Notice

is given that an extraordinary meeting of the Tasman District Council will be

held on:

|

Date:

Time:

Meeting

Room:

Venue:

Zoom

conference link:

Meeting ID:

Meeting Passcode:

|

Thursday 27 June 2024

1:00 pm - adoption LTP

Tasman Council Chamber

189 Queen Street, Richmond

https://us02web.zoom.us/j/86487598591?

864 8759 8591

268895

|

|

Tasman

District Council

Kaunihera

Katoa

AGENDA

|

MEMBERSHIP

|

Mayor

|

Mayor T King

|

|

|

Deputy Mayor

|

Deputy Mayor S Bryant

|

|

|

Councillors

|

Councillor C Butler

|

Councillor M Kininmonth

|

|

|

Councillor G Daikee

|

Councillor C Mackenzie

|

|

|

Councillor B Dowler

|

Councillor K Maling

|

|

|

Councillor J Ellis

|

Councillor B Maru

|

|

|

Councillor M Greening

|

Councillor D Shallcrass

|

|

|

Councillor C Hill

|

Councillor T Walker

|

(Quorum 7 members)

|

|

|

Contact Telephone: 03 543 8400

Email: Robyn.Scherer@tasman.govt.nz

Website: www.tasman.govt.nz

|

Tasman District

Council

Agenda – 27 June 2024

AGENDA

1 Opening, Welcome, KARAKIA

2 Apologies

and Leave of Absence

|

Recommendation

That apologies be accepted.

|

3 PUBLIC

FORUM

3.1 Nelson Tasman Climate Forum – Adoption of the

Climate Strategy and Action Plan

4 Declarations

of Interest

4 Reports

5.1 Adoption

of Long Term Plan 2024-2034 and Concurrent Policies......................... 4

5.2 Adoption

of Schedule of Fees and Charges 2024-2025....................................... 19

5.3 Long

term Plan Rates Resolution 2024-2025....................................................... 93

5.4 Adoption

of Tasman Climate Response and Resilience Strategy and Action Plan 2024-2035............................................................................................................................. 111

5 Confidential

Session

Nil

6 closing

KARAKIA

Tasman District

Council

Agenda – 27 June 2024

5 Reports

5.1

Adoption of Long

Term Plan 2024-2034 and Concurrent Policies

Decision Required

|

Report

To:

|

Tasman

District Council

|

|

Meeting

Date:

|

27

June 2024

|

|

Report

Author:

|

Alan

Bywater, Team Leader - Community Policy; Brylee Wayman, Senior Community

Policy Advisor - Data Analyst; Matthew McGlinchey, Actin Group Manager -

Financial; Pip Jamieson, Principal Policy Advisor

|

|

Report

Authorisers:

|

Dwayne

Fletcher, Strategic Policy Manager

|

|

Report

Number:

|

RCN24-06-19

|

1. Purpose

of the Report / Te Take mō te Pūrongo

1.1 The

purpose of this report is for the Council to adopt its final:

· Revenue

and Financing Policy 2024 (pages 193-255 in Attachment 2);

· Long Term Plan

2024-2034 (LTP) – Volumes 1 and 2 (Attachments 1 and 2) including the

Annual Plan for 2024/2025;

· Development and

Financial Contributions Policy 2024-2034 (Attachment 3);

· Rates Remission

Policy 2024-2034 (Attachment 4);

· Policy on

Postponement and Remission of Rates on Māori Land 2024-2034 (Attachment

5);

· Community

Facilities Funding Policy (Attachment 6);

· Housing and

Business Assessment for Tasman 2024 (Attachment 7);

· Housing and

Business Assessment for Nelson and Tasman Urban Environment 2024 (Attachment

8); and

· Thirteen (13)

Activity Management Plans (Attachment 9-21).

1.2 The

final LTP needs to be audited and adopted by 30 June 2024 in order to meet the

statutory deadlines and to set the rates for the 2024/2025 year.

1.3 Audit

NZ commenced its final review of the LTP 2024-2034 on 4 June 2024. The audit

report will be tabled at the meeting.

2. Summary

/ Te Tuhinga Whakarāpoto

2.1 The

Council adopted the LTP Consultation Document, supporting information, and

policies for concurrent consultation at its meeting on 25 March 2024. The

consultation period started on 28 March and finished on 28 April 2024 and the

Council received 1,060 submissions, including 12 late submissions. Hearings

were held on 8-10 May 2024 and 131 individuals or groups were scheduled to

speak.

2.2 The

Council has met the requirements of the Local Government Act 2002 in preparing

and consulting on the LTP Consultation Document, supporting information and

concurrent consultation documents, using the special consultative

procedure.

2.3 The

final LTP 2024-2034, the concurrent policies, and the Activity Management Plans

reflect the decisions made at the Council Deliberations meeting on 23 and 24

May.

2.4 The

LTP 2024-2034 can be characterised as:

· Sustaining

important services that enable the community to carry on with and enjoy daily

life;

· Maintaining

infrastructure and upgrading it as needed to meet regulatory requirements;

· Responding to

climate change;

· Providing for

growth in the District’s population;

· Managing the

environment;

· Modernising the

Council’s digital services; and

· Investing in

community facilities.

2.5 The

decisions the Council made on 24 May 2024 result in forecast rates increases

(excluding growth) as follows:

|

1.

2024/2025

|

2.

11.1%

|

3.

2029/2030

|

4.

4.0%

|

|

5.

2025/2026

|

6.

7.0%

|

7.

2030/2031

|

8.

3.5%

|

|

9.

2026/2027

|

10. 5.2%

|

11. 2031/2032

|

12. 4.6%

|

|

13. 2027/2028

|

14. 4.3%

|

15. 2032/2033

|

16. 2.2%

|

|

17. 2028/2029

|

18. 4.9%

|

19. 2033/2034

|

20. 3.2%

|

2.6 These

planned rates increases exceed our self-imposed rates increase cap in the

Financial Strategy in the 2024/2025 and 2025/2026 years, as was proposed in the

LTP Consultation Document.

2.7 We

are planning for an unbalanced budget in four of the 10 years of the LTP.

2.8 In

the LTP 2024-2034 net debt is budgeted to rise 81% to $451.9 million by

2033/2034. We have set our self-imposed debt cap at 160% of revenue and would

exceed this level in 2032/2033 and 2033/2034 as a result of borrowing for the

replacement wastewater treatment plants at Motueka and Tākaka.

2.9 We

have borrowing capacity above the debt cap and within the Local Government

Funding Agency limits. Following an emergency event we intend to reprioritise

existing work programmes, seek assistance from Government and borrow (above the

debt cap if necessary) to fund recovery. This additional borrowing will need to

be serviced by higher rates in subsequent years.

3. Recommendation/s

/ Ngā Tūtohunga

That the Tasman District Council

Part A:

1. receives

the Adoption of Long Term Plan 2024-2034 and Concurrent Policies report

RCN24-06-19; and

2. makes

the following resolutions having given due consideration to the submissions

received during the consultation process; and

3. adopts the Audit Report dated xx-June 2024 tabled at the meeting for inclusion in the Long

Term Plan 2024-2034; and

4. resolves, pursuant to section 100 of the Local

Government Act 2002, that it is financially prudent to plan for and set

projected operating revenues at a different level than is sufficient to meet

projected operating expenses for the 2024/2025, 2028/2029, 2032/2033 and

2033/2034 financial years, having had regards to:

· the estimated expenses of achieving and maintaining

the predicted levels of service set out in the long-term plan, including the

estimated expenses associated with maintaining the service capacity and

integrity of assets throughout their useful lives; and

· the projected revenue available to fund the estimated

expenses associated with maintaining the service capacity and integrity of

assets throughout their useful life; and

· the equitable allocation of responsibility for funding

the provision and maintenance of assets and facilities throughout their useful

life; and

· the Council’s funding and financial policies

adopted under section 102 of the Local Government Act 2002; and

· some operating expenditure having an enduring benefit

and that we have chosen not to fund this from rates e.g. the Digital Innovation

Programme; and

· the transition to fully funding depreciation; and

· the desire to balance expenditure and rating demands

with the impact this has on community well-being; and

5. adopts the Revenue and Financing Policy 2024 (pages

193-255 in Attachment 2 to the agenda

report), pursuant to section 102(1) of the Local Government Act 2002; and

6. adopts the Development and Financial Contributions

Policy 2024-2034 (Attachment 3 to the agenda report), pursuant to section

102(1) of the Local Government Act 2002; and

7. notes that the Development and Financial Contributions

Policy 2024-2034 has been amended to clarify that retirement village units are

subject to the bedroom-based assessment for water, wastewater, and stormwater

development contributions charges; and

8. adopts the Rates Remission Policy 2024-2034 pursuant

to section 102(3) of the Local Government Act 2002 (Attachment 4 to the agenda

report); and

9. adopts the Policy on Remission and Postponement of

Rates on Māori Land 2024-2034 pursuant to section 102(1) of the Local

Government Act 2002 (Attachment 5 to the agenda report); and

10. adopts the Community Facilities Funding Policy

(Attachment 6 to the agenda report); and

11. adopts the Housing and Business Assessment for Tasman

2024 (Attachment 7 to the agenda report) and the Housing and Business

Assessment for Nelson and Tasman Urban Environment 2024 (Attachment 8 to the

agenda report); and

12. adopts the following Activity Management Plans

(Attachments 9-21 to the agenda report):

· Environmental

Management

· Public Health and

Safety

· Transportation

· Coastal Assets

· Water Supply

· Wastewater

· Stormwater

· Waste Management

and Minimisation

· Rivers

· Reserves and

Facilities

· Libraries

· Property

· Council

Enterprise; and

13. authorises

the Chief Executive Officer to approve any minor edits or changes to the

Activity Management Plan documents, prior to publication; and

Part B

14. adopts the Long Term Plan 2024-2034 (Attachments 1 and

2 to the agenda report) pursuant to Section 93 of the Local Government Act 2002

including the audit report in Resolution 2 above; and

15. authorises

the Chief Executive Officer to approve any minor edits or changes to the Long Term Plan 2024-2034 document, prior

to publication; and

16. notes that that the Long Term Plan 2024-2034 includes

the Annual Plan for 2024/2025, and

17. requests that staff make the Long-Term Plan 2024-2034

publicly available.

4.1 The Council adopted the LTP Consultation

Document, supporting information, and policies for concurrent consultation at

its meeting on 25 March 2024. The consultation period started on 28 March and

finished on 28 April 2024.

4.2 The Consultation Document, supporting

information, and concurrent consultation material were published on the

Council’s website, Shape Tasman, and advertised through Newsline, social

media channels, and public notices. The Council attended 12 meetings (including

three drop-in sessions) around the District. The Kaihautū carried out hui

with nine iwi and Māori organisations during the consultation period.

4.3 The Council received 1,060 submissions,

including 12 late submissions. Hearings were held form 8-10 May 2024 in

Richmond, Tākaka, Motueka and via Zoom. There were 131 individuals or

groups scheduled to speak at hearings.

4.4 The Council deliberated on 23 and 24 May

2024 to consider the information and opinions expressed through the

submissions, receive advice from staff and then to make decisions about changes

to include in the final LTP, Activity Management Plans, the concurrent

policies, and the Schedule of Fees and Charges.

5. Analysis

and Advice / Tātaritanga me ngā tohutohu

Long Term Plan 2024-2034

5.1 The

final LTP needs to be audited and adopted by 30 June 2024 in order to meet the

statutory deadlines and to strike the rates for the 2024/2025 year. It is

possible to adopt on

1 July 2024 (due to section 55 of the Legislation Act 2019) but staff do not

recommend this if avoidable.

5.2 At the deliberations meeting on 24 May

2024, the Council decided to proceed with its preferred options in the

Consultation Document for:

· Choice 1: Financial Sustainability.

· Choice 2.1 Sealed Road Maintenance.

· Choice 2.2: Public Transport.

· Choice 2.3: Safety for Pedestrians and Cyclists.

· Choice 3: Climate Change and Resilience.

· Choice 4: Investing in Community Facilities.

5.3 The Council considered staff advice

about updated projections for the financial position at the end of the

2023/2024 year, budget changes since the Consultation Document and supporting

information was adopted, and options to reduce the impact on rates and debt.

5.4 The Council made a number of decisions

at the deliberations meeting that affected the budgets for the LTP 2024-2034.

5.5 The report to the deliberations meeting

on 23 and 24 May 2024 included reducing the budgets across the organisation for

consultancy by not adjusting for inflation in the 2024/2025 year. The figure of

$365,000 was contained in the report as the effect of this saving.

Subsequently, staff have become aware that this was an error and the figure

should have been $260,000. LTP budgets have been altered accordingly.

5.6 The decisions made at the deliberations

meeting have been incorporated into the LTP 2024-2034 document and the related

policies and documents.

5.7 Volume 1 of the final LTP 2024-2034

includes:

· The Mayor and Chief Executive’s message

· A description of the Council’s work in general

· A summary of the Plan for 2024-2034

· A snapshot of the engagement with our community

· The Council’s decisions on the Key Choices (from the

Consultation Document)

· The Council’s Vision, Purpose and Community Outcomes

· A financial summary

· A description of what is included in the Plan

· Council Activities Summaries

· Rates example properties

· Accounting Information – including the forecasting assumptions

· A disclosure statement

· Audit opinion (once issued)

· Appendix – Glossary of Terms

5.8 Volume 2 contains the supporting

policies and strategies for the LTP:

· Funding Impact Statement (rates) including rating maps

· Financial Strategy

· Infrastructure Strategy

· Revenue and Financing Policy

· Summary of the Significance and Engagement Policy

· Statement on Fostering Māori Participation in Council Decision

Making Processes through Ngā Iwi/Council Partnership

· Variations from the Water and Sanitary Services Assessment and Waste

Management and Minimisation Plan.

5.9 Audit NZ commenced its final review of

the LTP 2024-2034 on 4 June 2024. The Audit Report will be tabled at the

meeting.

5.10 The Long-Term Plan 2024-2034 is provided for adoption at this

meeting (Attachments 1

and 2).

Development and Financial Contributions

Policy 2024-2034

5.11 The Council consulted on three main changes to the

Policy:

· Including a change to criteria for small homes discounts;

· An application process and criteria for determining which

non-residential developments are eligible for a special assessment; and

· Remissions for some types of development on specific categories of

Māori land.

5.12 The draft Policy also contained higher Development

Contributions charges, based on the growth infrastructure capital expenditure

in the proposed Long-Term Plan 2024-2034 and Infrastructure Strategy.

5.13 The Council consulted on the Development and

Financial Contributions Policy 2024-2034 concurrently with the LTP Consultation

Document and heard submissions on it jointly with the LTP.

5.14 At the deliberations meeting on 23 May, the Council

confirmed the proposed changes to Policy, and agreed to further changes to the

Wakefield stormwater and wastewater development contribution area maps.

5.15 At the deliberations meeting, the Council also

declined to specify new assessment rates for development contributions charges

for retirement village units. To avoid ambiguity, the Policy has been further

amended to clarify that retirement village units will be assessed using the

bedroom-based rates for water, wastewater, and stormwater charges. The Policy

already specifies a rate for Transportation charges for retirement village

units.

5.16 The final version of the Policy has also been

updated with Development Contributions charges and Schedules that reflect the

growth infrastructure costs in the final version of the LTP and relevant

Activity Management Plans.

5.17 These changes have been made in the version of the Policy for

adoption (Attachment 3). The Development and Financial Contributions

Policy will remain as a separate document from the LTP 2024-2034.

Rates Remission Policy

5.18 We consulted on including a new rates remission

policy for social housing providers and papakāinga, as well as several

relatively minor changes to the Rates Remission Policy.

5.19 At the deliberations meeting the Council confirmed

these changes and the final policy is presented for adoption at this meeting

(Attachment 4).

Policy on Postponement and Remission of

Rates on Māori Land

5.20 We proposed the introduction of the new Policy on

Postponement and Remission of Rates on Māori Land and undertook

consultation on this.

5.21 At the deliberations meeting the Council confirmed

this new policy and it is presented for adoption at this meeting (Attachment

5).

Community Facilities Funding Policy

5.22 We consulted on the introduction of a Community

Facilities Funding Policy that documents the Council’s expectations for

community fundraising contributions to new facilities and documents the

District Facilities and Shared Facilities Rates.

5.23 At the deliberations meeting the Council agreed to

make some relatively minor wording changes to the Policy. These have been

included in the final version of the Policy for adoption at this meeting

(Attachment 6).

Housing and Business Assessments

5.24 The Housing and Business Assessment (HBA) is

required under the National policy Statement Urban Development and underpins

the LTP 2024-2034.

5.25 The Tasman HBA and Combined Nelson Tasman HBA were

adopted as supporting information the LTP Consultation Document and made

available to the public.

5.26 Minor changes as a consequence of decisions made by

the Council on the LTP 2024-2034 have been incorporated into these documents

and they are presented for adoption (Attachments 7 and 8).

Activity Management Plans

5.27 The Activity Management Plans underpin the LTP

2024-2034. The draft Activity Management Plans were published as supporting

information to the Consultation Document and some submissions were received on

aspects of them.

5.28 The Council made several decisions at the

deliberations meetings on 23 and 24 May which have been incorporated into the

relevant Activity Management Plans. The Activity Management Plans (Attachments

9-21) are presented for adoption at this meeting.

6.1 The options are outlined in the

following table. Staff recommend option 1.

|

Option

|

Advantage

|

Disadvantage

|

|

1.

|

Adopt the following:

· Revenue and Financing Policy.

· Long Term Plan 2024-2034.

· Development and Financial Contributions Policy.

· Rates Remission Policy.

· Policy on Postponement and Remission of Rates on Māori Land.

· Community Facilities Funding Policy.

· Housing and Business Assessment.

· Activity Management Plans.

|

· Enables

the Council to meet its statutory deadlines for the LTP and related plans and

policies.

· Enables

rates to be struck for the 2024/2025 year.

· Enables

staff to commence the processes to implement the LTP for the 2024/2025 year

in a timely manner.

· Enables

staff to contact submitters to inform them of the decisions the Council has

made.

· The

Council’s intention for delivery of services can be conveyed to the

community.

|

· There

are no notable disadvantages for this option.

|

|

2.

|

Do not adopt the LTP 2024-2034 and

associated policies and documents

|

There are no notable advantages for this option.

|

· Staff

will not have clear direction for the delivery of services for the 2024/2025

year.

· The

Council’s intention for the delivery of its services will not be clear

to the community

· Re-work on

aspects of the documents would become necessary with associated costs and

staff time requirements, prior to adoption by Council at a future date.

· Creates substantial difficulties with striking the rates for the

2024/2025 year.

|

7.1 The legal requirements and

considerations were detailed in the Long-Term Plan 2024-2034 Deliberations

Report (RCN24-05-22).

7.2 Under section 93(3) the Council must

adopt the Long-Term Plan prior to the commencement of the first year to which

it relates.

8. Iwi

Engagement / Whakawhitiwhiti ā-Hapori Māori

8.1 The engagement undertaken with iwi

during the development of the Long -Term plan 2024-2034 was detailed in the

Long-Term Plan 2024-2034 Deliberations Report (RCN24-05-22).

9. Significance

and Engagement / Hiranga me te Whakawhitiwhiti ā-Hapori Whānui

9.1 The overall LTP 2024-2034 and associated

policies are of high significance.

9.2 A consultation process, using the

special consultative procedure, that is consistent with the high level of

significance of the decisions to be made, has been undertaken on the LTP

Consultation Document and concurrent consultations, with the supporting documents

providing additional information.

9.3 At the deliberations meeting on 23/24 May 2024 the Council

noted the various budget changes since the Consultation Document, concurrent

consultations and supporting information were adopted, and decided that further

consultation would not be undertaken.

|

|

Issue

|

Level of

Significance

|

Explanation of

Assessment

|

|

1.

|

Is there a high level

of public interest, or is decision likely to be controversial?

|

High

|

We have received a

relatively high number of submissions on the LTP Consultation Document

indicating the level of public interest. Fewer submissions were

received on the concurrent consultations.

|

|

2.

|

Are there impacts on

the social, economic, environmental or cultural aspects of well-being of the

community in the present or future?

|

High

|

We are in a period of

high cost of living increases that is affecting the economic wellbeing of

many in our community. Deciding on the level of the rates revenue requirement

in Year 1 in particular, as well as subsequent years, will have an impact on

economic wellbeing. Similarly, decisions on potential changes to levels of

service could affect social, economic, cultural or environmental wellbeing.

|

|

3.

|

Is there a

significant impact arising from duration of the effects from the decision?

|

Medium

|

The impact is

primarily in Year 1 of the Plan. The Council has the opportunity to make

further decisions through the Annual Plan processes or if required by

amending the LTP

|

|

4.

|

Does the decision

relate to a strategic asset? (refer Significance and Engagement Policy for

list of strategic assets)

|

Medium

|

The LTP includes

plans for the management of our strategic assets.

|

|

5.

|

Does the decision

create a substantial change in the level of service provided by Council?

|

Low

|

The LTP to be adopted

has makes minor changes to the level of service.

|

|

6.

|

Does the proposal,

activity or decision substantially affect debt, rates or Council finances in

any one year or more of the LTP?

|

High

|

The decisions made

will affect the debt, rates, and the Council’s finances for the next 10

years, albeit modifiable through subsequent Annual Plans.

|

|

7.

|

Does the decision

involve the sale of a substantial proportion or controlling interest in a CCO

or CCTO?

|

NA

|

The LTP does not plan

for the sale of a substantial proportion or controlling interest in a CCO or

CCTO.

|

|

8.

|

Does the proposal or

decision involve entry into a private sector partnership or contract to carry

out the deliver on any Council group of activities?

|

NA

|

|

|

9.

|

Does the proposal or

decision involve Council exiting from or entering into a group of

activities?

|

NA

|

|

|

10.

|

Does the proposal

require particular consideration of the obligations of Te Mana O Te Wai

(TMOTW) relating to freshwater and Affordable Waters services?

|

NA

|

|

10. Communication

/ Whakawhitiwhiti Kōrero

10.1 Following adoption, the media will be notified on

the adoption of the LTP 2024-2034.

10.2 Once adopted the LTP 2024-2034 document will be

professionally designed and posted on the Council’s website. Final

versions of the concurrent policies, Activity Management Plans, and other

supporting information will also be posted on the Council's website.

10.3 Hardcopies of the LTP 2024-2034 will be made

available for reference at Council service centres and libraries.

10.4 Submitters will be contacted by email or letter to

notify them of the decisions made by the Council on the LTP 2024-2034 and

concurrent consultations.

11. Financial

or Budgetary Implications / Ngā Ritenga ā-Pūtea

11.1 The Financial Strategy in the LTP 2024-2034

introduces a dynamic rates cap (excluding growth) based

on the inflation rate the Council is expected to experience (i.e. the Local

Government Cost Index (LGCI)) and an adjustor for service changes (currently

set at 3% per annum). The adjustor for service changes provides some capacity to respond to further unfunded mandates

imposed by the Government, as well as respond to the needs and wants of our

community.

11.2 The

planned rates increases exceed our self-imposed rates increase cap in the

Financial Strategy in the 2024/2025 and 2025/2026 years.

11.3 We

are planning for an unbalanced budget in the following years: 2024/2025,

2025/2026, 2028/2029, 2032/2033 and 2033/20342. Unbalanced budgets are planned

in these years either where:

· Some operating

expenditure has an enduring benefit and we have chosen not to fund this from

rates e.g. the Digital Innovation Programme; or

· We are transitioning

to fully funding depreciation; or

· We are balancing

expenditure and rating demands with the impact this has on community

well-being.

11.4 The Financial Strategy in the LTP 2024-2034 also

introduces a dynamic net debt cap at 160% of revenue.

11.5 In the LTP 2024-2034 net debt is budgeted to rise

81.7% to $451.9 million by 2033/2034. Our self-imposed debt cap will be

exceeded in 2032/2033 and 2033/2034 as a result of borrowing for the

replacement wastewater treatment plants at Motueka and Tākaka.

11.6 We have borrowing capacity above the debt cap and within the Local

Government Funding Agency limits. Following an emergency event we intend

to reprioritise existing work programmes, seek assistance from Government and

borrow (above the debt cap if necessary) to fund recovery. This additional

borrowing would need to be serviced by higher rates in subsequent years.

12.1 There is a low risk that the Council’s

consultation processes might be challenged. In general, the risks to legal

challenge have been mitigated through:

12.1.1 providing a consultation period that meets the

one-month minimum i.e. that meets the statutory requirement;

12.1.2 having a comprehensive consultation plan and monitoring

this throughout the consultation process; and

12.1.3 providing several different ways for people to make

submissions; and

12.1.4 identifying and contacting people who are interested

and affected parties for various of the proposals and changes in the

Consultation Document and concurrent consultations; and

12.1.5 providing communications technology that enabled people

to present their submissions to hearings remotely.

12.2 There is some residual risk of legal

challenge as a result of the post-consultation budget changes that were

incorporated into the final LTP 2024-2034. The Council considered this legal

risk in some detail in the deliberations report (RCN24-05-22)

and decided against further consultation.

13. Climate

Change Considerations / Whakaaro

Whakaaweawe Āhuarangi

13.1 The adoption of the LTP 2024-2034 will have an

impact on both greenhouse gas emissions and climate adaptation opportunities or

threats. The Council’s planned programme for mitigation and adaptation

was one of the key issues consulted on and having considered that feedback,

decisions have been incorporated into the LTP 2024-2034.

13.2 The Council’s planned response to climate

change is outlined in the draft Tasman Climate Response Strategy and Action

Plan which was a concurrent consultation. The Strategy and Action Plan aligns

with the Government’s plans, policies and legal obligations relating to

climate change (e.g. Climate Change Response Act, Emissions Reduction Plan,

National Adaptation Plan etc). Staff recommend the adoption of the final

version of the Strategy and Action Plan in a separate report on the agenda for this

meeting.

14. Alignment

with Policy and Strategic Plans / Te Hangai ki ngā aupapa Here me ngā

Mahere Rautaki Tūraru

14.1 The Council’s strategy for the development of

the LTP 2024-2034 has been to ensure that the document aligns with our key

strategic priorities and community outcomes.

14.2 The LTP 2024-2034 is the vehicle through which resources are

allocated for the delivery of the services and projects that the Council

provides. Various Council strategies and policies, as well as statutory

requirements and other obligations and risks, have been used to prioritise and

allocate the resources planned in the LTP.

15.1 The development of the LTP 2024-2034 has been undertaken over

an 18-month plus period. The Council has undertaken multiple workshops on

a wide range of related topics and made decisions at some key points in the

process.

15.2 The

Council has met the requirements of the Local Government Act 2002 in preparing

and consulting on the LTP Consultation Document, supporting information, and

concurrent consultation documents. The audit on the final LTP 2024-2034

commenced on 4 June 2024 and the audit report will be tabled at this meeting.

Adopting the final LTP 2024-2034, and the Rating Resolutions (in a separate

report on this agenda), concludes this part of the three-year cycle.

15.3 The Council has similarly met the requirements of

the Local Government Act 2002 in the preparation and consultation on the

Revenue and Financing Policy, Development and Financial Contributions Policy,

Rates Remission Policy, Policy on Postponement and Remission of Rates on

Māori Land and Community Facilities Funding Policy.

15.4 The LTP 2024-2034 will come into effect on 1 July

2024 and will be in force until 30 June 2027, unless there is a subsequent

amendment.

15.5 The LTP document will be professionally designed,

reviewed again by Audit NZ (to ensure no material changes have taken place) and

published prior to 30 July 2024.

15.6 Council staff will send copies of the final LTP

2024-2034 to the organisations required under the Local Government Act 2002,

and will make copies available in Council offices, libraries and on our

website.

15.7 Staff will also provide responses to submitters advising them of the

Council’s decisions on the key choices, the concurrent

consultations and the other topics included in the deliberations report.

|

1.

|

Tasman's

10-Year Plan 2024-2034 Volume 1 (Under Separate Cover)

|

|

|

2.

|

Tasman's

10-Year Plan 2024-2034 Volume 2 (Under Separate Cover)

|

|

|

3.

|

Development

and Financial Contributions Policy for adoption (Under Separate Cover)

|

|

|

4.

|

Rates Remission

Policy (Under Separate Cover)

|

|

|

5.

|

Policy on

the Remission and Postponement of Rates on Māori Land (Under Separate

Cover)

|

|

|

6.

|

Community

Facilities Funding Policy (Under Separate Cover)

|

|

|

7.

|

Housing

and Business Assessment - Tasman (Under Separate Cover)

|

|

|

8.

|

Housing

and Business Assessment Nelson Tasman (Under Separate Cover)

|

|

|

9.

|

Environmental

Management Activity Management Plan (Under Separate Cover)

|

|

|

10.

|

Public

Health and Safety Activity Management Plan (Under Separate Cover)

|

|

|

11.

|

Transportation

Activity Management Plan (Under Separate Cover)

|

|

|

12.

|

Coastal

Assets Activity Management Plan (Under Separate Cover)

|

|

|

13.

|

Water

Supply Activity Management Plan (Under Separate Cover)

|

|

|

14.

|

Wastewater

Activity Management Plan (Under Separate Cover)

|

|

|

15.

|

Stormwater

Activity Management Plan (Under Separate Cover)

|

|

|

16.

|

Waste

Management and Minimisation Activity Management Plan (Under Separate

Cover)

|

|

|

17.

|

Rivers

Activity Management Plan (Under Separate Cover)

|

|

|

18.

|

Parks and

Facilities Activity Management Plan (Under Separate Cover)

|

|

|

19.

|

Libraries

Activity Management Plan (Under Separate Cover)

|

|

|

20.

|

Property

Activity Management Plan (Under Separate Cover)

|

|

|

21.

|

Council

Enterprises Activity Management Plan (Under Separate Cover)

|

|

Tasman District

Council

Agenda – 27 June 2024

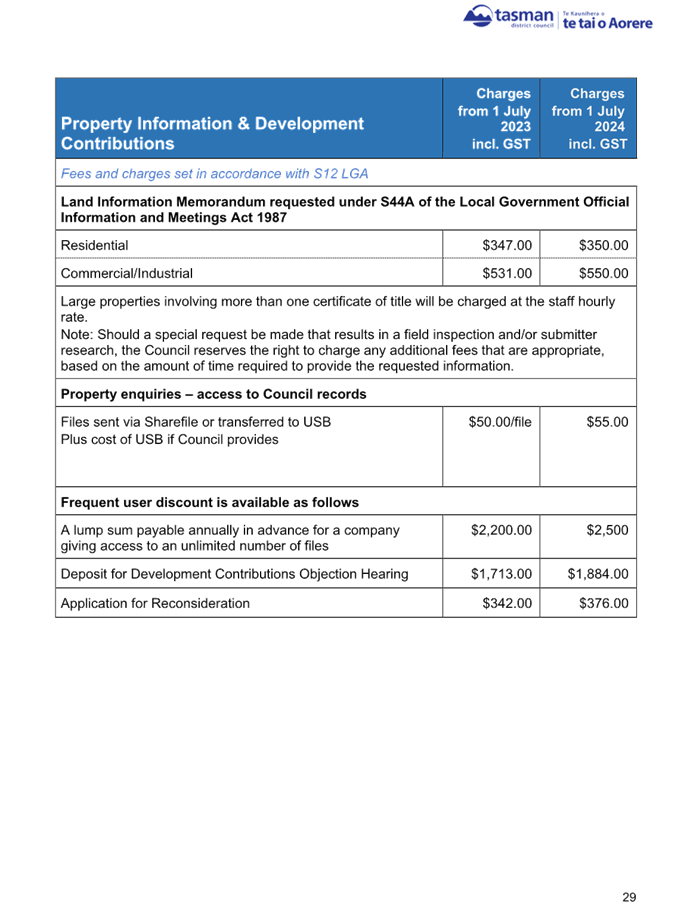

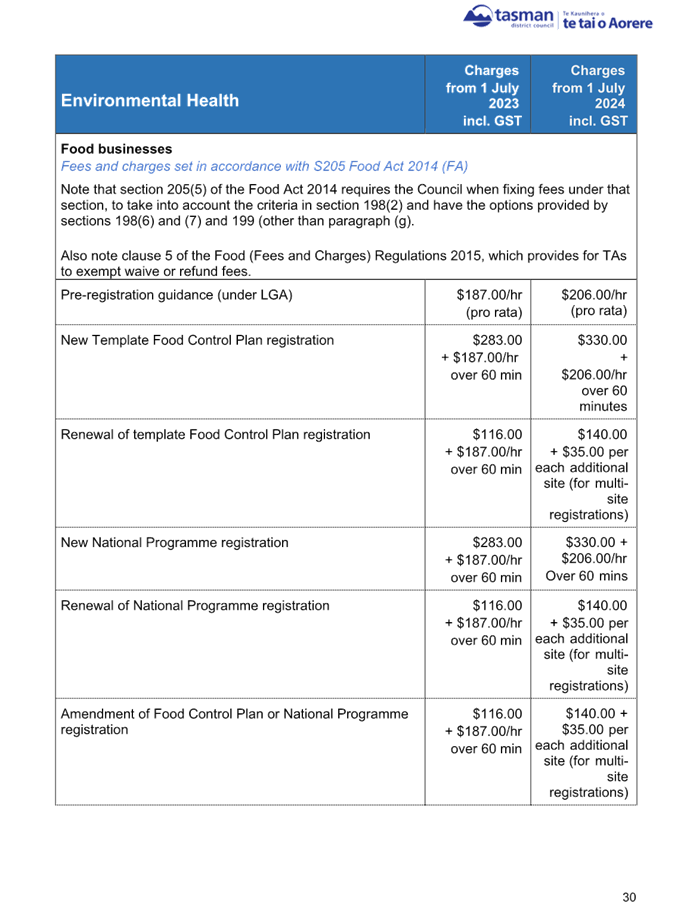

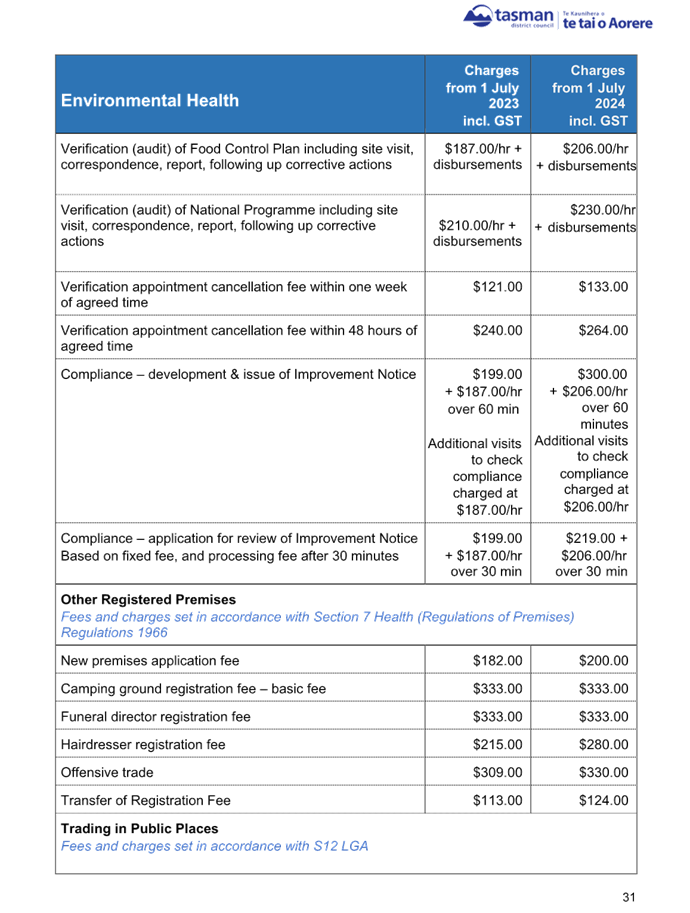

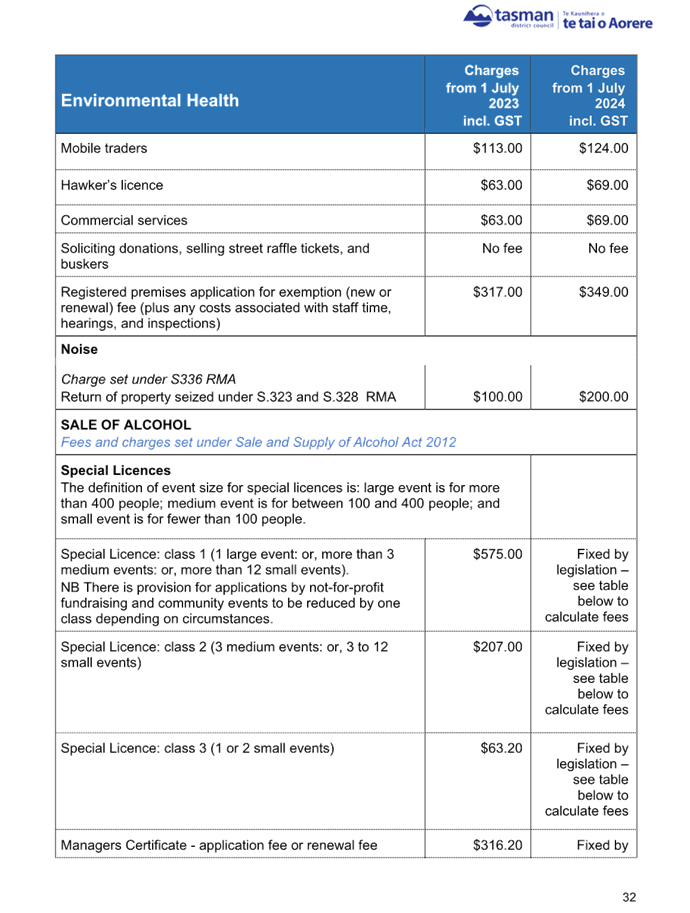

5.2 Adoption of Schedule of Fees and Charges

2024-2025

Decision Required

|

Report

To:

|

Tasman

District Council

|

|

Meeting

Date:

|

27

June 2024

|

|

Report

Author:

|

Alan

Bywater, Team Leader - Community Policy; Lyn Kearney, Strategic Policy

Administrator

|

|

Report

Authorisers:

|

Dwayne

Fletcher, Strategic Policy Manager; John Ridd, Group Manager - Service and

Strategy

|

|

Report

Number:

|

RCN24-06-20

|

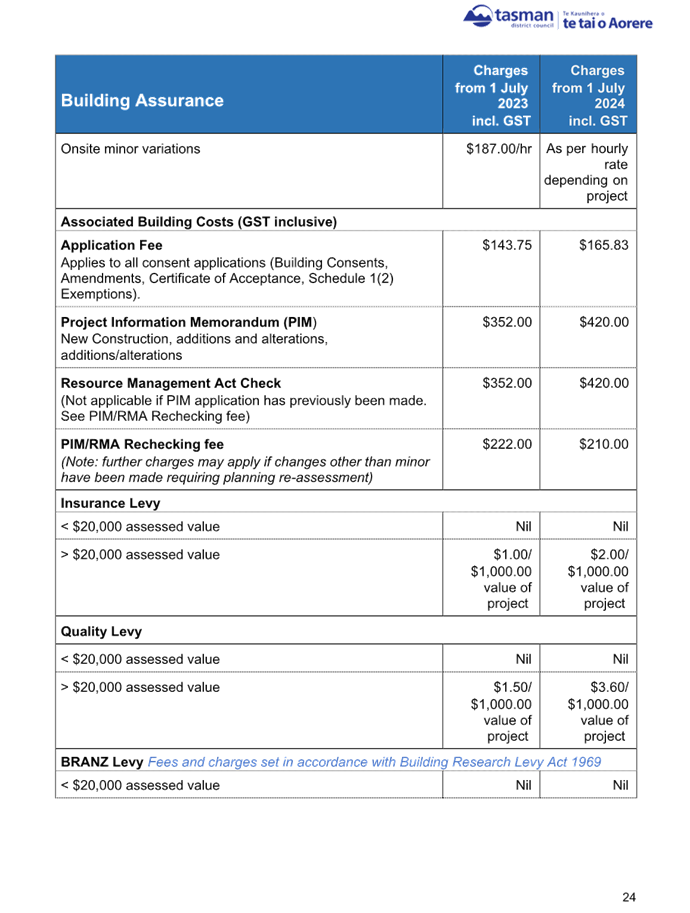

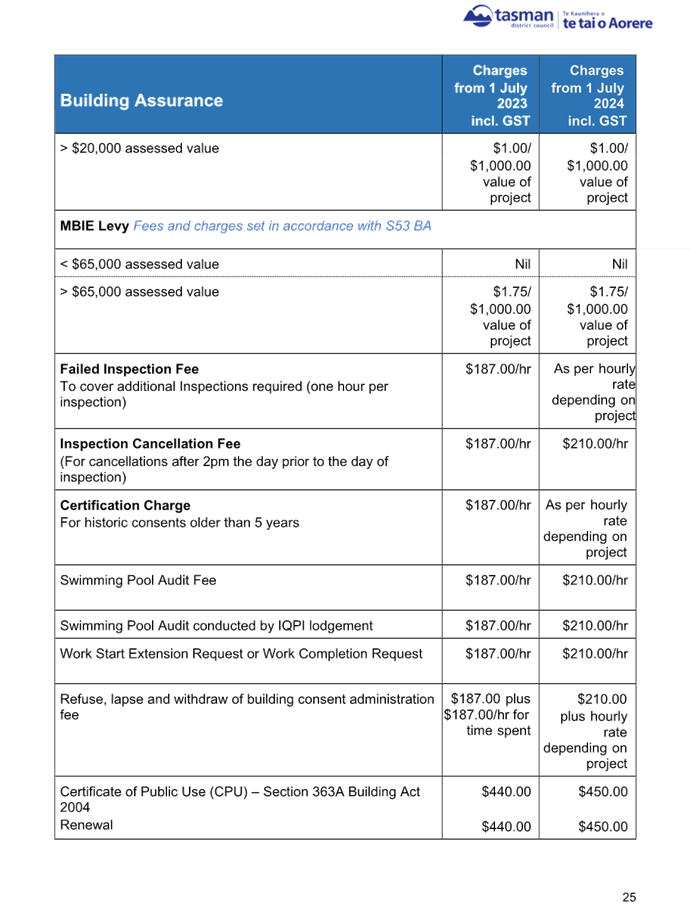

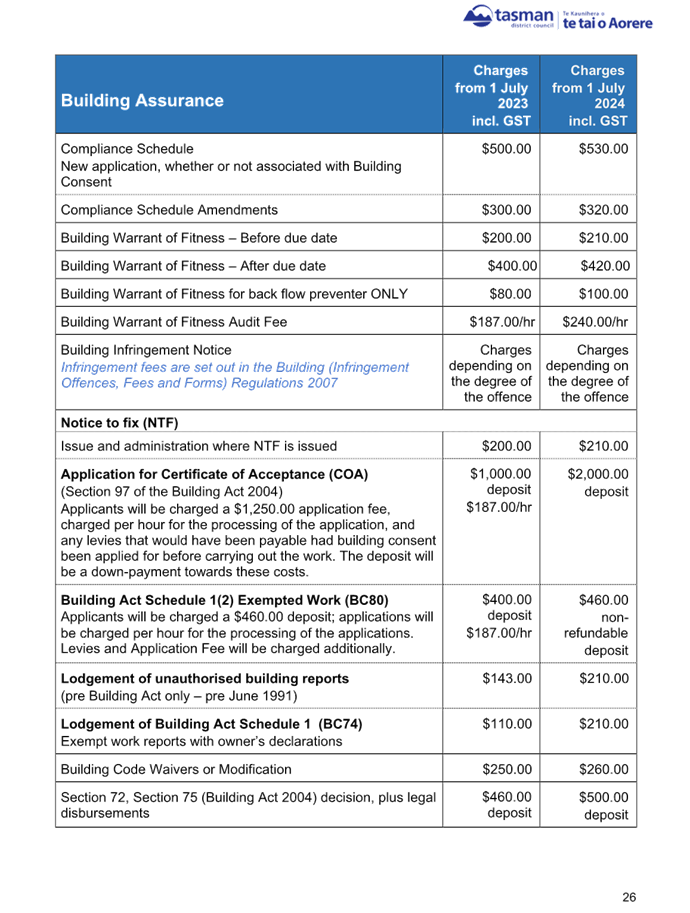

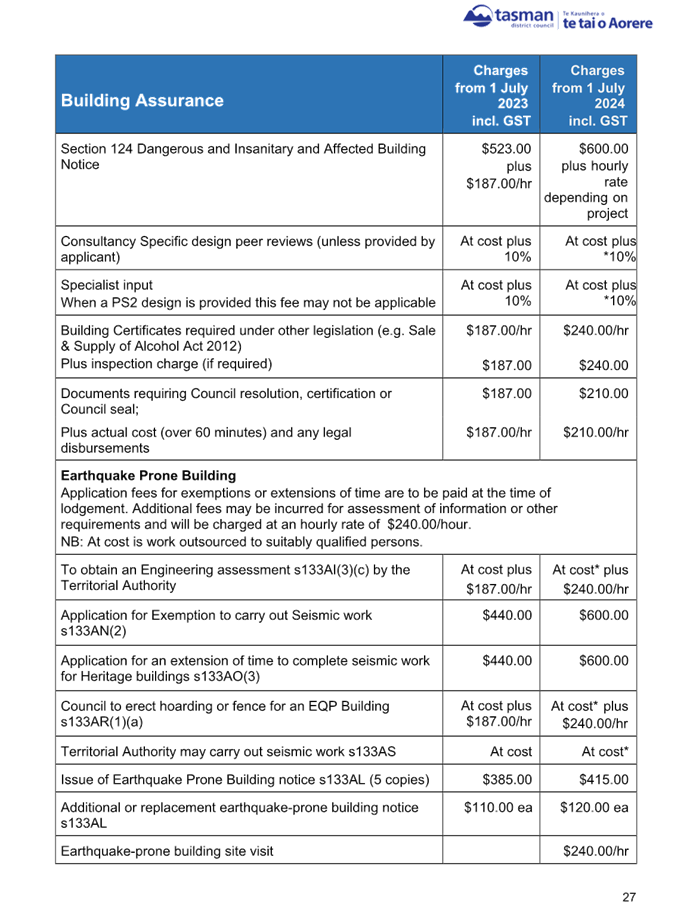

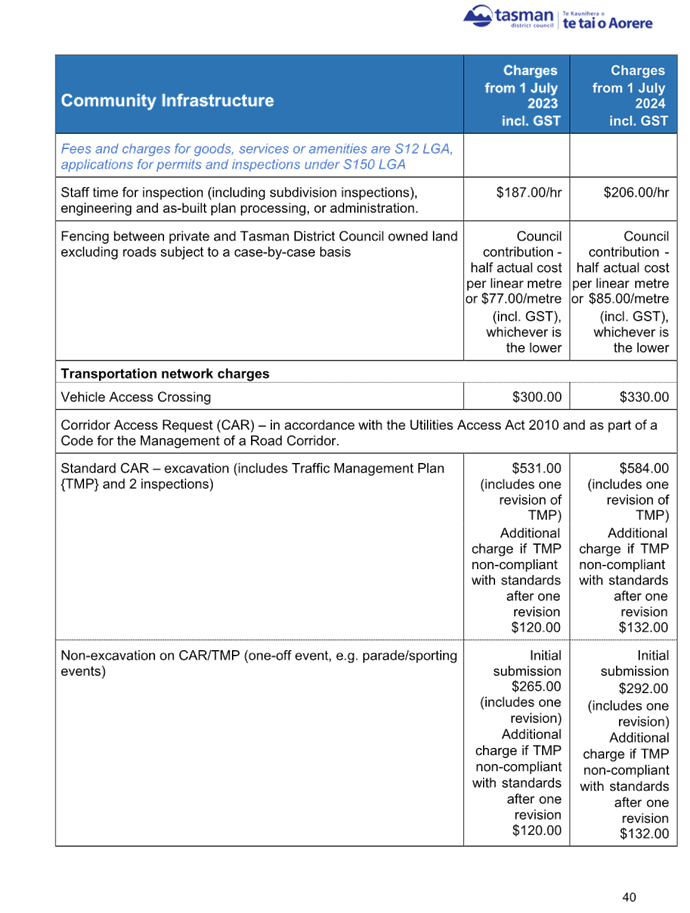

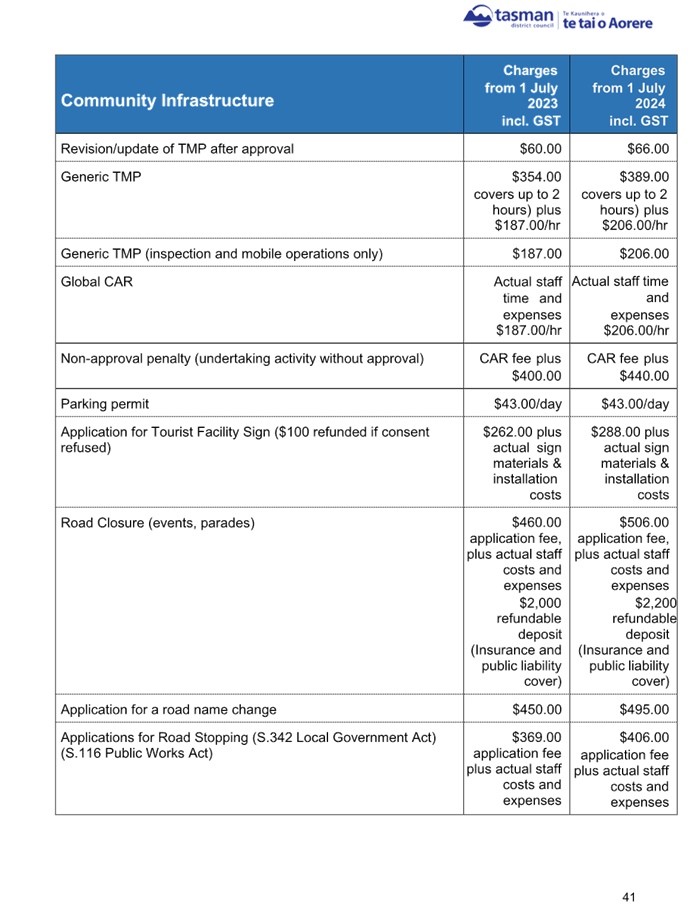

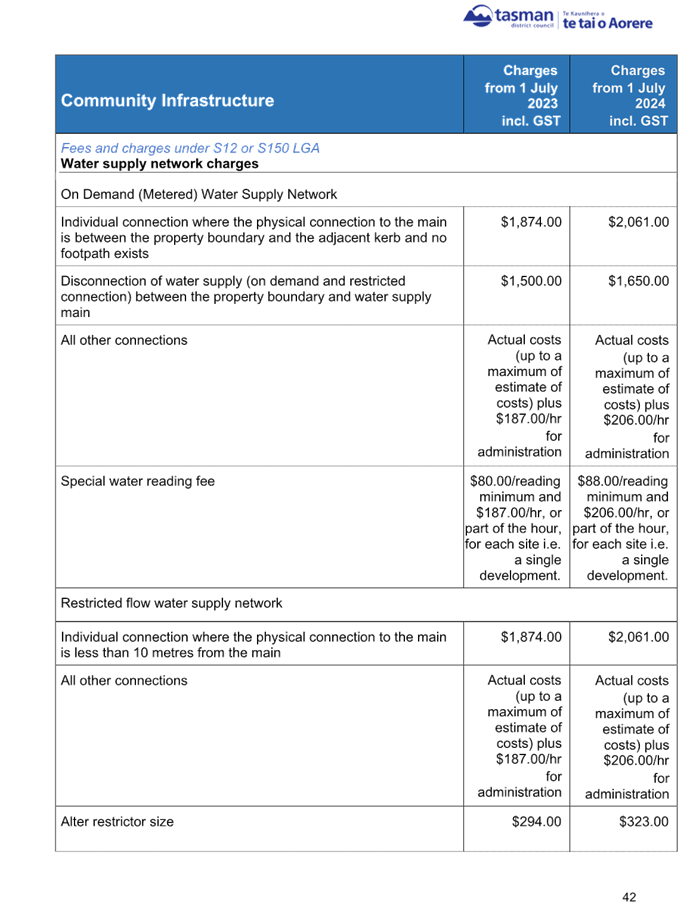

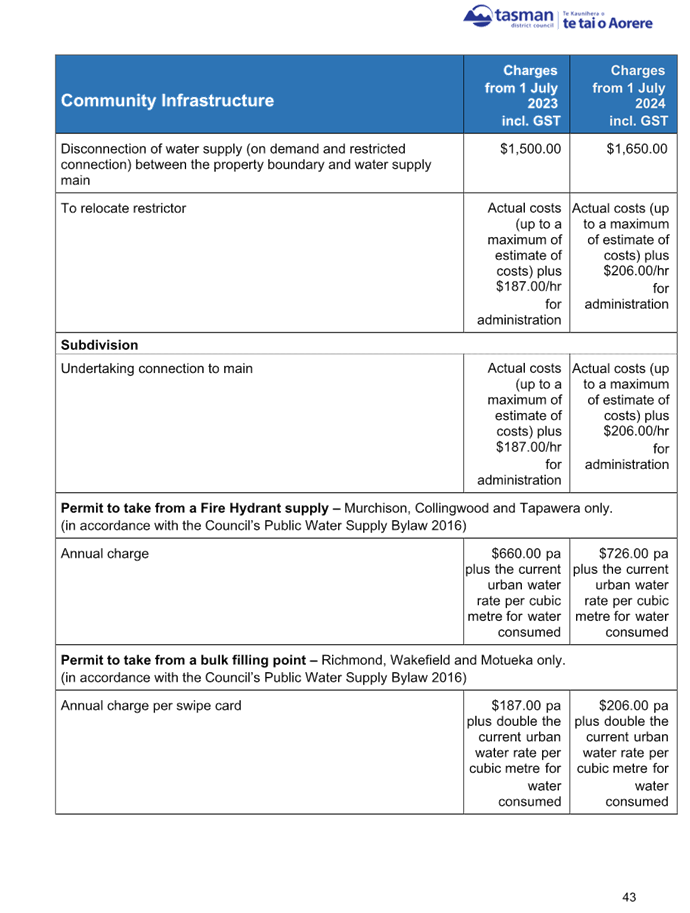

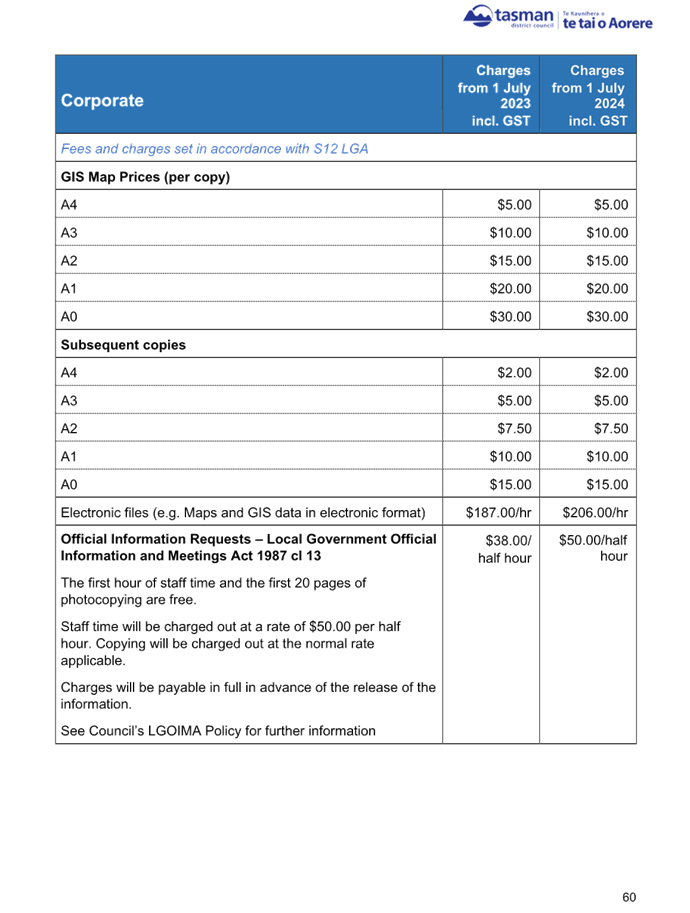

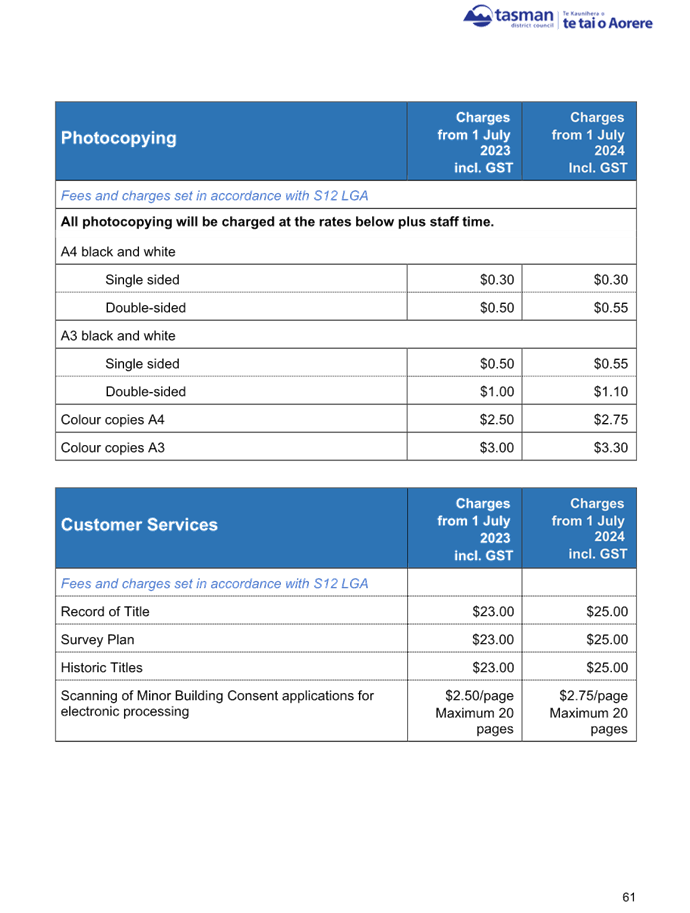

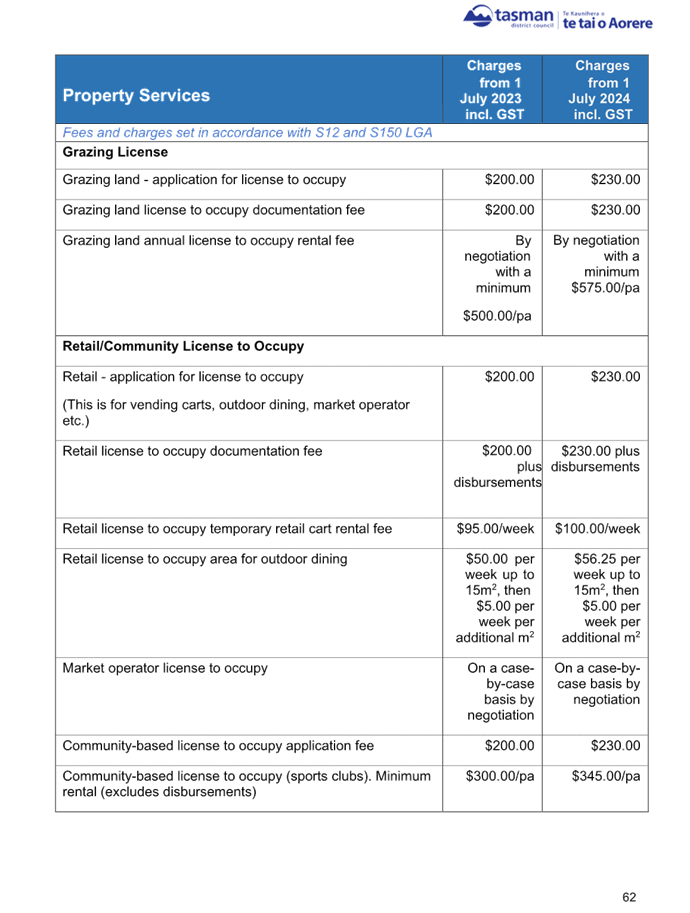

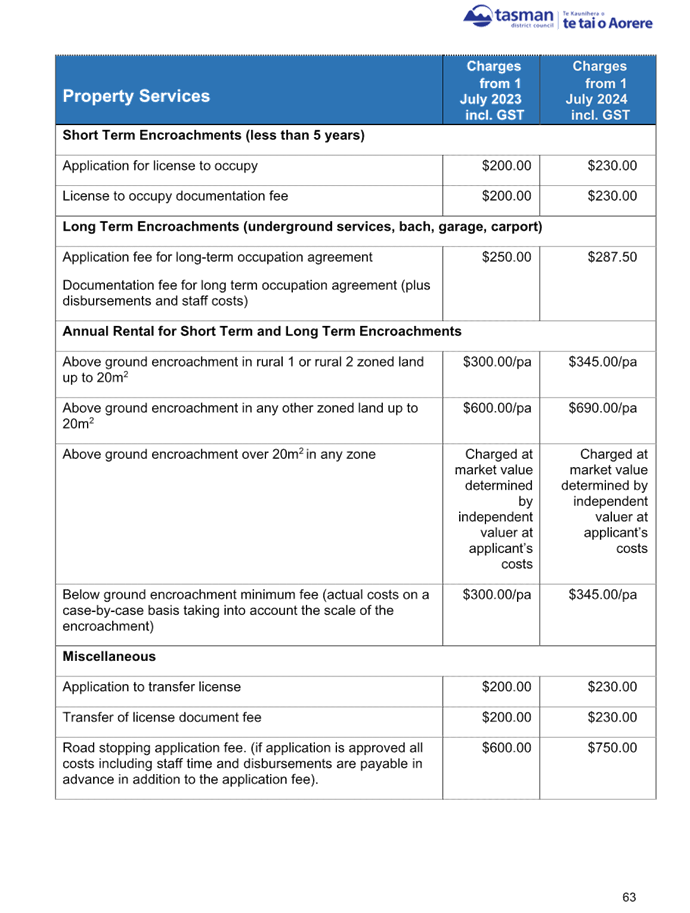

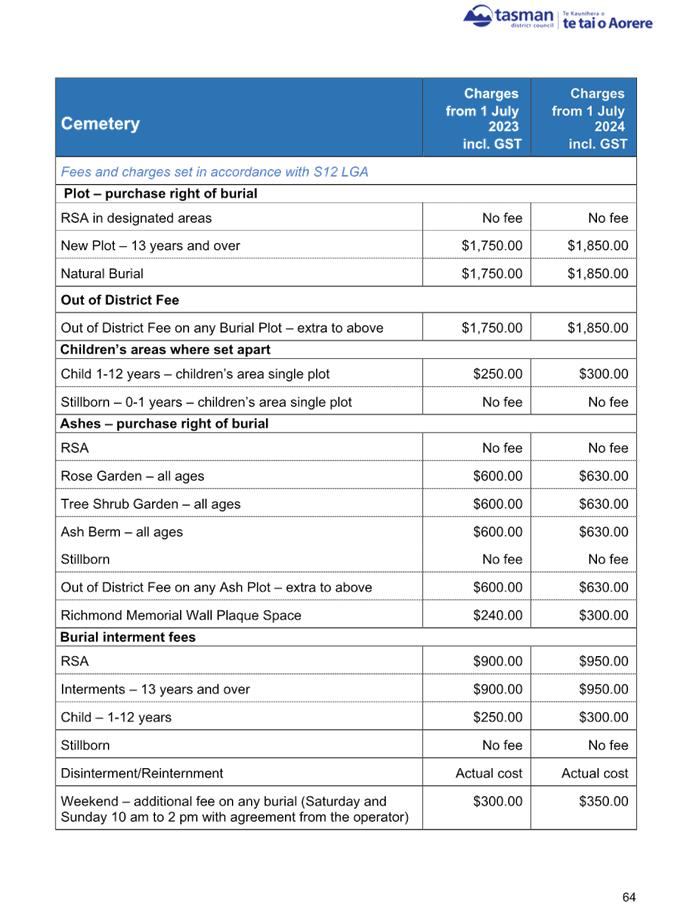

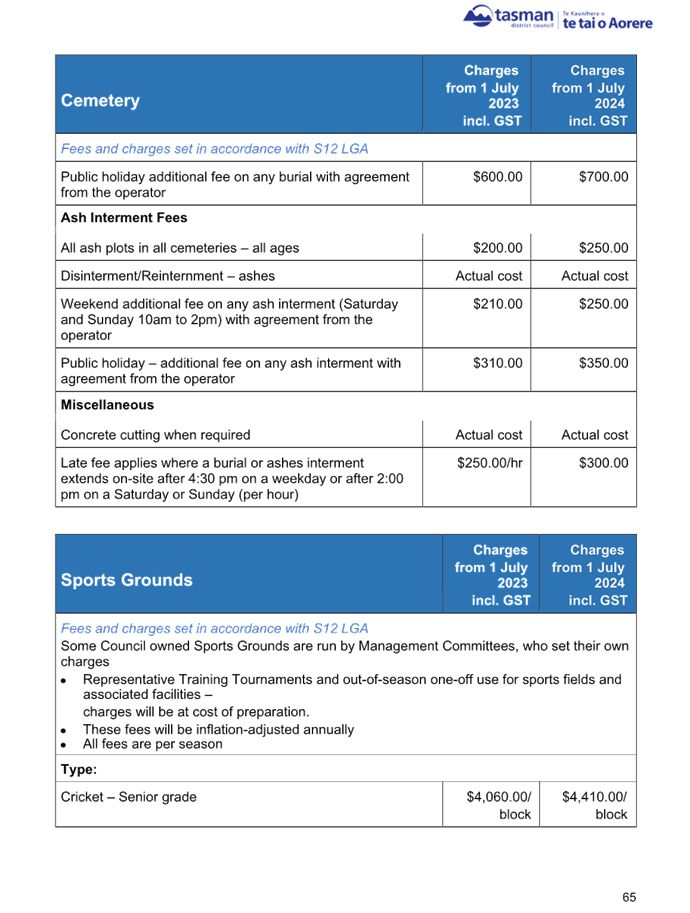

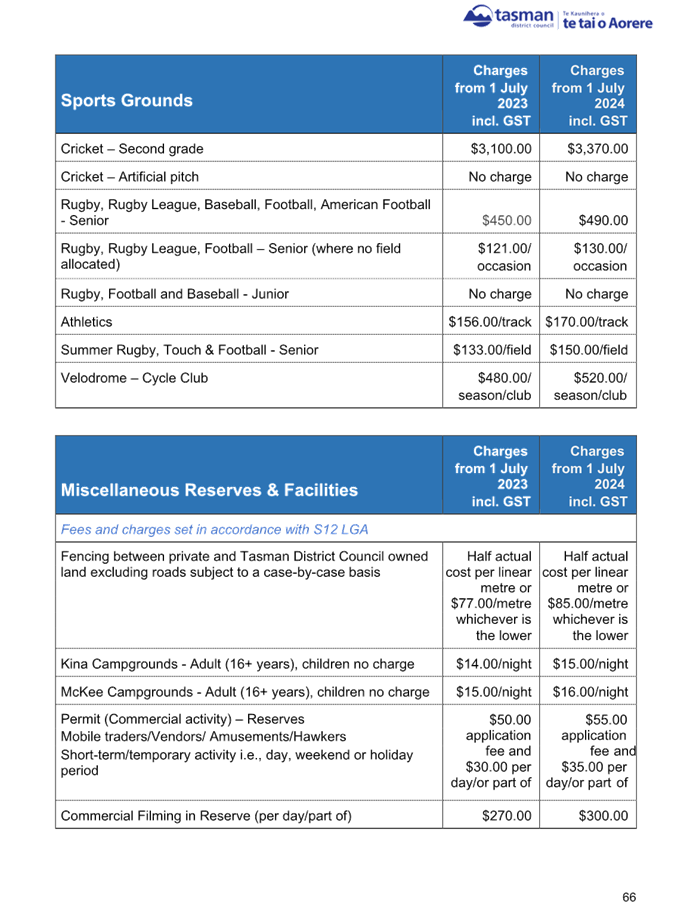

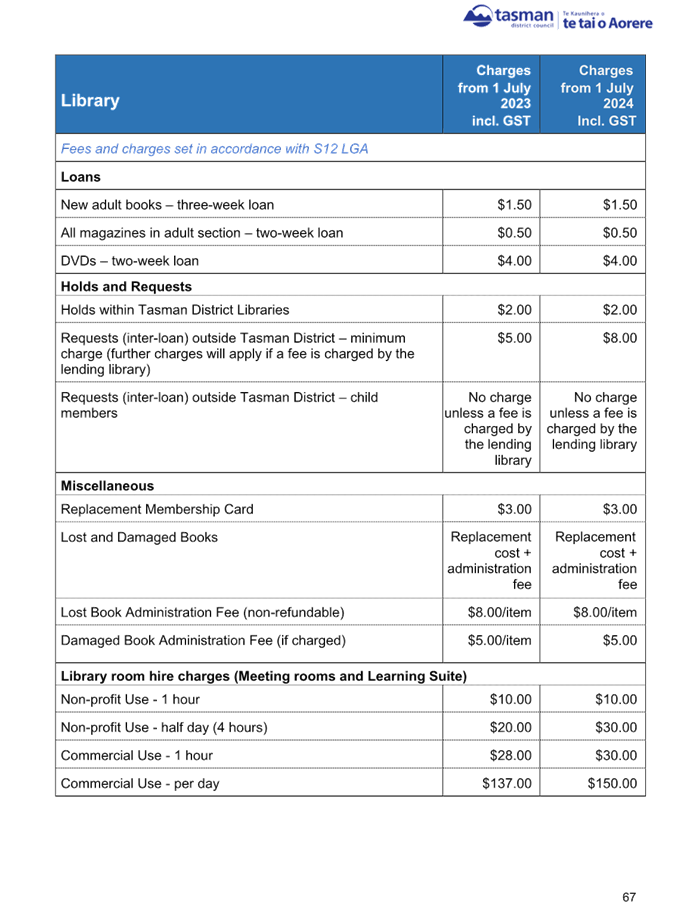

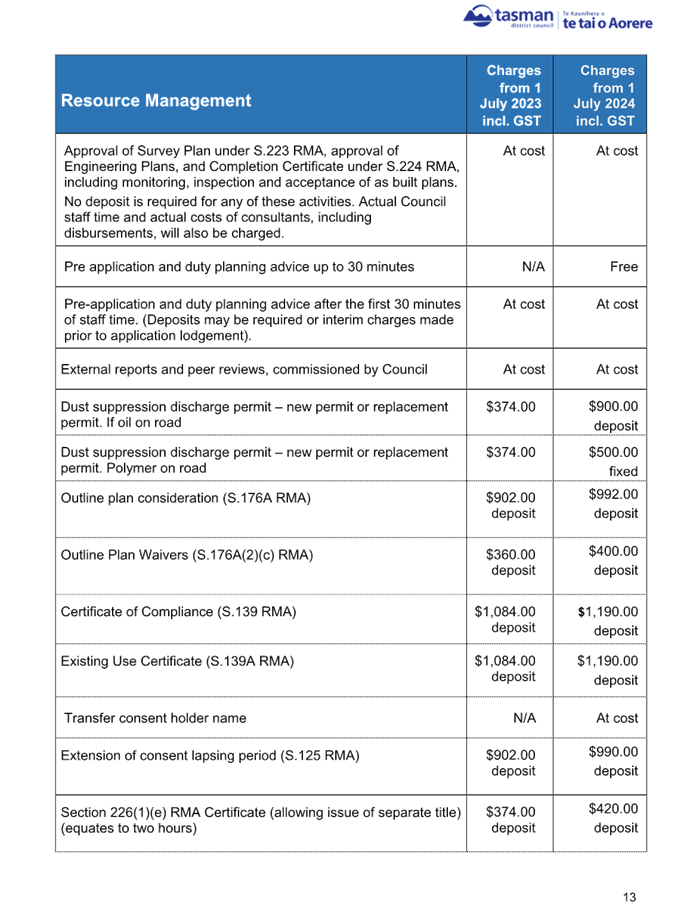

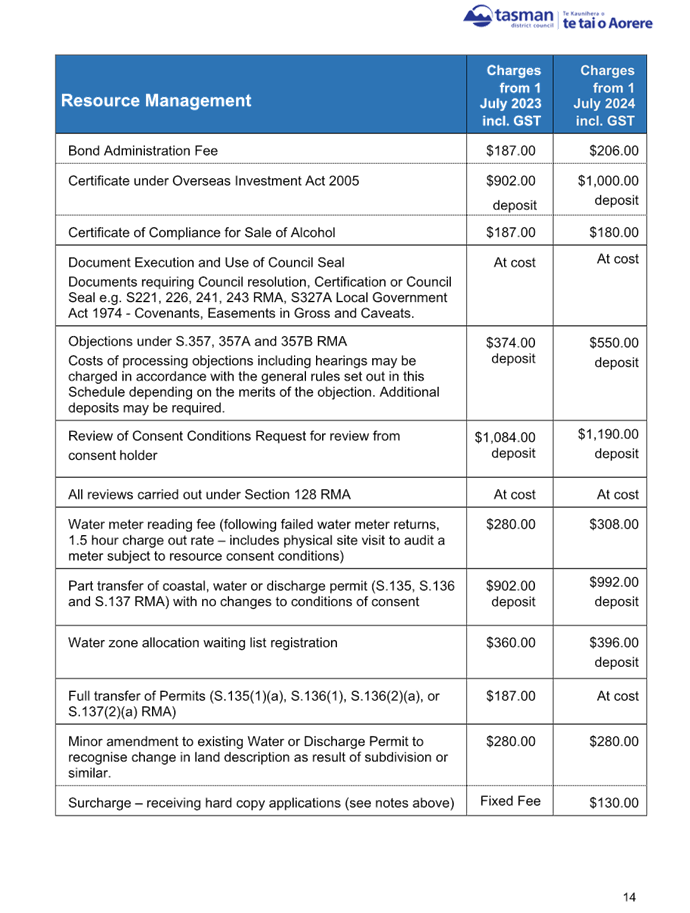

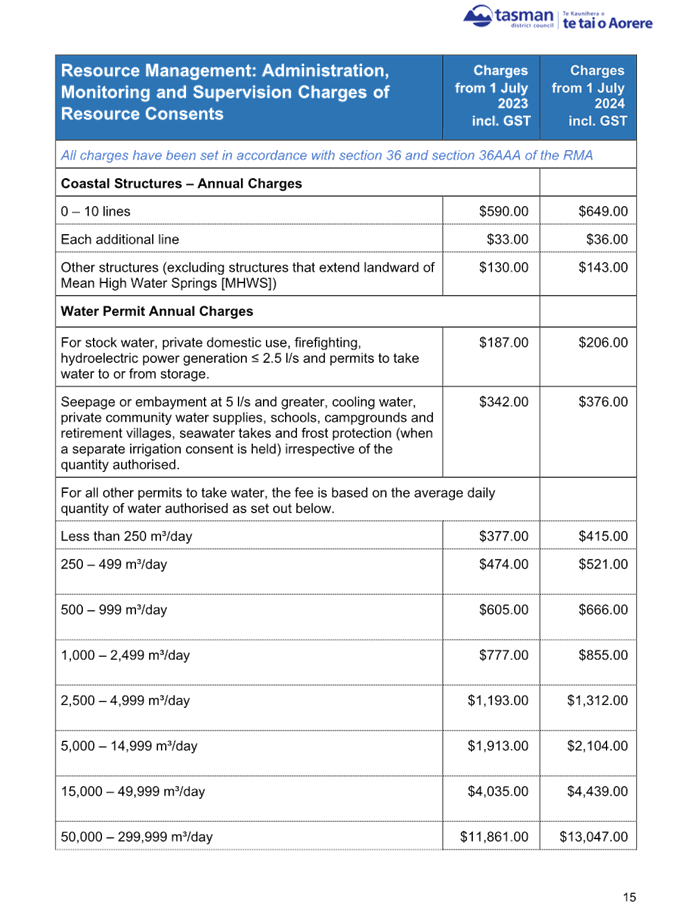

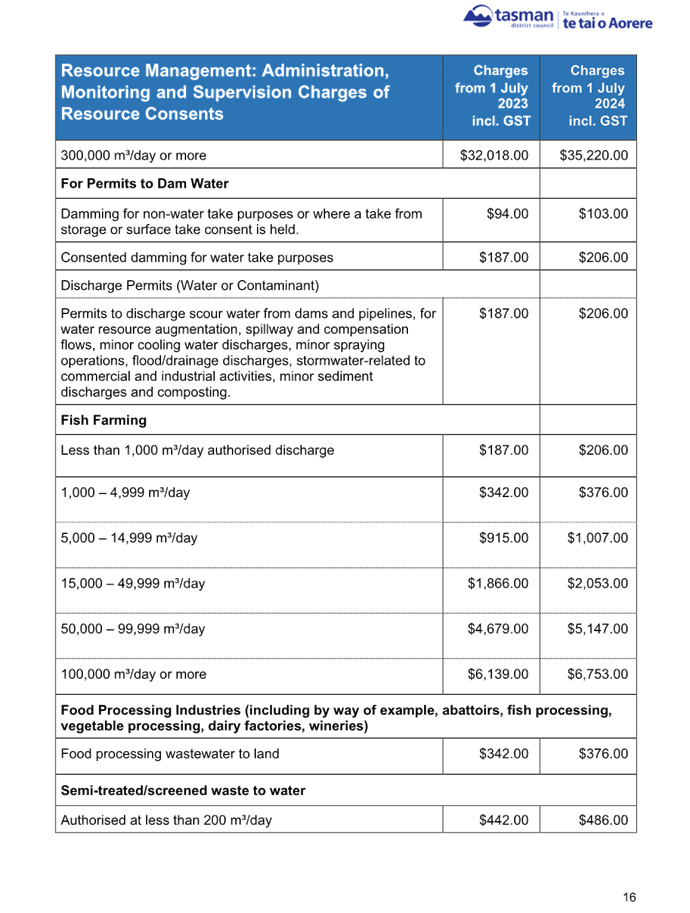

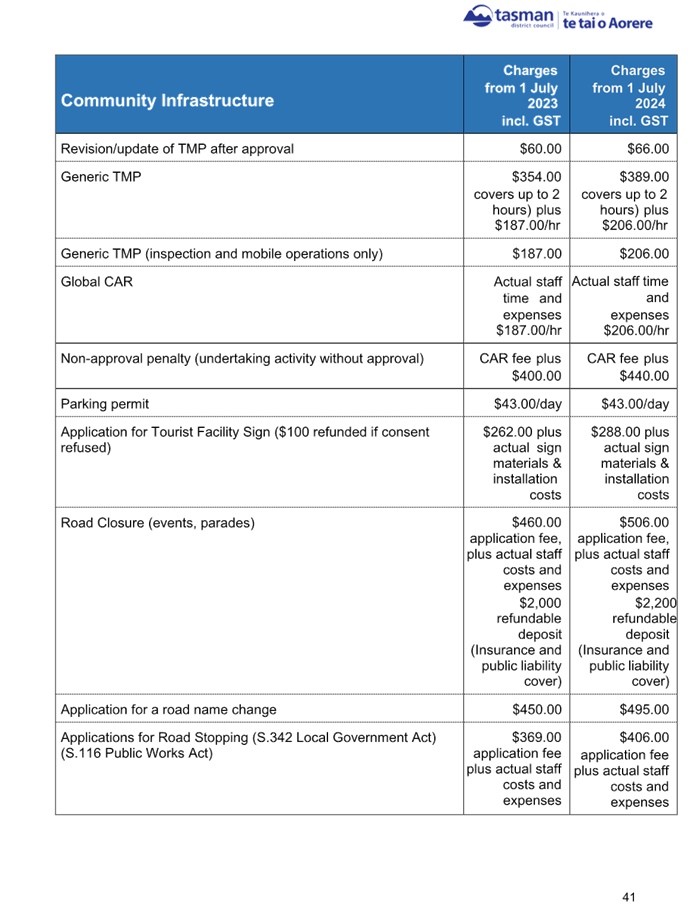

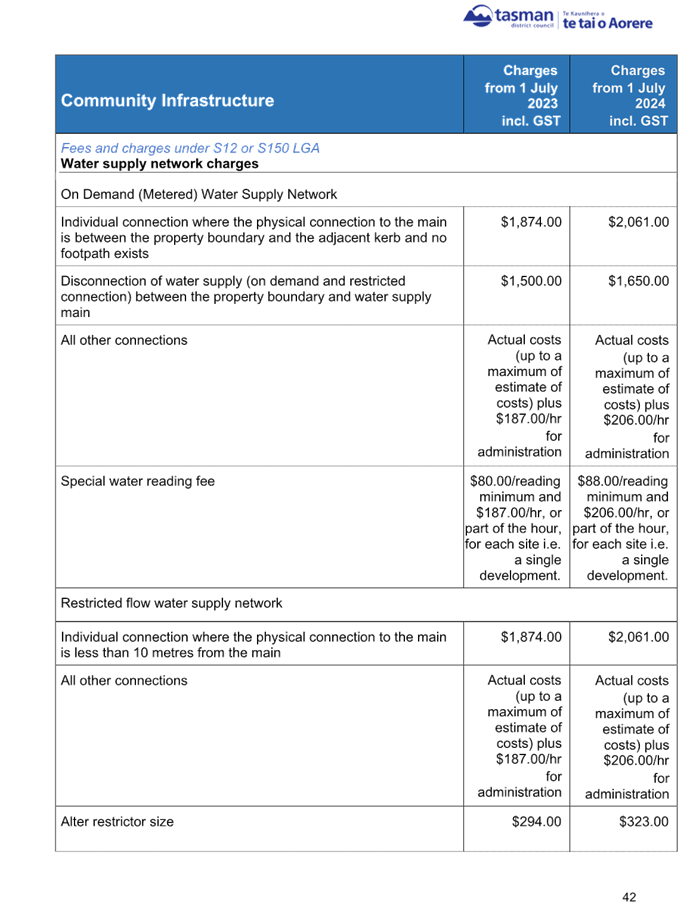

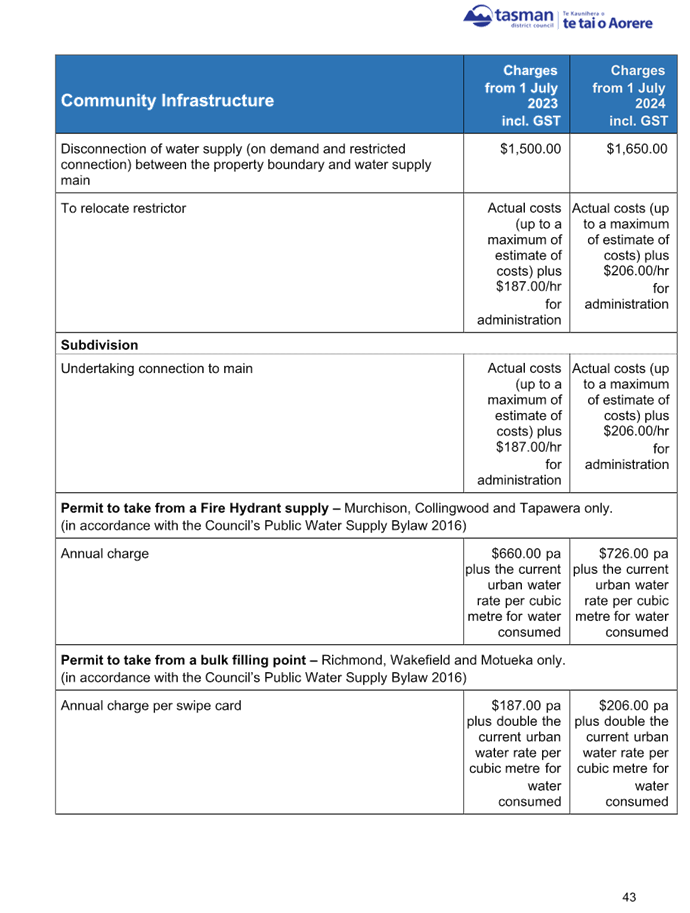

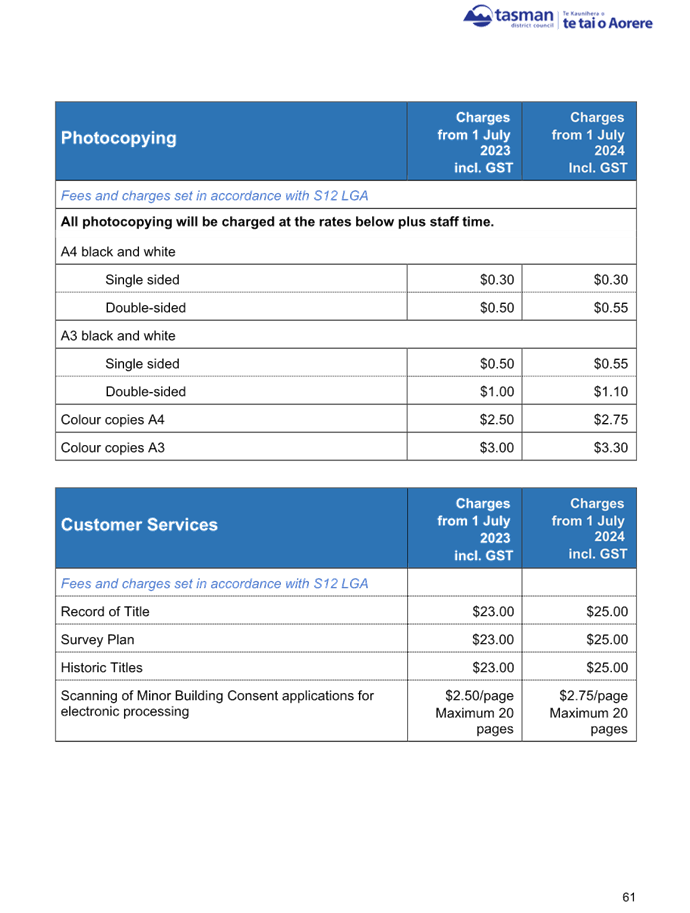

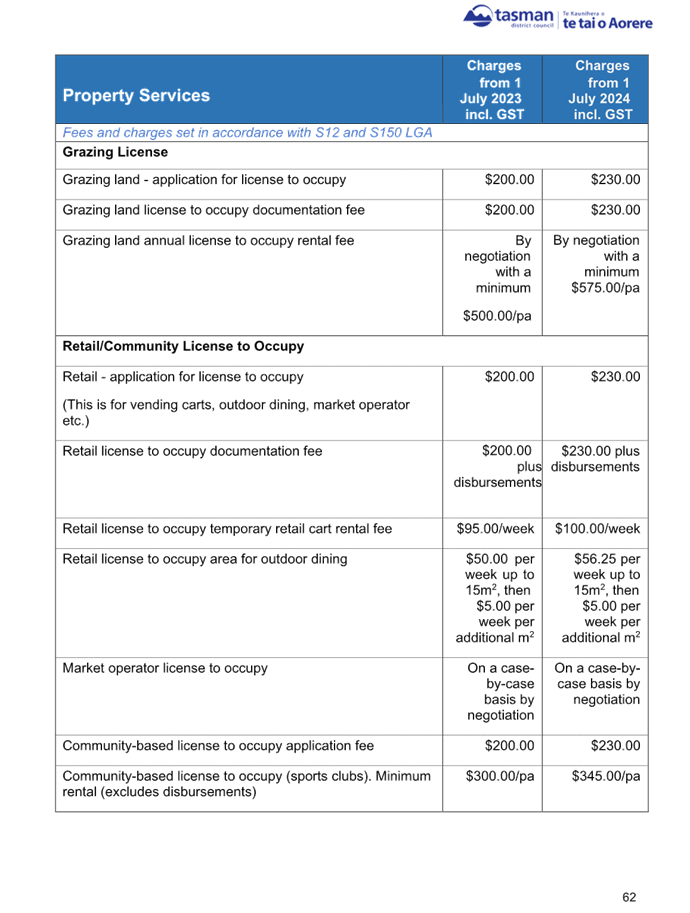

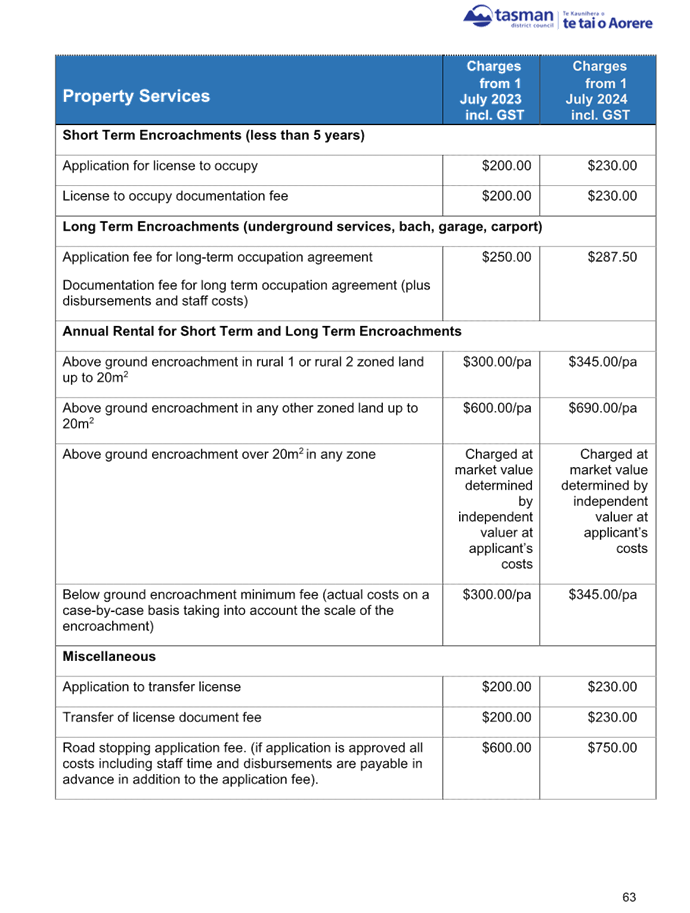

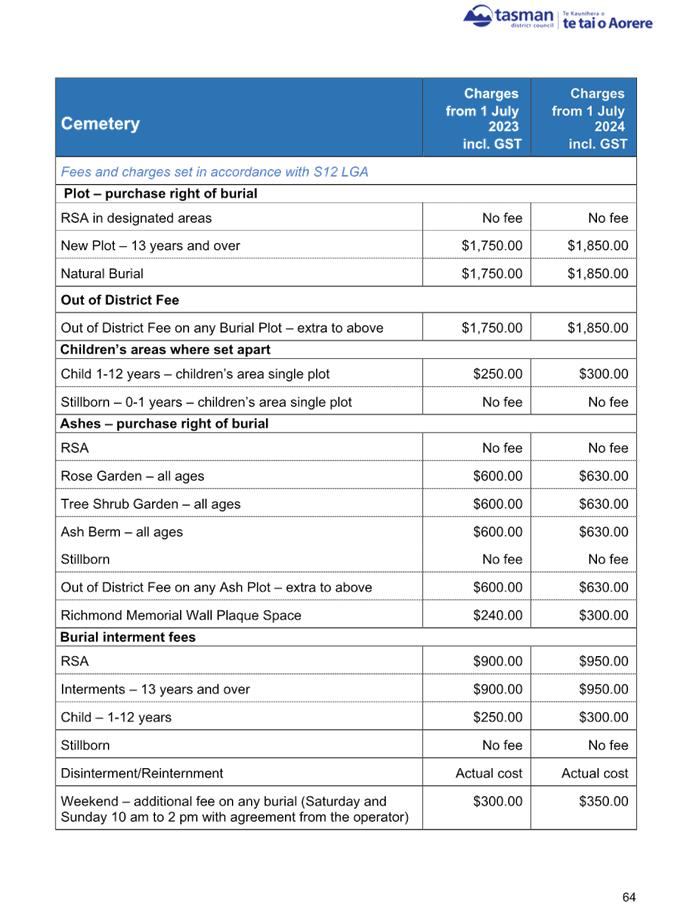

1. Purpose

of the Report / Te Take mō te Pūrongo

1.1 This

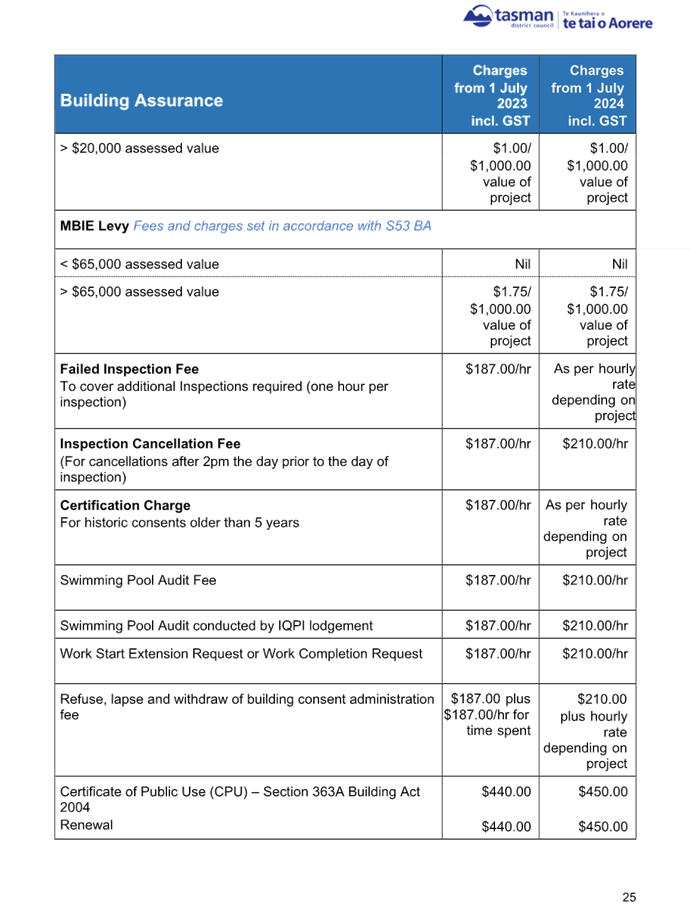

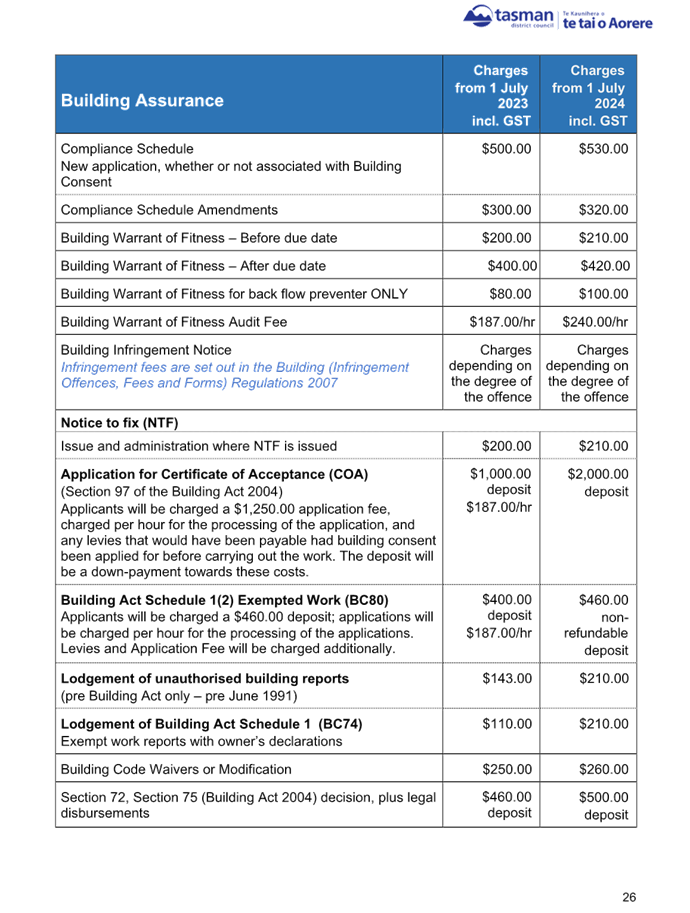

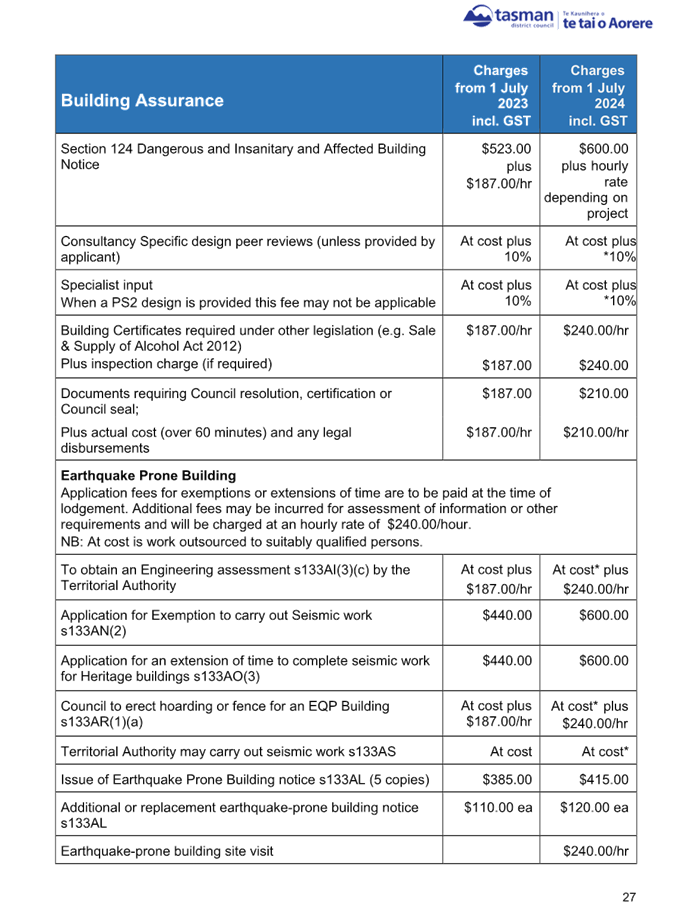

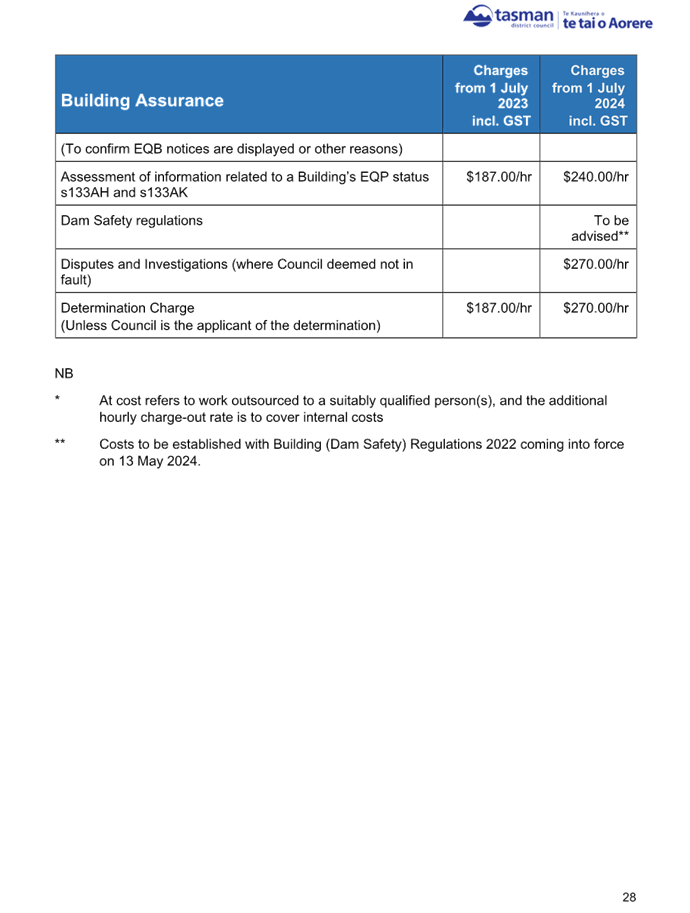

report presents the finalised Schedule of Fees and Charges 2024-2025 (Attachment

1) for adoption by the Council.

2. Summary

/ Te Tuhinga Whakarāpoto

2.1 The

Council can set fees and charges to recover costs associated with its services.

The Council reviews fees and charges annually and recommends changes, additions

or deletions through a “Schedule of Fees and Charges”.

2.2 At

the 25 March 2024 meeting the Council adopted the Statement of Proposal for the

Draft Schedule of Fees and Charges 2024/2025 for public consultation.

2.3 The

consultation period was 28 March to 28 April 2024 which ran concurrently with

the consultation on the Long Term Plan 2024-2034 (LTP).

2.4 This

year the Council proposed to increase fees and charges by 10% in general across

most areas and proposed several other changes including adding and removing

some fees and charges.

2.5 The

Council received 132 submissions on the Draft Schedule. There were 31

submitters who spoke to their submission at the public hearings on 8, 9 and 10

May 2024.

2.6 The

Council deliberated on the written and oral submissions at its meeting on 23

and 24 May 2024 and confirmed most of the fees in the draft schedule but

amended some fees.

3. Recommendation/s

/ Ngā Tūtohunga

That the Tasman

District Council

1. receives

the Adoption of Schedule of Fees and Charges 2024-2025 RCN24-06-20; and

2. notes that staff have incorporated all the changes

decided by the Council at the Long Term Plan 2024-2034

Deliberations meeting on 23 and 24 May 2024; and

3. adopts

the final Schedule of Fees and Charges 2024-2025 (Attachment 1 to the agenda

report) effective from 1 July 2024; and

4. authorises

the Chief Executive Officer to approve any minor editorial amendments to the

Schedule of Fees and Charges 2024-2025, prior to it being made available on the

Council’s website.

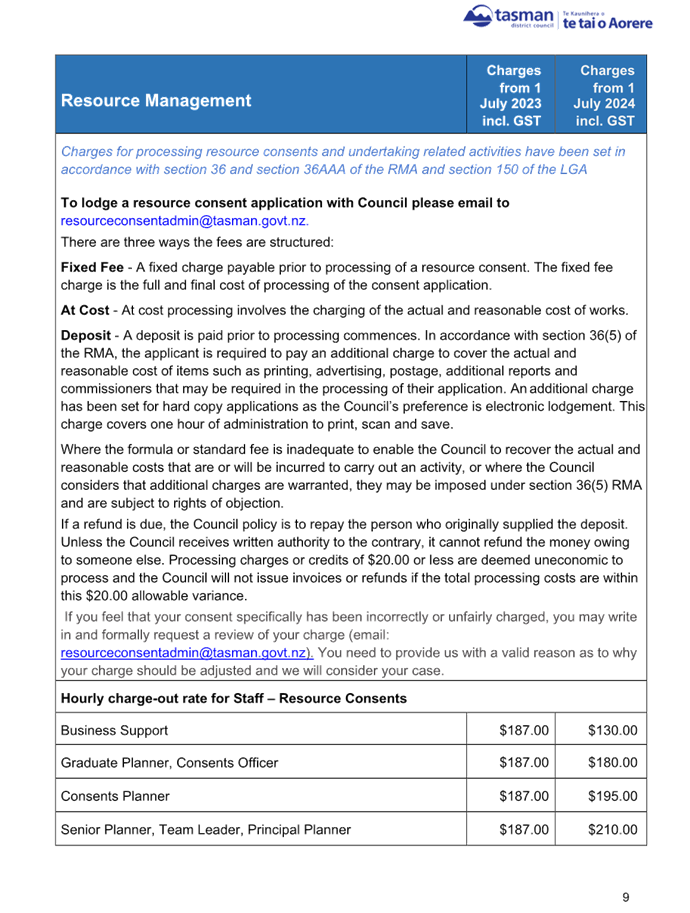

4.1 Under the Revenue and Financing Policy,

the Council recovers some costs associated with its services via fees and

charges. Some of these fees and charges are set by statute and others by the

Council.

4.2 Staff review fees and charges annually

and recommend changes, additions or deletions to the Council via the

“Schedule of Fees and Charges”.

Review of the Schedule of Fees and

Charges

4.3 Most fees and charges were

increased by at least 10% and where appropriate rounded up or down to the

nearest dollar. This increase accounts for the significant rising costs of

delivering Council services across the board and is similar to the proposed rates

revenue requirement increase for 2024/2025 (excluding growth). The increase

helps maintain the share of the Council’s revenue from fees and charges.

Increasing fees and charges reduces the impact of cost increases on ratepayers

but increases the costs to users of Council services.

4.4 The

Council is required to consult on certain fees and charges using the Special

Consultative Procedure under the Local Government Act 2002 (LGA). While the

Council is not required to publicly consult on the entire Draft Schedule, the

Council has done so in past years to meet all legislative requirements and

decided to do the same this year.

4.5 The Council adopted a Statement

of Proposal (including the Draft Schedule of Fees and Charges) and carried out

consultation under Sections 83 and 87 of the LGA.

The consultation process and its outcomes

4.6 The

draft schedule was publicly consulted on between 28 March and 28 April 2024 and

was consulted on at the same time as the 10-Year Plan 2024-2034.

4.7 The

draft schedule and the 10-Year Plan were advertised through the Council’s

social media and website, Newsline, and through the public engagement tool

Shape Tasman. Copies of the draft schedule were also made available at the

Council’s service centres.

4.8 The Council

received 132 submissions on the schedule. We heard the following points:

|

Theme

|

Number of submissions

|

|

Opposed to a blanket increase in fees

|

28

|

|

The 10% increase is too high and should

be less

|

21

|

|

Supports the principle of user-pays

|

12

|

|

Opposed to the proposed aerodrome fees

|

46

|

|

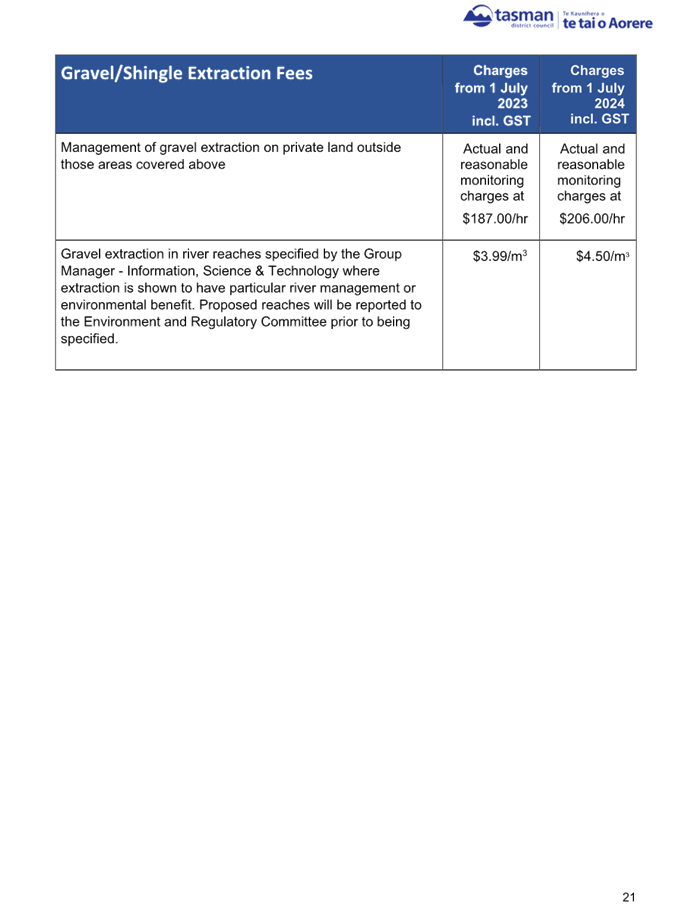

Opposed increase in gravel extraction

fees and change in fee structure for rivers

|

3

|

|

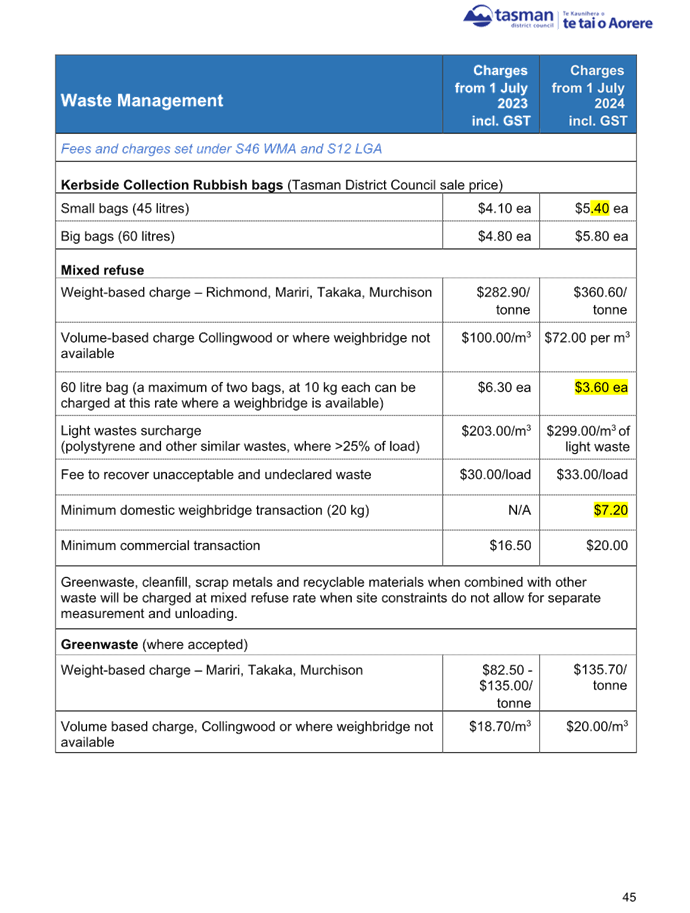

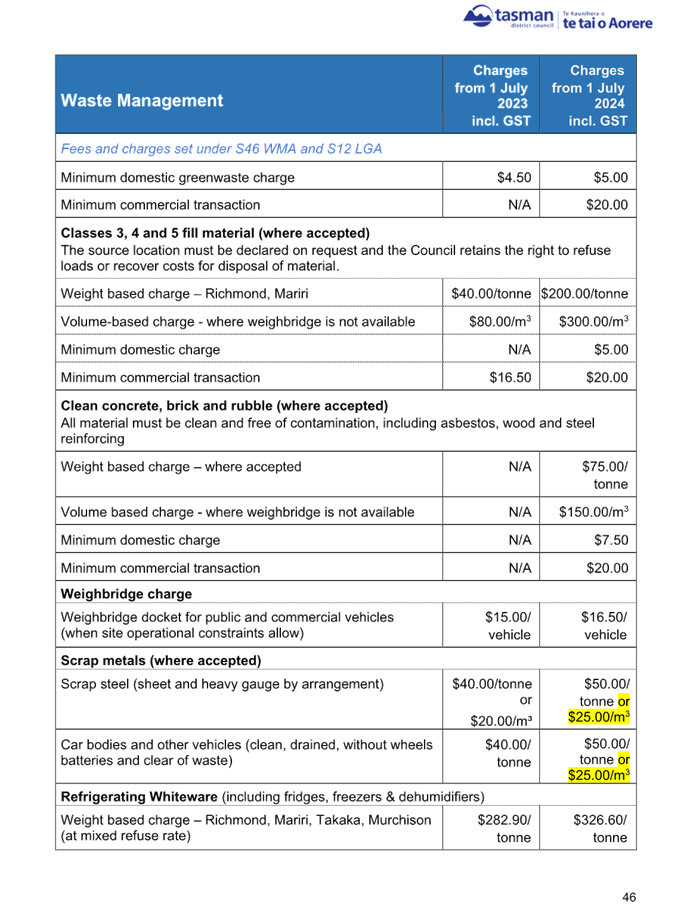

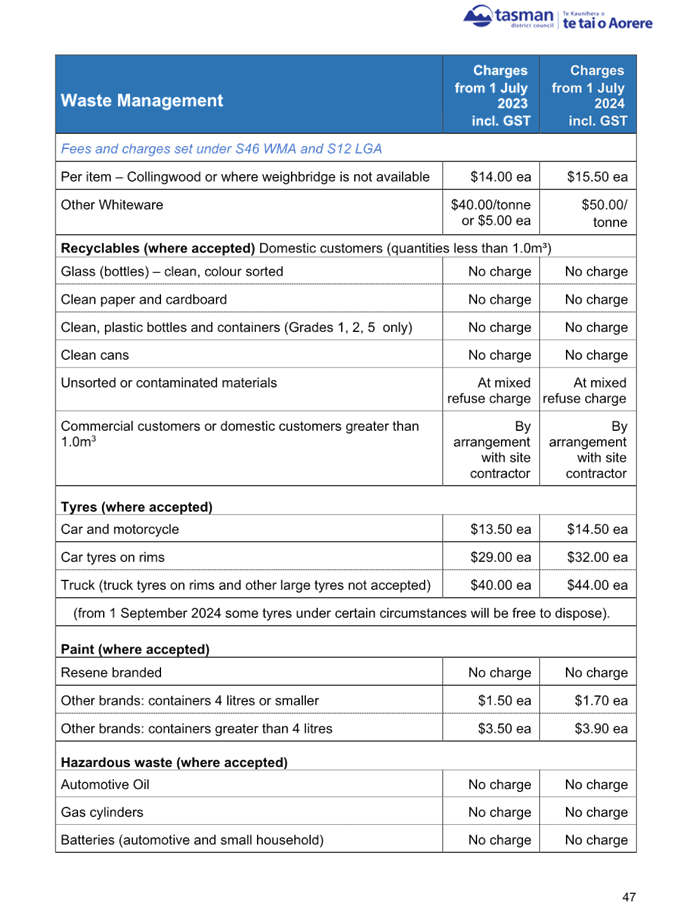

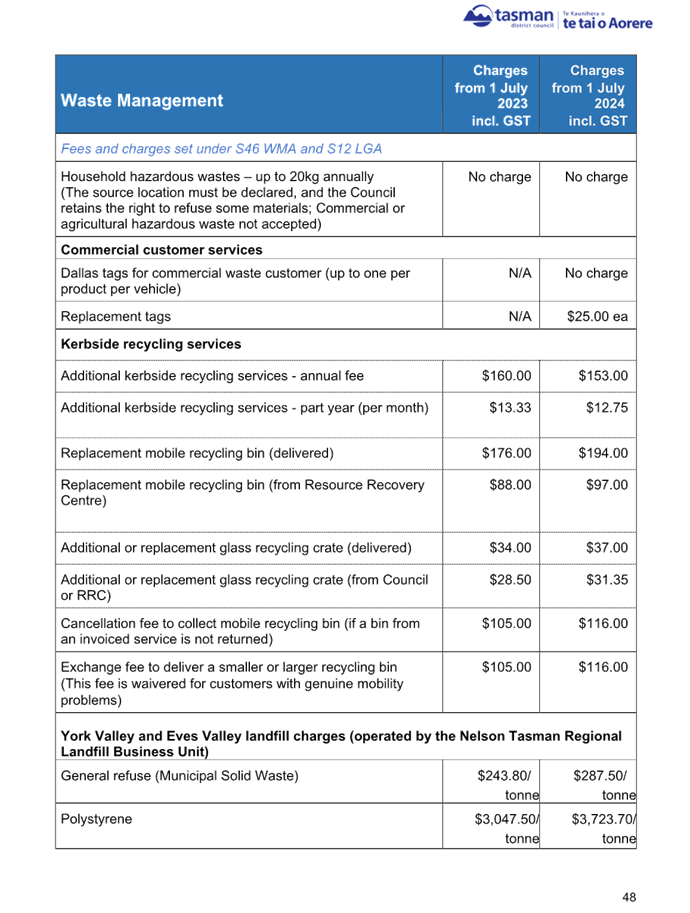

Concerns regarding the increase in waste

management charges (including disposal of rubble and soils)

|

11

|

|

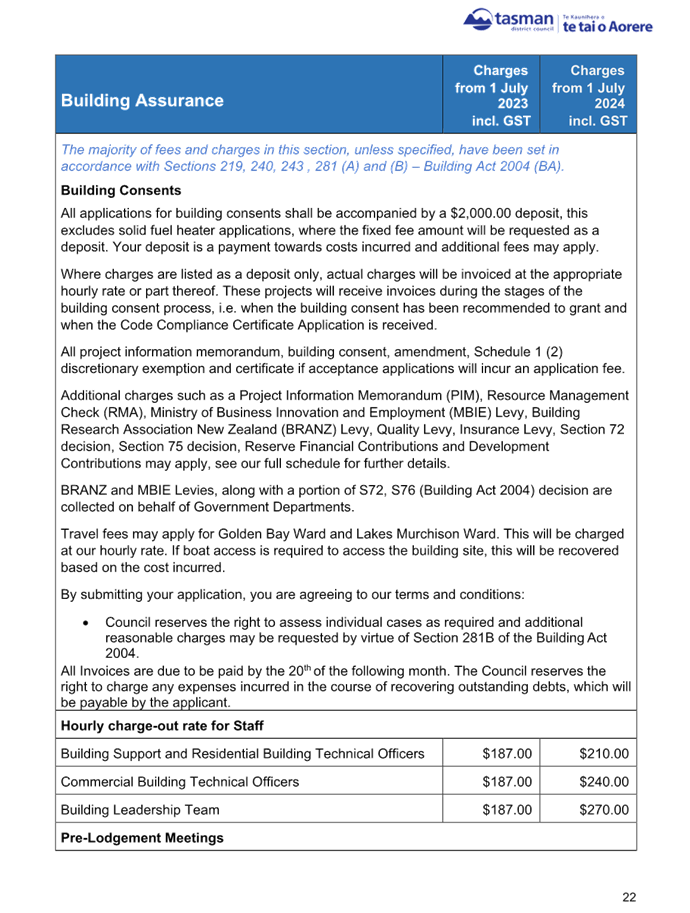

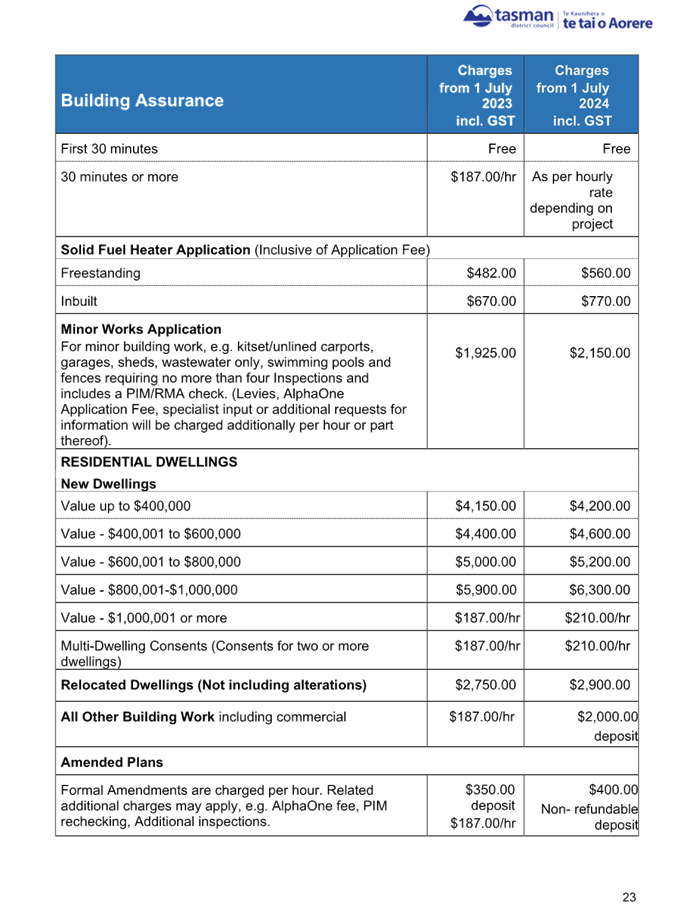

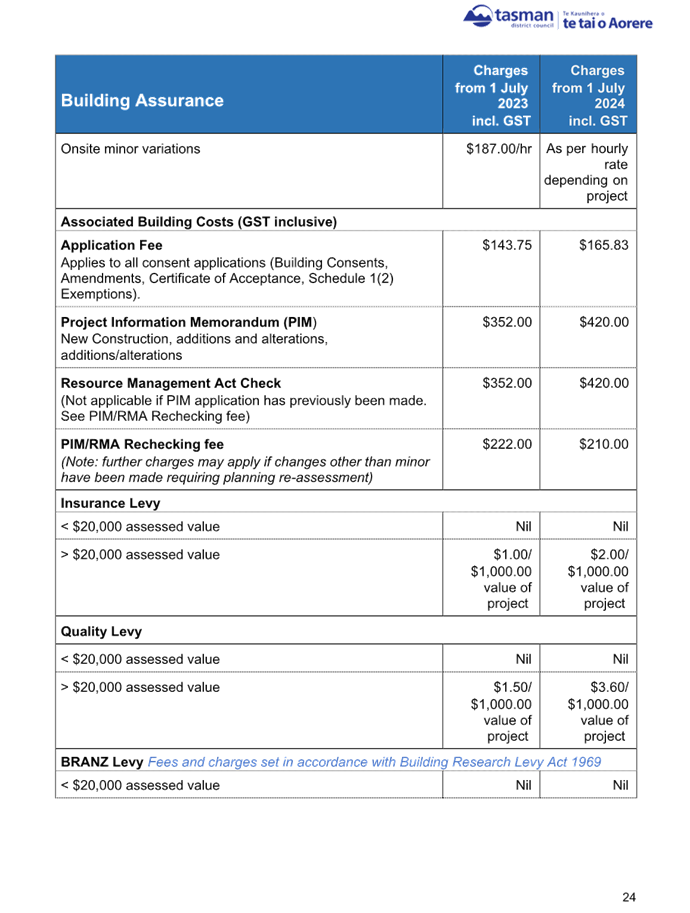

Concerns regarding fees, increase of

fees, and administrative burden of building consents

|

2

|

|

Proposes revisions to how we process and

charge for resource consents

|

2

|

|

Port and Marina fees with no facilities

|

2

|

|

Concerns regarding berthage proposed

increase in fees and quality of services

|

2

|

|

Concerns regarding the slow and poor

service at Council

|

13

|

|

Concerns over fees for dog registration

|

3

|

|

Flat rate for e-Bus users

|

1

|

4.9 The Council

heard submitters on 8, 9 and 10 May 2024 and deliberated on the submissions

(written and verbal) on 23 and 24 May 2024.

4.10 The Council changed the Motueka and

Tākaka aerodrome fees for single aircraft movements for everyone not

covered by a separate agreement to $15 per landing and capped recreational user

fees to $15 per day. The Council confirmed the retention of the annual bulk

landing fee for recreational users at a new rate of $375 per annum. The Council

confirmed the removal of proposed bond fees and confirmation of the hangar

application fee at $1,725 (to be credited against their account on successful

completion of the build). The Council noted that staff will negotiate directly

with Nelson Aviation College for aircraft movement fees.

4.11 The

Council requested that enhanced data is collected on the level of aerodrome

usage made by people making use of the bulk landing fee option to inform a

further review of these fees to be undertaken in conjunction with the Annual

Plan 2025/2026.

4.12 The

Council made changes to the waste management minimum weight-based charge and

the charge for a 60-litre refuse bag, as well as the price for a Tasman

District Council rubbish bag.

4.13 The

Council agreed to minor wording clarifications for volume-based waste charges

noting these apply to the Collingwood Resource Recovery Centre (or when a

weighbridge is out of service at any other site) and to amend the description

of “Cleanfill” in the Schedule of Fees and Charges.

4.14 The

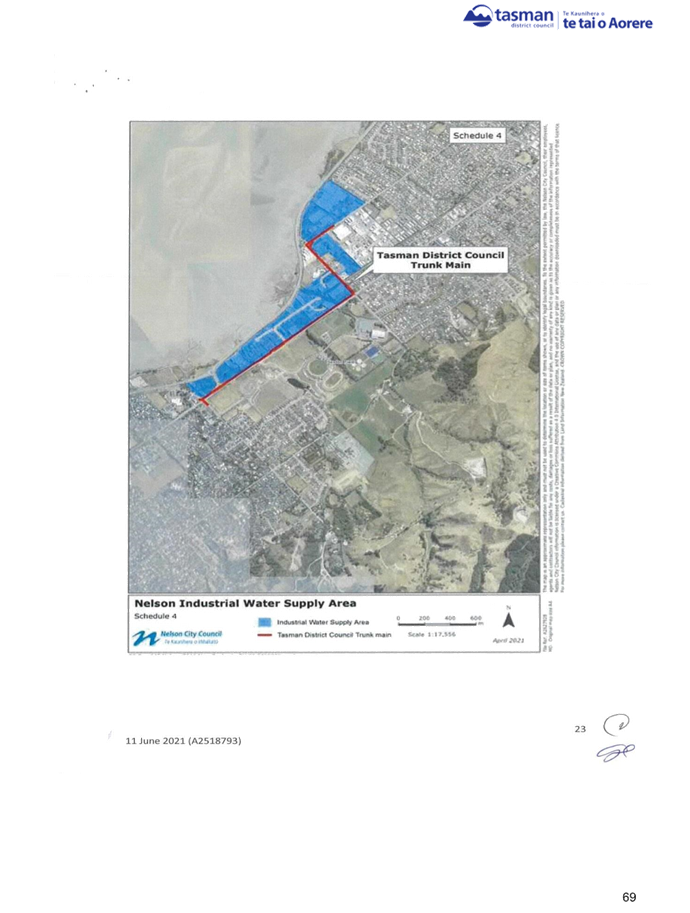

Council agreed to increase the water supply charges to Nelson City Council and

the Nelson Industrial Water Supply Area to reflect the increase in rates as a

result of higher costs in the LTP after the Draft Schedule of Fees and Charges

was published for consultation.

4.15 These

changes have been made, as well as several other minor amendments for

clarification (highlighted), in the Final Schedule of Fees and Charges

2024/2025 for adoption.

4.16 At

the deliberations meeting, the Council adopted the charges for dog control to

enable the public notification requirements to be met prior to 1 July 2024.

5. Analysis

and Advice / Tātaritanga me ngā tohutohu

5.1 The Draft Schedule of Fees and Charges

for 2024/2025 has been consulted on and needs to be adopted to enable the new

fees to be levied from 1 July 2024.

6.1 The options are outlined in the

following table:

|

Option

|

Advantage

|

Disadvantage

|

|

1.

|

Adopt the revised Draft Schedule of Fees

& Charges 2024/2025, including any minor amendments agreed at the 23 May

2024 Council Meeting.

|

Consultation has been undertaken in

accordance with the LGA, and the community’s views have been considered

in the decision-making. The Council can implement the schedule on 1 July 2024

allowing recovery of costs from users of the services we provide.

|

None.

|

|

2.

|

Make minor amendments to the Schedule of Fees

and Charges 2024/2025 and then adopt it at this meeting.

|

The Council can make any minor changes to

the Schedule if required.

|

The public will not be able to have their

say on these changes.

There will be no analysis of the effects

(financial or otherwise) of making the amendments.

|

|

3.

|

Not adopt the Schedule of Fees and

Charges 2024/2025.

|

The Council can request staff to report

to a future Council meeting with more information on the proposed changes.

|

Any changes to the Schedule that are

significant, or material may require a further round of public consultation.

There will likely be a delay in adopting

the Schedule resulting in potential lost income.

|

6.2 Option 1 is recommended. Staff

recommend this option as all the changes agreed or confirmed at the Council

meeting deliberations on 23 May 2024 have been incorporated into the updated

Schedule. Adoption of the Schedule will enable the fees and charges to be

implemented starting 1 July 2024.

7.1 The Council can set fees and charges:

7.1.1 under section 12 of the LGA which is a

global empowering provision that enables the Council to make decisions and

undertake acts and activities in pursuit of its functions;

7.1.2 under section 150 of the LGA for certain

functions provided for in bylaws or in enactments that do not already

explicitly provide for fees to be charged;

7.1.3 under section 36 of the Resource Management

Act 1991;

7.1.4 under section 205 of the Food Act 2014; and

7.1.5 under other government legislation as noted

in the Draft Schedule of Fees and Charges.

7.2 Setting

fees and charges aligns with the Council’s Financial Strategy and Revenue

and Financial Policy.

7.3 The

consultation on the schedule followed the Special Consultative Procedure and

the principles of consultation that are required by the LGA.

8. Iwi

Engagement / Whakawhitiwhiti ā-Hapori Māori

8.1 The

Kaihautū sent a memo to Te Tauihu GM/CEO’s forum outlining the

key items being proposed in the LTP, including the Draft Schedule of Fees and

Charges 2024, along with a timeline for consultation and submissions.

9. Significance

and Engagement / Hiranga me te Whakawhitiwhiti ā-Hapori Whānui

9.1 Changes to the Schedule of Fees and

Charges were assessed as a medium level of significance.

9.2 A special consultative procedure has

been carried out.

9.3 There was a high level of interest

amongst affected and interested parties for the proposed aerodromes fees and

some interest in the waste management fees and Port Tarakohe marina fees and

dog control fees.

|

|

Issue

|

Level of

Significance

|

Explanation of

Assessment

|

|

1.

|

Is there a high level

of public interest, or is decision likely to be controversial?

|

Medium

|

The schedule was

consulted on and the public was made aware of the proposed increases.

Interest was higher than in recent years but still moderate overall.

|

|

2.

|

Are there impacts on

the social, economic, environmental or cultural aspects of well-being of the

community in the present or future?

|

Low

|

There may be an

economic impact on some users of our services in the community.

|

|

3.

|

Is there a

significant impact arising from duration of the effects from the decision?

|

Low

|

The Council assesses

the Schedule of Fees and Charges annually. The Council may decide to change

the fees and charges at any point over the year, providing the relevant

consultation requirements are met.

|

|

4.

|

Does the decision

relate to a strategic asset? (refer Significance and Engagement Policy for

list of strategic assets)

|

NA

|

The decision does not

relate to a strategic asset.

|

|

5.

|

Does the decision

create a substantial change in the level of service provided by Council?

|

NA

|

The decision does not

change the level of service provided by the Council.

|

|

6.

|

Does the proposal,

activity or decision substantially affect debt, rates or Council finances in

any one year or more of the LTP?

|

Medium

|

Fees and charges are

part of the Council’s plan to fund its activities and services

annually. If fees and charges do not rise by approximately the same level as

rates, the proportion of the funding between the two sources changes.

|

|

7.

|

Does the decision

involve the sale of a substantial proportion or controlling interest in a CCO

or CCTO?

|

NA

|

The decision does not

relate to a CCO.

|

|

8.

|

Does the proposal or

decision involve entry into a private sector partnership or contract to carry

out the deliver on any Council group of activities?

|

NA

|

The decision does not

relate to a public-private partnership.

|

|

9.

|

Does the proposal or

decision involve Council exiting from or entering into a group of

activities?

|

NA

|

The decision does not

involve existing from or entering into a group of activities.

|

|

10.

|

Does the proposal

require particular consideration of the obligations of Te Mana O Te Wai

(TMOTW) relating to freshwater or particular consideration of current

legislation relating to water supply, wastewater and stormwater

infrastructure and services?

|

NA

|

This decision does

not require particular consideration of the obligations of Te Mana O Te Wai

(TMOTW) relating to freshwater and Affordable Waters.

|

10. Communication

/ Whakawhitiwhiti Kōrero

10.1 The Draft Schedule of Fees and Charges 2024/2025

was made publicly available on the Council’s website and hard copies at

the Council’s libraries and offices from 28 March to 28 April 2024. There

were several media releases via newspaper, radio, social media releases, Giggle

TV, Shape Tasman and Newsline.

10.2 We drew the public’s attention to the

consultation on the Schedule of Fees and Charges at several community

consultation meetings and drop-in sessions for the LTP around the District.

10.3 The new schedule of fees and charges will be

published on the Council’s website and publicised via Newsline.

10.4 Staff will send letters/emails to all submitters to

informing them about the decisions made by the Council.

11. Financial

or Budgetary Implications / Ngā Ritenga ā-Pūtea

11.1 The Schedule of Fees and Charges reflect the

Council’s financial statement and is in keeping with budgets set out in

the LTP. If the schedule is not adopted before 1 July 2024 the Council may not

be able to recover the expected costs for some Council activities in the

2024/2025 year.

11.2 If the Council decides not to increase the

fees at a similar level as rates increase, the proportion of the costs being

funded by rates will increase but may remain within the ranges in the Revenue

and Financing Policy.

12.1 Staff have arranged the timing of the Schedule of

Fees and Charges process so that the new fees and charges can start on 1 July

2024. Budgets for the 2024/2025 financial year are based on the schedule being

adopted by 1 July 2023. If the schedule is not adopted before 1 July 2023,

the Council may not be able to recover the expected costs for some services

that we provide.

12.2 There is a risk that the the Council’s

consultation processes might be challenged. This was mitigated through:

· providing a consultation period of one month. This helps ensure the

community has sufficient time to understand the information and make

submissions;

· communicating the availability of the schedule through a range of

methods and media; and

· using the Special Consultative Procedure for all fees and charges.

13. Climate

Change Considerations / Whakaaro

Whakaaweawe Āhuarangi

13.1 The

schedule attached to this report was considered by staff in accordance with the

process set out in the Council’s ‘Climate Change Consideration

Guide 2022’.

13.2 Staff are not aware of any fees that might

detract from the goals of the Tasman Climate Action Plan 2019.

14. Alignment

with Policy and Strategic Plans / Te Hangai ki ngā aupapa Here me ngā

Mahere Rautaki Tūraru

14.1 Fees and charges are set annually by the Council

which aligns with the Council’s Revenue and Financing Policy ensuring

costs are distributed from ratepayers onto users of Council services where

there may be private benefits to specific individuals.

14.2 The Chief Executive Officer has delegated authority

to amend waste management and commercial fees during the year if required.

15. Conclusion

/ Kupu Whakatepe

15.1 The

Council sets a schedule of fees and charges to recover some of the costs

associated with its services in a way that is consistent with its Revenue and

Financing Policy.

15.2 The

Council has developed a draft schedule for the 2024/2025 calendar year and has

publicly consulted on it.

15.3 The

schedule has been updated based on the decisions made at the deliberations

meeting on 23 and 24 May 2024.

15.4 For these reasons, staff recommend that the

Council adopt the Schedule of Fees and Charges 2024/2025 so that it can come

into effect from 1 July 2024.

16. Next

Steps and Timeline / Ngā Mahi Whai Ake

16.1 The Schedule of Fees and Charges 2024/2025 will come into effect on

1 July 2024.

16.2 The Schedule of Fees and Charges 2024/2025 will be made publicly

available on the Council’s website and hard copies at the Council’s

libraries and offices. A media release will be made via social media, Shape

Tasman and Newsline.

16.3 Submitters to the consultation process will be made aware of the

changes and decisions that the Council has made, via email or letter. This will

occur over the next few weeks.

|

1.⇩

|

Schedule

of Fees & Charges 2024-2025 for adoption

|

27

|

Tasman District

Council

Agenda – 27 June 2024

Tasman District Council Agenda – 27 June 2024

5.3 Long term Plan Rates Resolution 2024-2025

Decision Required

|

Report

To:

|

Tasman

District Council

|

|

Meeting

Date:

|

27

June 2024

|

|

Report

Author:

|

Margie

French, Senior Revenue Accountant

|

|

Report

Authorisers:

|

Mike

Drummond, Group Manager - Finance

|

|

Report

Number:

|

RCN24-06-21

|

1. Purpose

of the Report / Te Take mō te Pūrongo

1.1 To

set the Tasman District Council rates for the 2024/2025 rating year.

2. Summary

/ Te Tuhinga Whakarāpoto

2.1 Approval

of the Council’s work programme through the adoption of the Long Term Plan 2024-2034 determines the amount of rates

funding required to complete that programme.

2.2 The

Local Government (Rating) Act 2002 sets out the procedure and requirements for

setting rates, due dates, and penalties.

2.3 The

Council is required to pass a resolution on an annual basis to set the rates,

due dates, and penalties for the forthcoming rating year.

2.4 This

report is for setting the rates, due dates, and penalties for the

Council’s 2024/2025 financial year.

2.5 The

rates in this report are GST inclusive.

2.6 As

is good practice, the rates resolutions, except for actual numbers, have been

reviewed for legislative compliance by a legal consultant.

3. Recommendation/s

/ Ngā Tūtohunga

That the Tasman District Council:

1. receives

the Long term Plan Rates Resolution 2024-2025 report RCN24-06-21; and

2. sets the following rates under the Local Government (Rating) Act

2002 for the financial year commencing on 1 July 2024 and ending on 30 June

2025;

|

Rate Type

|

Differential category

|

Categories of land on which Rate is set

|

Factors

|

Rate (GST Inc.)

|

|

General

Rate

|

|

Every

rateable rating unit in the District

|

Rate

in the $ of Capital Value

|

0.2043

cents

|

The capital values are assessed by

independent valuers. Their results are audited by the Office of the

Valuer General.

|

Rate Type

|

Differential category

|

Categories of land on which Rate is set

|

Factors

|

Rate (GST Inc.)

|

|

Uniform

Annual General Charge (UAGC)

|

|

Every

rateable rating unit in the District

|

Fixed

amount per Rating Unit

|

$

394.00

|

Targeted Rates

|

|

Rate Type

|

Differential category

|

Categories of land on which Rate is set

|

Factors

|

Rate

(GST Inc.)

|

|

|

1

|

Stormwater Rate

|

|

|

|

|

Every

rateable rating unit in the District which has a land value

|

|

|

|

|

|

|

Urban

Drainage Area- Stormwater Differential

|

Rating

units in the Stormwater Urban Drainage Rating Area

|

Rate

in the $ of Capital Value

|

0.0468

cents

|

|

|

|

|

Balance

of the District-General Drainage Stormwater Differential

|

Rating

units with land value, that are not in the Stormwater Urban Drainage Rating

Area

|

Rate

in the $ of Capital Value

|

0.0049

cents

|

|

|

Ratepayers in the Urban Drainage Rating Area receive greater benefit

from stormwater infrastructure or cause the need for stormwater

infrastructure. For this reason the Council has determined that a

differential charge will be applied as follows:

*Urban Drainage Area –Stormwater Differential- A differential of

1 will apply.

*Balance of the District- General Drainage Stormwater Differential- A

differential of 0.105 will apply.

|

|

|

2

|

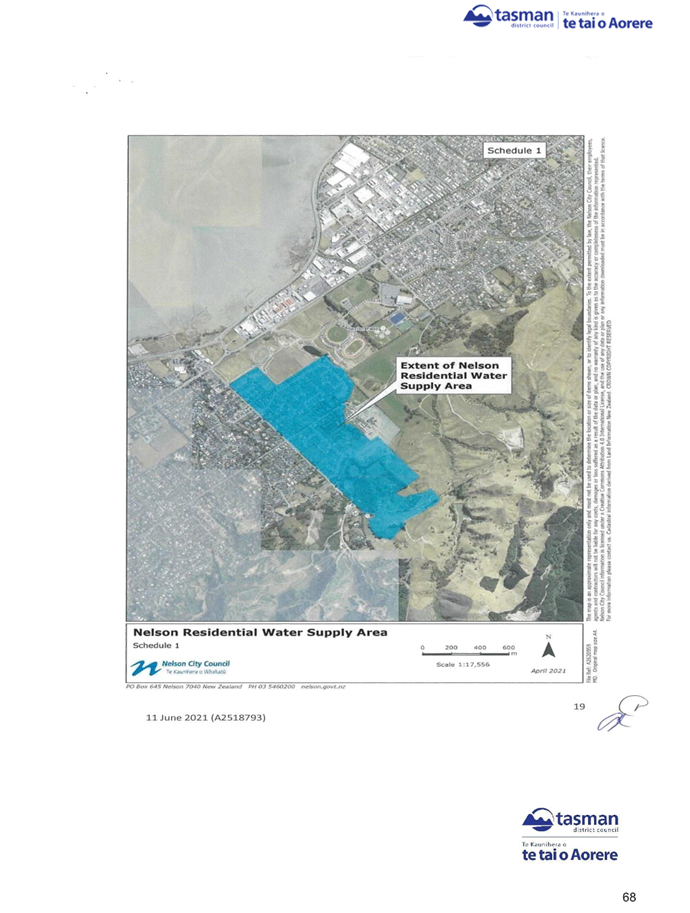

Water Supply Rates

|

|

2.1

|

Water Supply Rates – Urban Water Supply Metered

Connections and

Rural Water Extensions to Urban Water Schemes (“The Club”)

|

|

2.1(a)

|

Water

Supply – Urban Water Supply Metered Connections (excluding Motueka

Water Supply): Volumetric charge

|

|

Provision

of service being the supply of metered water to those rating units in the

District which have metered water connections, excluding those connected to

the Motueka Water Supply.

|

Per

m3 of water supplied

|

$

3.56

|

|

|

2.1(b)

|

Water

Supply – Urban Water Supply Metered Connections (excluding Motueka

Water Supply): Service Charge

|

|

Provision

of a service being a connection to a metered water supply by rating units in

the District, excluding those connected to the Motueka Water Supply.

|

Fixed

amount per connection (meter)

|

$

437.99

|

|

|

2.1(c)

|

Water

Supply- Rural Water Extensions to Urban Water Schemes

|

|

Provision

of a service being a connection to a supply of water via a rural extension to

urban schemes through a low flow restricted water connection.

|

Extent

of provision of service: 1m3/day (based on water restrictor

volume). E.g. 2m3/day restrictor volume will be charged at

two times the listed annual rate

|

$ 1,038.70

|

|

The 1m3 base rate is set at 80% of the Urban Metered

Connections volumetric rate multiplied by 365.

The extensions that will be charged this rate are: Best Island Water

Supply, Māpua/ Ruby Bay Water Supply, Brightwater/Hope Water Supply,

Richmond Water Supply, Wakefield Water Supply, and any others which are

referred to as the Other Rural Water Supply Extensions.

|

|

Rate Type

|

Differential category

|

Categories of land on which Rate is set

|

Factors

|

Rate

(GST Inc.)

|

|

2.2

|

Water Supply Rates – Motueka Water Supply Metered

Connections

|

|

2.2(a)

|

Water

Supply – Motueka Water Supply Metered Connections: Volumetric charge

|

|

Provision

of service being the supply of metered water to rating units connected to the

Motueka Water Supply

|

Per

m3 of water supplied

|

$

3.39

|

|

2.2(b)

|

Water

Supply – Motueka Water Supply Metered Connections: Service charge

|

|

Provision

of service being a connection to the Motueka Water Supply

|

Fixed

amount per connection (meter)

|

$

100.49

|

|

2.3

|

Water Supply – Rural Connections

|

|

2.3(a)

|

Water

Supply- Dovedale Rural Water Supply

|

|

Provision

of a service being a connection to the Dovedale Rural Water Supply through a

low flow restricted water connection

|

|

|

|

|

|

Dovedale

Differential A*

|

|

Extent

of provision of service: 1m3/day up to 2m3/day (based

on water restrictor volume).

|

$

999.24

|

|

|

|

Dovedale

Differential B*

|

|

Extent

of provision of service: 1m3/day above 2m3/day

(based on water restrictor volume).

|

$

776.85

|

The Council has determined that a differential charge will be applied:

*Dovedale Differential A- includes the supply of water for up to and

including the first 2m3 per day. This rate is charged based on the

extent of provision of service using the size of restrictor volume, with a base

of 1m3 per day. A differential of 1 per 1m3 per day will

apply.

For example, rating units with a 2m3 per day restrictor volume

will be billed two of the Differential A charge.

*Dovedale Differential B- includes the supply of water greater than 2m3

per day. This rate is charged based on the extent of provision of service using

the size of restrictor volume, with a base of 1m3 per day will

apply. A differential of 0.77 per 1m3 per day will apply.

For example, rating units with a 3m3 per day restrictor volume

will be billed two of the Differential A charge and one of the Differential B

charge.

|

|

Rate Type

|

Differential category

|

Categories of land on which Rate is set

|

Factors

|

Rate

(GST Inc.)

|

|

|

2.3(b)

|

Water

Supply- Redwood Valley Rural Water Supply

|

|

Provision

of a service being a connection to the Redwood Valley Rural Water Supply

through a low flow restricted water connection

|

Extent

of provision of service: 1m3/day (based on water restrictor

volume). E.g. 2m3/day restrictor volume will be charged at

two times the listed annual rate

|

$

699.86

|

|

|

2.3(c)

|

Water

Supply- Eighty Eight Valley Rural Water Supply

|

|

Provision

of a service being a connection to the Eighty Eight Valley Rural Water Supply

through a low flow restricted water connection

|

Extent

of provision of service: 1m3/day (based on water restrictor

volume). E.g. 2m3/day restrictor volume will be charged at

two times the listed annual rate

|

$

499.97

|

|

|

2.3(d)

|

Water

Supply- Eighty Eight Valley Rural Water Supply- Service Charge

|

|

Provision

of a service being a connection to the Eighty Eight Valley Rural Water Supply

through a low flow restricted water connection

|

Fixed

amount per rating unit

|

$

531.38

|

|

|

2.3(e)

|

Water

Supply- Hamama Rural Water Supply- Variable Charge

|

|

Provision

of a service being a connection to the Hamama Rural Water Supply

|

Rate

in the $ of Land Value

|

0.0458

cents

|

|

|

2.3(f)

|

Water

Supply- Hamama Rural Water Supply- Service Charge

|

|

Provision

of a service being a connection to the Hamama Rural Water Supply

|

Fixed

amount per rating unit

|

$

311.30

|

|

|

2.3(g)

|

Water

Supply- Hamama Rural Water Supply- Fixed Charge based on set land value

|

|

Rating

units in the Hamama Rural Water Supply Rating Area

|

Rate

in the $ of set land value (which is the land value at the time capital works

were completed in 2005)

|

0.1650

cents

|

|

|

2.4

|

Water Supply Firefighting

|

|

|

2.4(a)

|

Water

Supply: Motueka Firefighting

|

|

Rating

units in the Motueka Firefighting Water Supply Rating Area

|

Fixed

amount per Rating Unit

|

$

95.74

|

|

|

2.4(b)

|

Water

Supply: Tākaka Firefighting- Capital

|

|

Every

Rating Unit in the Golden Bay Ward

|

|

|

|

|

|

|

Tākaka

CBD Differential

|

Rating

units in the Takaka Firefighting Water Supply Commercial CBD Rating Area

|

Rate

in the $ of Capital Value

|

0.0448

cents

|

|

|

|

|

Tākaka

Residential Differential

|

Rating

units in the Tākaka Firefighting Water Supply Residential Rating Area

|

Fixed

amount per Rating Unit

|

$

32.54

|

|

|

|

|

Tākaka

Balance of Golden Bay Ward Differential

|

Rating

units in the Tākaka Firefighting Water Supply Rest of Golden Bay Rating

Area

|

Fixed

amount per Rating Unit

|

$

10.06

|

|

|

2.4(c)

|

Water

Supply: Tākaka Firefighting- Operating

|

|

Rating

units in the Tākaka Firefighting Water Supply Commercial CBD Rating Area

and Tākaka Firefighting Water Supply Residential Rating Area.

|

Fixed

amount per Rating Unit

|

$21.53

|

|

|

2.5

|

Water Supply - Dams

|

|

|

2.5(a)

|

Water

Supply- Dams: Wai-iti Valley Community Dam

|

|

Where

land is situated, and the provision of service and the activities controlled

under the Tasman Resource Management Plan under the Resource Management Act

1991. This rate will apply to those rating units in the Wai-iti Dam

Rating Area that are permit holders under the Resource Management Act 1991

because they are able to use the amount of augmented water as permitted by

their resource consent and apply it to the land in accordance with the amount

and rate specified in the resource consent.

|

Extent

of provision of service: charged at $ per hectare as authorised by water

permits granted under the Resource Management Act 1991

|

$

212.21

|

|

|

3

|

Wastewater Rate

|

|

Provision of a service. The provision of service is

measured by the number of toilets and/or urinals (“pans”)

connected either directly or by private drain to a public wastewater system

with a minimum of one pan being charged per connected rating unit

|

|

|

|

|

|

First

toilet or urinal ("pan")

|

|

Uniform

charge in the $ for each toilet or urinal (pan)

|

$

766.93

|

|

|

|

2nd-10th

toilets or urinals ("pans")

|

|

Uniform

charge in the $ for each toilet or urinal (pan)

|

$

575.20

|

|

|

|

11th

or more toilets or urinals ("pans")

|

|

Uniform

charge in the $ for each toilet or urinal (pan)

|

$

383.47

|

|

The costs associated with wastewater are lower per pan the more pans

that are present. For this reason the Council has determined that a

differential charge will be applied as follows:

*One toilet or urinal. A differential of 1 is set.

*2-10 toilets or urinals. A differential of 0.75 is set.

*11 or more toilets or urinals. A differential of 0.5 is set.

|

|

4

|

Regional River Works Rate

|

|

Every rateable rating unit in the District.

|

|

|

|

|

|

River

Rating Area X Differential

|

Rating

units in the River Rating Area X

|

Rate

in the $ of Capital Value

|

0.0338

cents

|

|

|

|

River

Rating Area Y Differential

|

Rating

units in the River Rating Area Y

|

Rate

in the $ of Capital Value

|

0.0338

cents

|

|

|

|

River

Rating Area Z Differential

|

Rating

units in the River Rating Area Z

|

Rate

in the $ of Land Value

|

0.0141

cents

|

|

|

|

|

|

|

|

|

|

The river works benefits are not equal throughout the District. For this

reason, the Council has determined that a differential charge will be applied.

The differentials are planned so that the Area X Differential and Area Y

Differential will be charged at the same rate, and the total amount of rates

planned to be generated by the combined Area X Differential and Area Y

Differential is the same as the planned rates generated for the Area Z

Differential.

|

|

Rate Type

|

Differential category

|

Categories of land on which Rate is set

|

Factors

|

Rate

(GST Inc.)

|

|

5

|

Motueka Business Rate

|

|

Where the land is situated being rateable rating units in the

Motueka Business Rating Area A and B and the use to which the land is put.

The land usage categories as set out in the Rating Valuations Rules 2008 for

actual property use that will be charged for this rate include: Commercial,

Industrial, Multi use commercial/ industrial, Residential- public communal/

multi use, Lifestyle- multi use, Transport, Utility services- communications,

Community services- Medical and allied, and Recreational

|

|

|

|

|

|

Motueka

Business Area A Differential

|

This

will apply to properties with land use categories as listed above for rateable

rating units in Motueka Business Rating Area A

|

Rate

in the $ of Capital Value

|

0.0377

cents

|

|

|

|

Motueka

Business Area B Differential

|

This

will apply to properties with land use categories as listed above for

rateable rating units in Motueka Business Rating Area B

|

Rate

in the $ of Capital Value

|

0.0188

cents

|

|

6

|

Richmond Business Rate

|

|

Where the land is situated being rateable rating units in the

Richmond Business Rating Area and the use to which the land is

put. The land usage categories as set out in the Rating

Valuations Rules 2008 for actual property use that will be charged for this

rate include: Commercial, Industrial, Multi use commercial/ industrial,

Residential- public communal/ multi use, Lifestyle- multi use, Transport,

Utility services- communications, Community services- Medical and allied, and

Recreational

|

Rate in the $ of Capital Value

|

0.0377 cents

|

|

7

|

Māpua Stopbank Rate

|

|

Rating units in the Māpua Stopbank Rating Area

|

Fixed amount per Rating Unit

|

$ 44.70

|

|

8

|

Torrent Bay Replenishment Rate

|

|

Rating units in the Torrent Bay Rating Area A and B

|

|

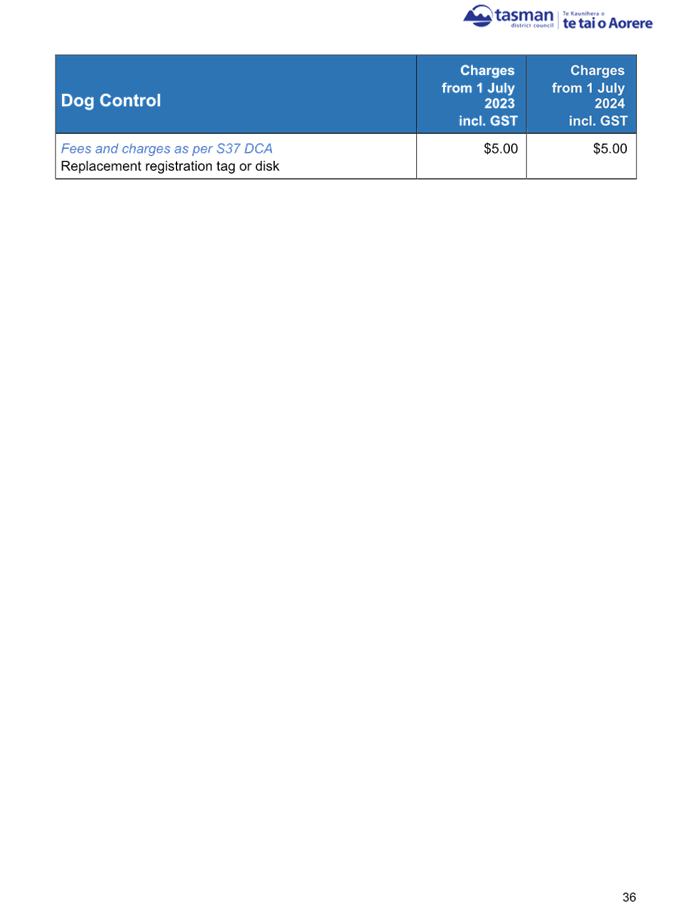

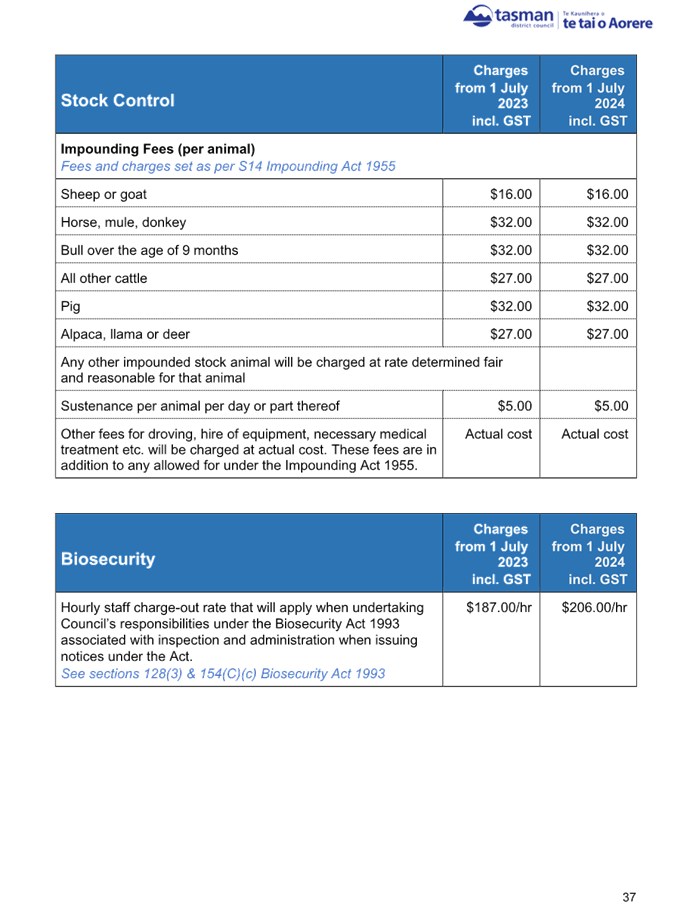

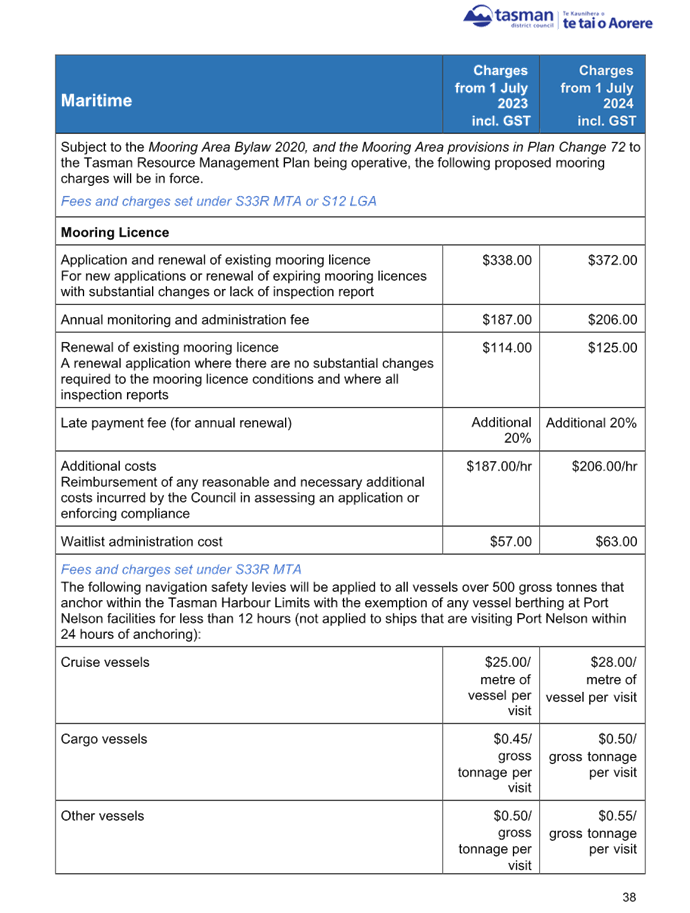

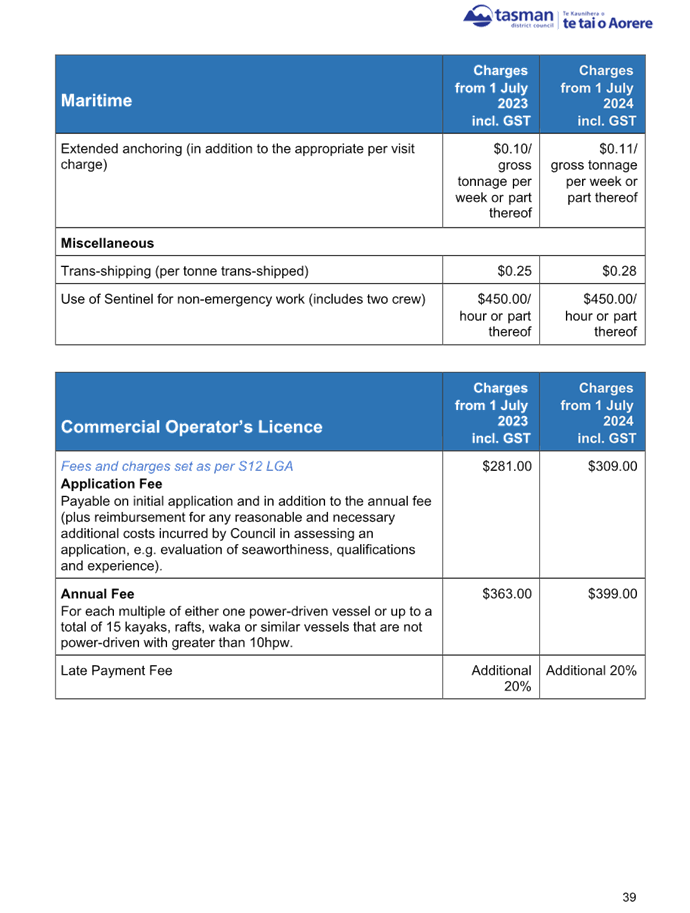

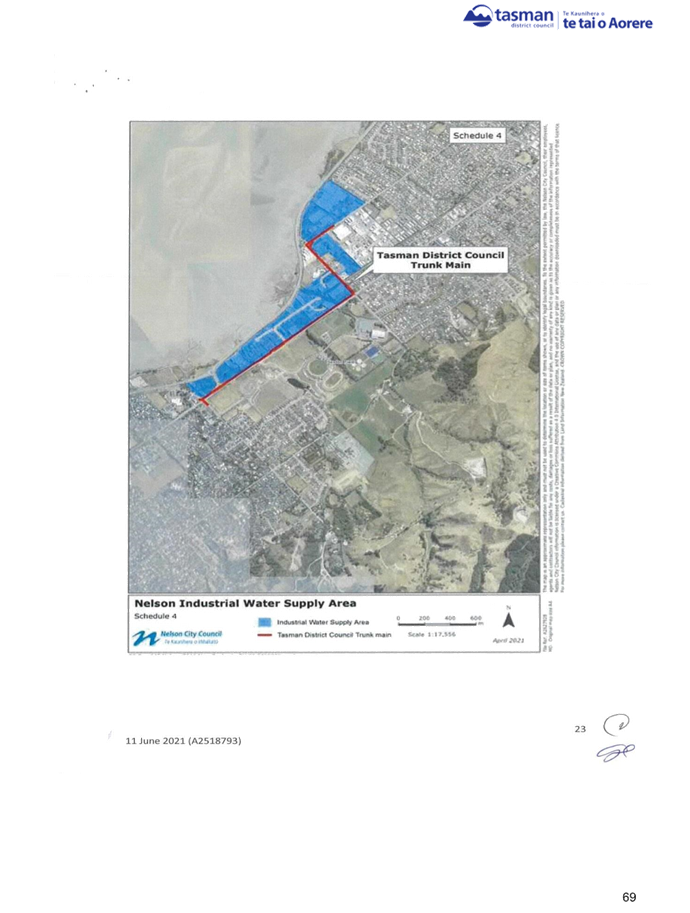

|