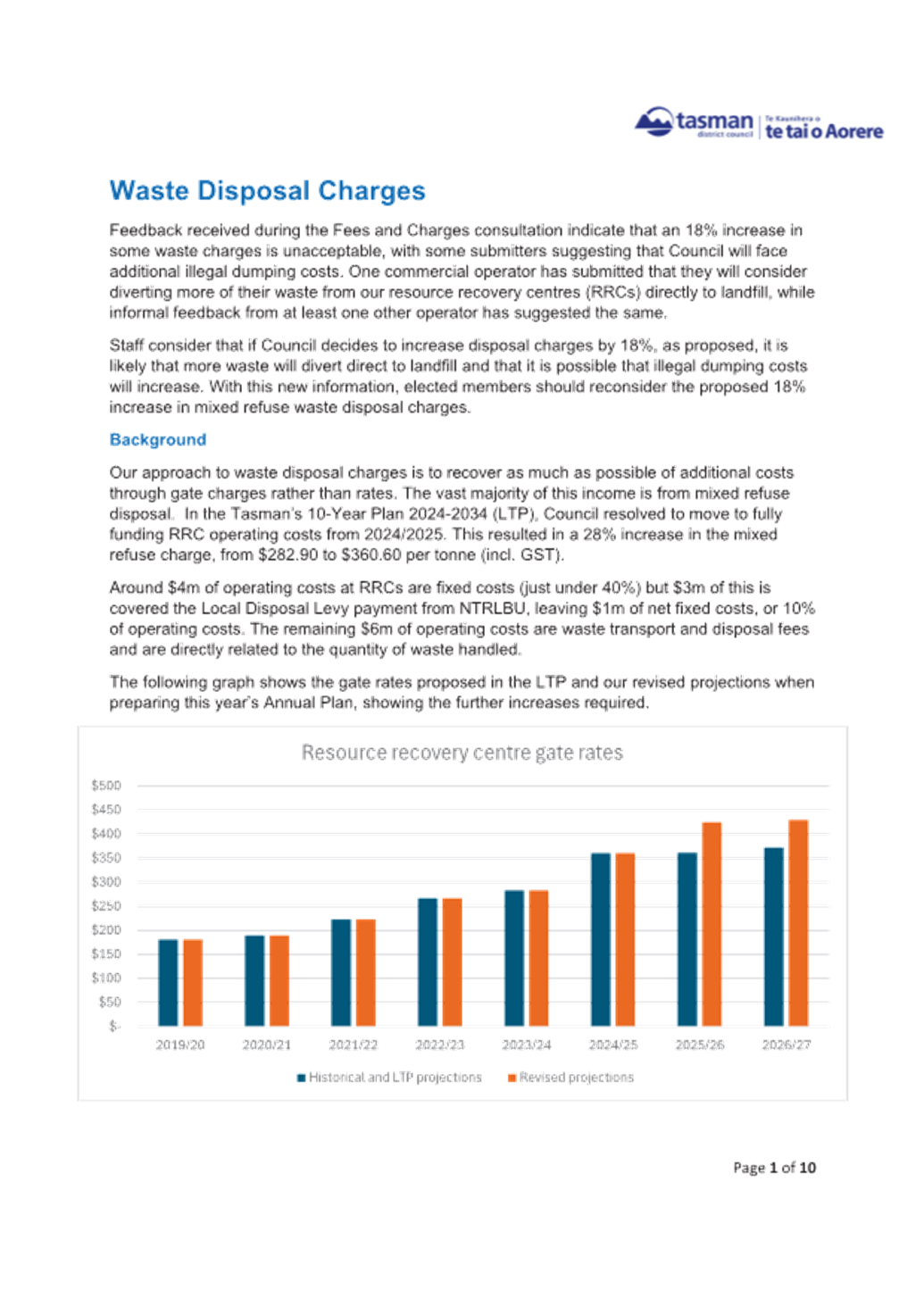

The staff response to waste fee

submissions is detailed in Attachment 2.

In response to submissions, staff

recommend reducing the level of increase for mixed refuse fees from 18% to

12%. This change is recommended due to the significant reduction in tonnage

compared to forecasted in Tasman’s 10-Year Plan 2024-2034. The recommended

changes are intended to reduce the quantity of waste being diverted from

resource recovery centres to landfills and instances of illegal dumping.

Other changes have been recommended and are outlined in Attachment 2.

|

|

Maritime Fees

|

|

Six submitters opposed the proposed

Maritime fees, particularly the mooring licences in the Māpua area. They

see the fees as excessive and poorly justified, raising concerns about lack

of consultation, increased bureaucracy, and unclear benefits. Some questioned

whether more cost-effective service options had been considered, such as community

management.

|

The staff response to Maritime fee

submissions is detailed in Attachment 3.

In response to submissions, staff

recommend reducing the annual monitoring and

administration fee from the proposed $226 (which would have been an increase

from $206 in the current financial year), to $153. This aligns the fee with

the annual charge for Coastal Permits, reflecting the original intent of the

system to cost less than a Coastal Permit. This change reduces the long-term

cost burden to mooring licence holders, while maintaining administrative cost

recovery.

|

|

Building Assurance – Travel Fee

|

|

Submissions 34719 and 34832 opposed the

proposed $100 travel fee for building inspection visits to Golden Bay and

Lakes-Murchison, arguing it is unfair and inconsistent with how services are

charged in other parts of the district. They felt all residents should be

treated equally and not face extra costs based on location.

|

The $100

travel fee covers the added cost of providing inspection services in remote

areas like Golden Bay and Lakes-Murchison. The Council could consider funding

these travel costs from general rates but this contradicts the general user

pays approach funding building assurance and could be inconsistent with the

funding ratios in the Revenue and Financing Policy and Activity Management

Plan.

Alternatively,

the Council could increase the fee for all building consents to cover the

anticipated travel costs. However, the number of building consents

(across the District) and the number in the areas where the travel costs

apply, as well as the number of inspections required across the year, are

very variable. As a result, being able to accurately set fees for all

building consents to include the travel costs in these areas would be very

hard to do.

Due to low

inspection demand, these areas don’t have dedicated staff. Instead,

inspectors travel from Motueka (for Golden Bay) and Richmond (for

Lakes-Murchison). Currently we service Lakes Murchison two days per week and

Golden Bay three days per week.

After

reviewing options, a fixed fee to cover travel costs to remote areas was

found to be the fairest and most transparent approach. This aligns with

Section 281B of the Building Act 2004, which supports fee adjustments to meet

actual service costs.

The fee covers

travel from the nearest staffed service centre to the ward’s service

centre. Travel within the ward is already included in the standard inspection

fee.

Remote

inspection tools are being explored and may reduce or remove the need for

this fee for some inspections in future.

Staff recommend proceeding with this new

fee.

|

|

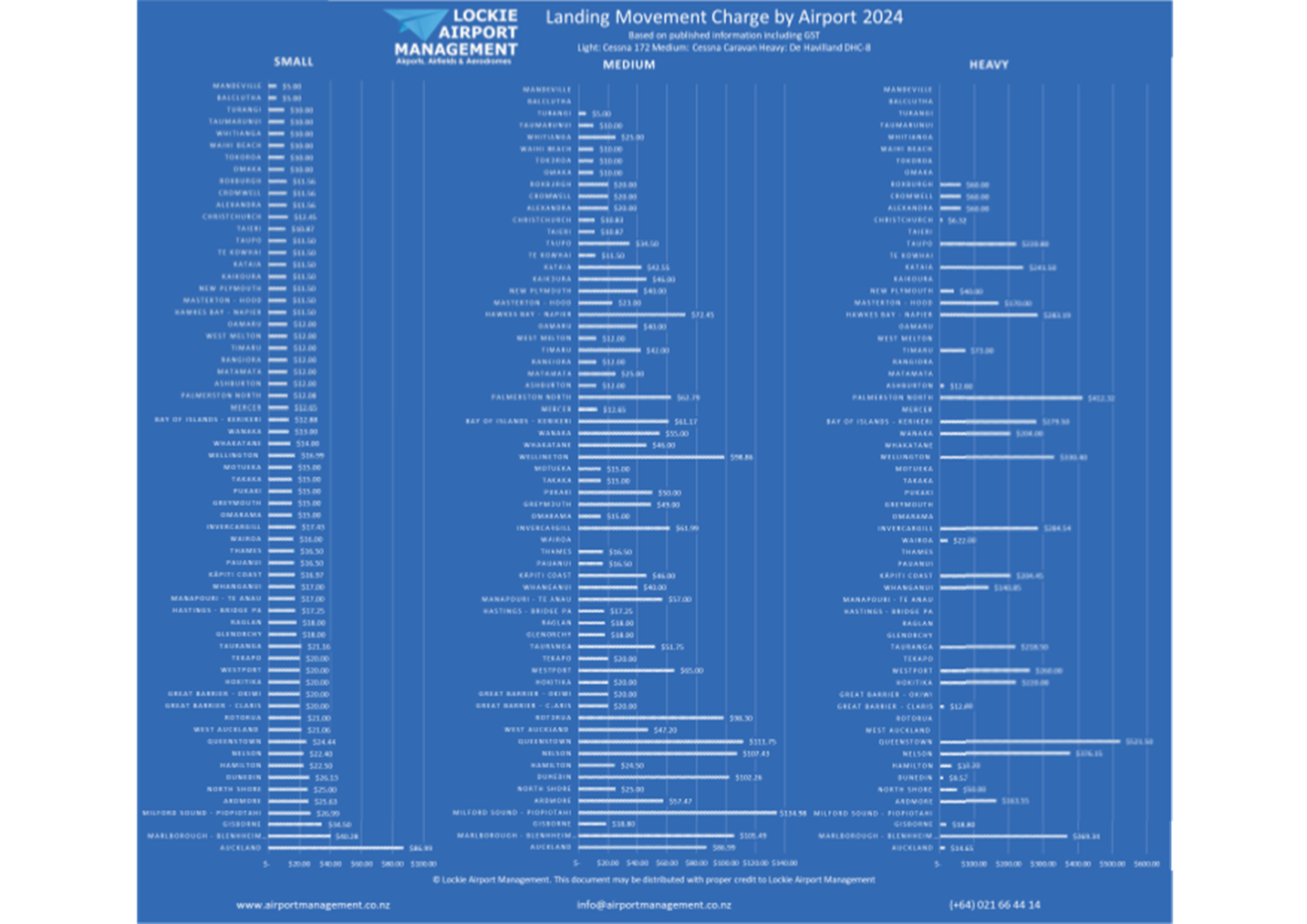

Aerodrome Fees

|

|

Submitters 34721 and 34831 opposed parts

of the proposed fee changes for the Motueka and Tākaka aerodromes. One

submitter argued that fee increases at Motueka are unjustified, noting

increased revenue from other sources, and calls for the fees to be reduced

instead. The other submission was concerned with the clause allowing fees to

be varied under “special circumstances,” saying it lacks

transparency and could lead to unfair decisions.

|

The operational costs of maintaining and

managing the aerodromes continue to rise.

Investments such as the NZ Post building

are undertaken on commercial terms and are not funded through landing fees.

The revenue from this sort of development does not offset the operational

costs that landing fees are intended to recover. While the Motueka aerodrome

is user-pays, the Tākaka aerodrome has been funded 72% by rates in

2024/2025.

All hangars are based upon commercial

terms and therefore any associated income, interest and any other costs are

not considered part of the aeronautical model used to set landing fees.

The following costs are included in the

aeronautical model used to set landing fees:

- Legal fees

- Signage

- Health and Safety inspections

- Runway and ground repairs and maintenance

- Fencing maintenance

- Wildlife management

- CAA compliance – this involves current and constantly

changing regulations and obligations (AIP, meetings, emergency exercises,

signage etc.)

- Notice to Aviator (NOTAM) issuance and monitoring

- Staff management inclusive of planning and operations

Staff obtained an independent review of

landing fees in November 2024 (Attachment 4). The review found that the

average landing fee for a small aircraft around the country is $16.38.

Currently, very few smaller aerodromes in

New Zealand achieve complete cost recovery due to the high costs of

compliance. Blenheim has achieved this and its current charges are $40.29 per

landing for a small aircraft.

Regarding notes in the Aerodrome

schedule, the ability to vary fees under special circumstances is considered

necessary to allow flexibility during the transition to the new fee

structure. This discretion enables the Council to respond appropriately to individual

cases without undermining the overall framework.

Staff recommend proceeding with the

proposed fee increases as consulted.

|

|

Environmental

Assurance – Environmental Incident Inspection Charge

|

|

Submitters 34831 and 34832 oppose the

proposed Environmental Incident Inspection Charge. They argue it is not

legally supported under section 36 of the Resource Management Act and raises

concerns about fairness, efficiency, and due process. Both suggest that

environmental enforcement is a public good and that costs for isolated or

unavoidable breaches should not be imposed on consent holders.

|

This charge recovers costs incurred when

the Council investigates environmental incidents not directly related to a

resource consent. It is made under section 150 of the Local Government Act

2002, not section 36 of the RMA. These inspections are carried out under

section 332 of the RMA to assess compliance, and the charge aligns with

user-pays and polluter-pays principles, ensuring that costs are not unfairly

passed to the wider community. Charges are applied when it is found,

following an investigation, that a breach has occurred. The Council will

apply this fee in line with its enforcement guidelines and will consider the

circumstances of each incident, including emergencies or unavoidable events.

Proposed amendments to the RMA (Clause 10 of the Consenting and Other System

Changes Amendment Bill) are expected to further support this cost recovery

approach. Some other councils across New Zealand charge for this including

Wellington Regional Council and Southland Regional Council.

Staff recommend confirming this new fee.

|

|

Property

Information – Property Enquiries

|

|

Submitter 34722 commented on the Property

Information fee for property files, which is increasing by 10% from $55 to

$59 as excessive, citing the difference in costs between the three councils

of Te Tauihu.

Additionally, they request justification

for the 10% increase in the per annum charge to companies for unlimited

access to property files.

|

Staff acknowledge the

concern regarding the increase in the Property Information fee, and the

comparison with other councils in Te Tauihu. The 10% increase aligns with a

standard adjustment applied across various Council fees and reflects rising

costs, particularly staff time involved in processing property file requests.

Currently, the

property file process is only partially automated. Staff are investigating ways to improve efficiency which

may reduce cost increase pressure in the future and could be reflected in

future charges.

Staff recommend

continuing with the proposed 10% increase.

|

|

Corporate –

Official Information Requests (LGOIMA)

|

|

Submission 34831 opposed the increase in

the LGOIMA half hour charge from $50 to $60. They argue that the increase

lacks justification and goes against the Ministry of Justice guidance of $38

per half hour. They state that the fee disproportionately affects individuals

and non-profits, who rely on official information to monitor and engage with

Council actions. The submitter also asks for fee reductions and exemptions

for community organisations.

|

In the last few

years, the numbers of formal LGOIMAs received by Council has increased from

512 in 2023 to 730 in 2024. This increased number is putting pressure on the

organisation to respond to large requests. Neither the current fee nor

proposed fee come close to recovering the cost of these requests.

The Ministry of

Justice Charging Guidelines have not been updated since 2002 and the

staff’s view is that they no longer reflect the reasonable cost of

responding to LGOIMAs.

This increased amount

is broadly in line with the approach taken by other councils including Nelson

City Council (that has just adopted $50 per half hour for 2025/2026) and

Marlborough District Council (charging $50 per half hour for 2024/2025).

No consideration is

given to a separate rate for community organisations. The focus for staff

when considering whether to charge for a LGOIMA request is on the public

value of the request, as opposed to whether the request is on behalf of a

community organisation. The costs of responding to LGOIMA requests are the

same whatever the type of organisation requesting the information.

Staff recommend

confirming the proposed fee level.

|

|

Cemetery Fees

|

|

Submission 34831 opposed the increase to

adult burial interment fees, ash interment fees, and weekend and late

additional charges, stating that they were unjustified.

|

The proposed

increases to interment fees reflect rising interment costs from our

contractors. These adjustments are intended to ensure that the individuals

using the service cover the associated costs, rather than these being

subsidised by the general ratepayer.

Staff recommend

confirming the proposed fee level.

|

|

Fees Increasing by

more than 10%

|

|

Submission 34831 specifically identified

several fees proposed to increase by more than 10%. The submission stated

that these increases were not justified and noted that some of the fees

exceeding 10% were not mentioned in the Statement of Proposal.

|

These fees have been increased

to ensure the costs of providing specific services are fairly recovered from

users, rather than being subsidised by general ratepayers. Because the cost

components of each fee vary significantly, full breakdowns have not been

provided. Instead, brief explanations are included to give context and to

help users understand the purpose of each fee—particularly those in

specialised areas that are not relevant to most Tasman residents.

Some fees have increased by more

than 10% due to rounding for administrative efficiency. For example, stock

impounding fees have been rounded to the nearest dollar.

|

Water Supply Charges

5.5 Water

Supply Charges to Nelson City Council and the Nelson Industrial Water Supply

Area are calculated based on the income required from rates and water supply

charges to ensure that all water supply users pay equally.

5.6 Consultation

is taking place through direct contact to affected parties. This feedback will

be presented to the Council during the deliberations of the Annual Plan

2025/2026.

5.7 Once

feedback has been considered, these fees will be included into the Final

Schedule for adoption on 25 June 2025.

Recommended Corrections to the Schedule

5.8 Staff recommend

updating the property information file fee description to reflect that files

are shared via ShareFile links, not USB, due to security reasons.

5.9 Staff recommend updating the

Gravel and Shingle Extraction fees description to change the mass-to-volume

conversion from 1.8 tonne = 1 m3 to 2.0 tonne = 1 m3

as that is the value used in practice and 1.8 tonne = 1 m3 is likely too low on average and would unintentionally levy higher

costs on extractors.

5.10 Staff recommend the removal

of the road stopping fee under the Community Infrastructure section as this fee

is duplicated in the Property Services section of the Schedule. The correct fee

is the proposed $825 fee as this better reflects the initial administrative

costs of considering road stopping applications, as compared to the $434 fee

under Community Infrastructure.

Options for Dog Registration Fees

6.1 Due

to the large increase in dog registration fees and the quantity of submitters

opposing the increases, options for elected members have been provided below.

Staff recommend retaining the fees in the Draft Schedule (Option 1).

|

|

Proposed fees

|

Change from 2024/2025 fee

|

Deficit / additional funding from rates

|

|

Option 1 (as consulted)

|

Urban: $90

Rural: $70

Working: $50

|

Increase of $25

38% increase to urban

56% increase to rural

|

$0.00

|

|

Option 2

|

Urban: $85

Rural: $65

Working: $45

|

Increase of $20

31% increase to urban

44% increase to rural

|

$54,113.00

|

|

Option 3

|

Urban: $80

Rural: $60

Working: $40

|

Increase of $15

23% increase to urban

33% increase to rural

|

$108,226.00

|

|

Option 4

|

Urban: $75

Rural: $55

Working: $35

|

Increase of $10

15% increase to urban

22% increase to rural

|

$162,339.00

|

6.2 Note

that the proposed registration fees have been calculated to balance the dog

control account. Any decrease from the proposed registration fees will result

in a deficit in revenue and will need to be funded from rates. Funding dog

control from rates is contrary to what is stated in the Public Health and

Safety Activity Management Plan, which says that the cost of dog control

services will be funded by dog registration fees and recoveries from offending

owners.

6.3 Any

option to stage the increase in dog control fees over several years will result

in a deficit in this closed account. This deficit would either need to be

subsidised by rates or financed by increased borrowing, with the interest and

repayments to be funded by increased rates or higher dog control fees in future

years.

6.4 Any

option to reduce dog registration fees for specific dog owners e.g. those over

65 years of age will result in either the dog registration fees to other dog

owners increasing further or the reduction in revenue being funded by rates. We

do not currently have all dog owners’ ages (as we have had no reason to

collect this information). We would need to model the financial impact of

reducing the dog registration fees for over 65’s and consult on that

option after identifying the full range of costs and benefits. If elected

members are of a mind to explore this option, the date of birth of dog owners

could be collected during the next registration period to enable this option to

be modelled for the 2026/2027 fees. We would also need to assess the likelihood

of younger dog owners transferring ownership to over 65’s as a means of

reducing registration fees for their dogs.

6.5 The

Dog Control Act 1996 (s.37[6]) requires that the Council publicly notify the

Dog Control fees fixed for the registration year, in a newspaper circulating in

the District, at least once during the month preceding the start of every

registration year.

6.6 In

addition, pound fees are required to be adopted at least 14 days before the

resolution comes into effect and be publicly notified in a newspaper

circulating in the District.

6.7 To

enable us to meet these notification requirements, this report includes a

resolution to adopt the Dog Control fees at this meeting. The remainder of the

schedule of fees and charges will be presented for adoption at the 25 June 2025

Council meeting.

7. Financial

or Budgetary Implications / Ngā Ritenga ā-Pūtea

7.1 The

Revenue and Financing Policy states: “An activity should be funded by

users or exacerbators if an individual or group of individuals directly

receives the benefits of the activity or causes the action, and the costs of

the activity can easily be attributed and charged to that individual or group

of individuals”.

7.2 For

each activity, the Revenue and Financing Policy sets, in ranges, the proportion

of costs to be funded by rates, fees and charges, and other sources, expressed

as a range.

7.3 This

Schedule has been developed alongside the proposed rates revenue increase,

which is scheduled for deliberation by the Council on 4 June 2025. The Council

may amend the rates revenue requirement during the Annual Plan 2025/2026

deliberations.

7.4 If,

following deliberations on the Annual Plan 2025/2026, the increase in the rates

revenue varies from the proposed 8.8% (excluding growth), the proportions of

funding from different sources are likely to remain consistent with the ranges

in the Revenue and Financing Policy.

8.1 The options are outlined in the

following table:

|

Option

|

Advantage

|

Disadvantage

|

|

1.

|

Approve the staff recommendations and accept the revised

Draft Schedule of Fees and Charges 2025/2026, including any minor amendments

made at this meeting.

|

Consultation on the Schedule has been undertaken in

accordance with the Local Government Act 2002, and the community’s

views were considered in the staff recommendation.

The new fees can be charged from 1 July 2025 onwards.

|

This option does not allow the Council to request further

information on the fees and charges.

The public will not have an opportunity to be consulted on

any further changes to fees made at this meeting

|

|

2.

|

Decline the staff recommendations and accept the Draft

Schedule of Fees and Charges 2025/2026 as consulted on.

|

The new fees can be charged from 1 July 2025 onwards.

Fees can be charged at the same rates as consulted on.

|

This option does not allow the Council to request further

information on the fees and charges.

The public may feel that their feedback has been

unacknowledged. This may result in a reputational risk.

|

|

3.

|

Decline the staff recommendations and Draft Schedule of

Fees and Charges 2025/2026 in order to receive further information and/or

conduct further consultation.

|

Enables the Council to request more information on

proposed fees and make changes to specific proposed charges before approving

the same for further consultation.

The public will receive another chance to give feedback on

the proposed Schedule before it is adopted.

|

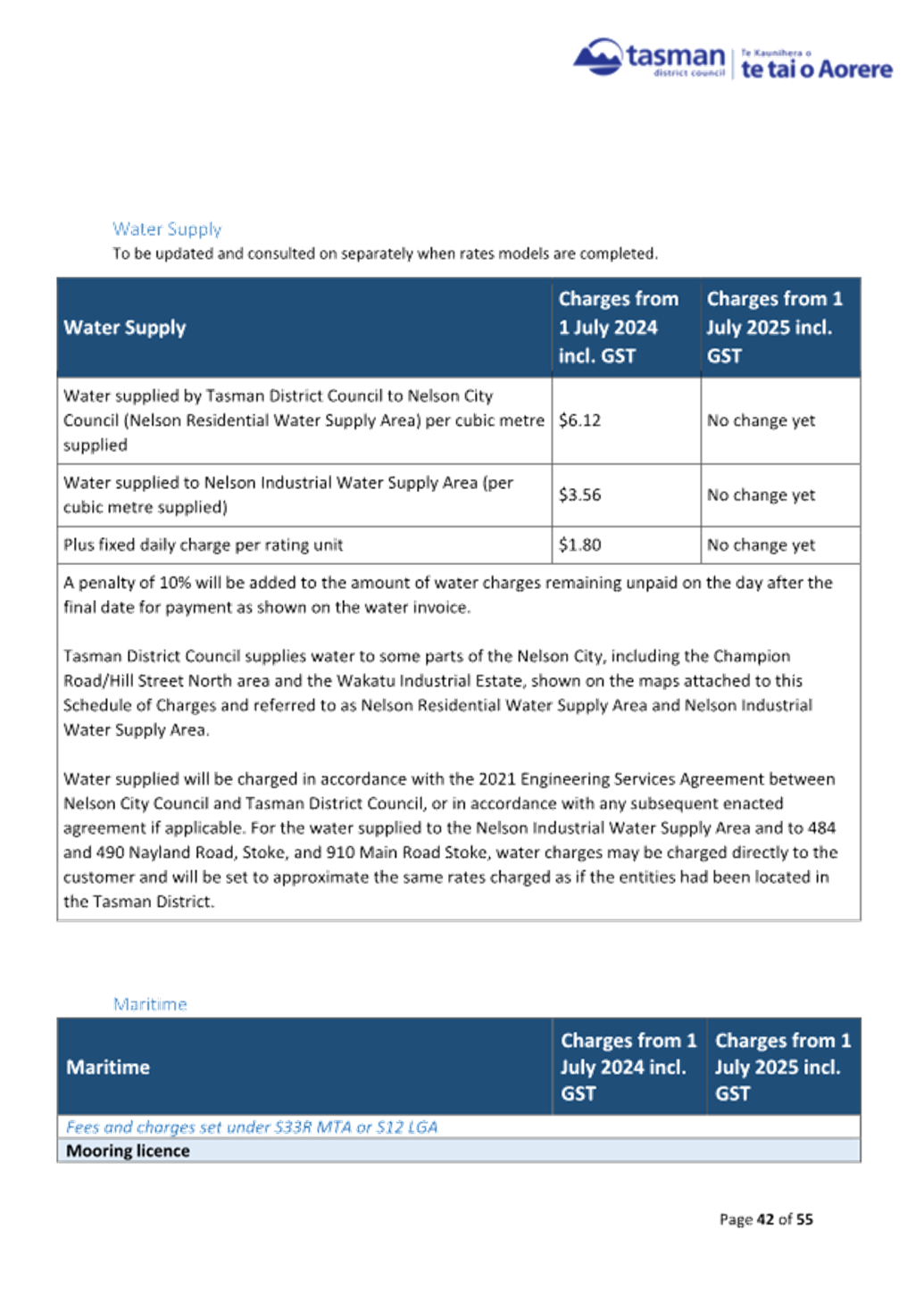

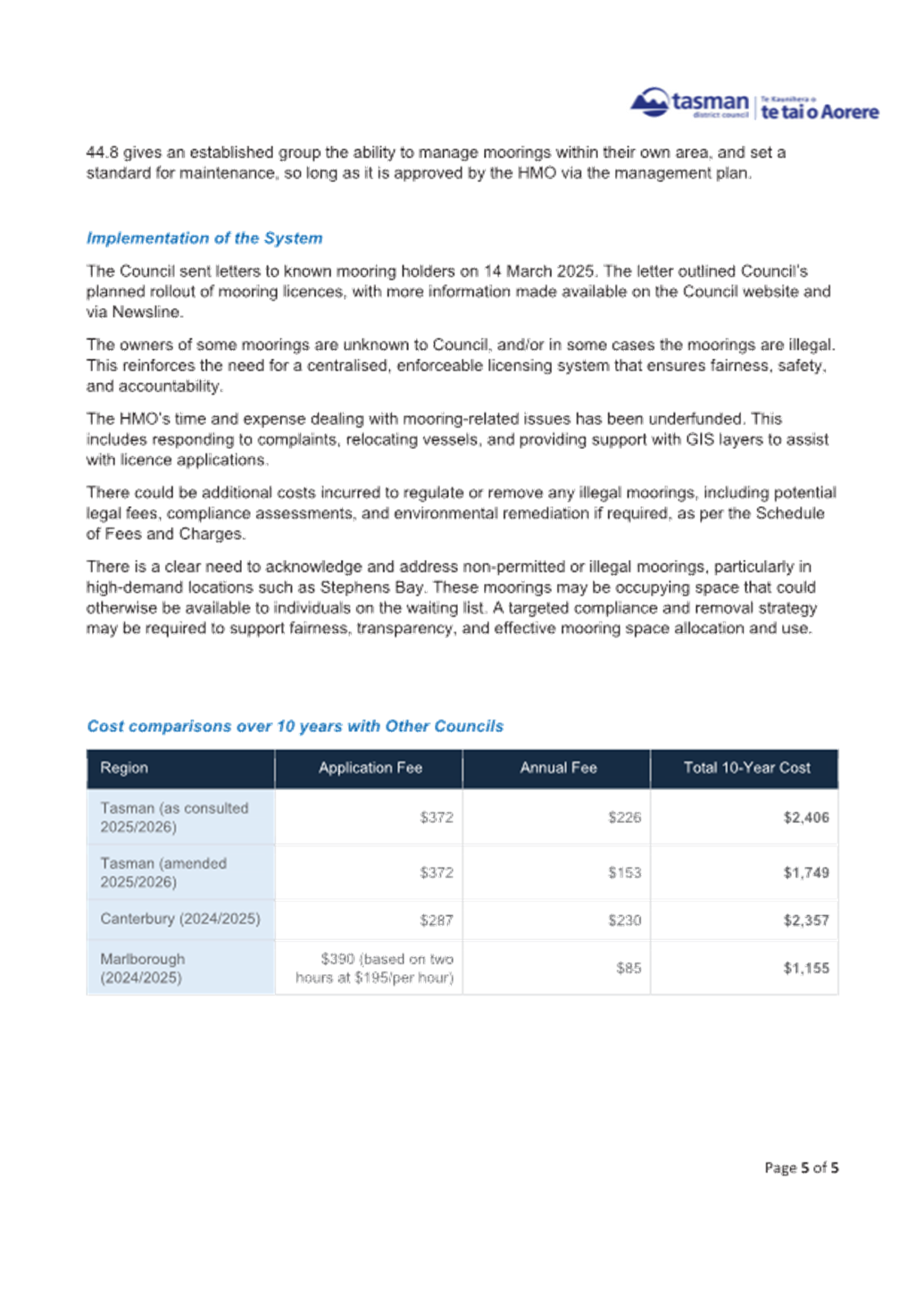

If substantive changes are made, the Schedule (or specific