Tasman District

Council

Agenda – 07 November 2024

5 Reports

5.1

Quarterly Financial

Report

Information Only - No Decision

Required

|

Report

To:

|

Tasman

District Council

|

|

Meeting

Date:

|

7

November 2024

|

|

Report

Author:

|

Paul

Egan, Management Accounting Manager

|

|

Report

Authorisers:

|

Mike

Drummond, Chief Financial Officer

|

|

Report

Number:

|

RCN24-11-1

|

1. Summary

/ Te Tuhinga Whakarāpoto

1.1 This three-monthly

financial report provides an update on key financial information as at the end

of September 2024.

1.2 This report updates actual revenues, expenditure, and the financial

position for year to date, 30 September 2024.

1.3 In the three months to September 2024,

material financial pressures on the Council for this financial year are

becoming clear. The tight budgeting included in the 2024-34 Long Term plan

carried a higher risk of adverse variances as it limited any discretionary

spending that could be sacrificed to ensure the overall financial performance

remained within budget.

1.4 While a full reforecast has not been

able to be undertaken due to constraints with resourcing and reporting on the

prior financial year, trends have been identified to bring to the

Council’s attention.

1.5 The year-to-date operating deficit on

the statement of comprehensive financial performance is $2.4 million worse than

expected at this point. The controllable deficit is $1.6 million

favourable to budget year to date September 2024.

1.6 Financial pressures are coming from

macro level factors that impact the whole organisation, and issues in

particular areas. These pressures are elaborated upon in sections six and

seven.

1.7 Treasury Policy Net debt at 30

September was $261.7 million, compared to the target of $279.7 million at June

2025.

1.8 Capital expenditure excluding Joint

Ventures is $16.4 million; 21% of revised full year budget of $80.5

million.

1.9 Some expenditure, especially insurance

and rates occurs and is budgeted for mainly in the first quarter of the

financial year.

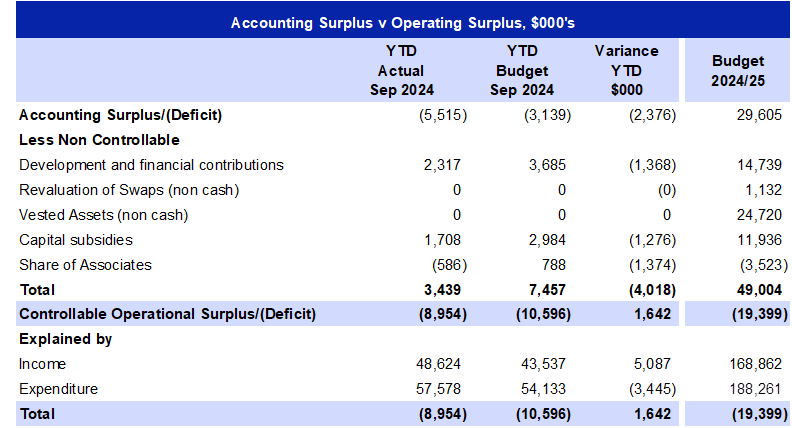

1.10 Table 1 below provides a

reconciliation of the accounting result compared to the operational position.

The operational position strips out non-cash items and items that can only be

used to fund capital expenditure e.g. swap revaluations, vested assets, and

capital subsidies. This is then a proxy for running a balanced budget where

operational expenditure is covered by operational income.

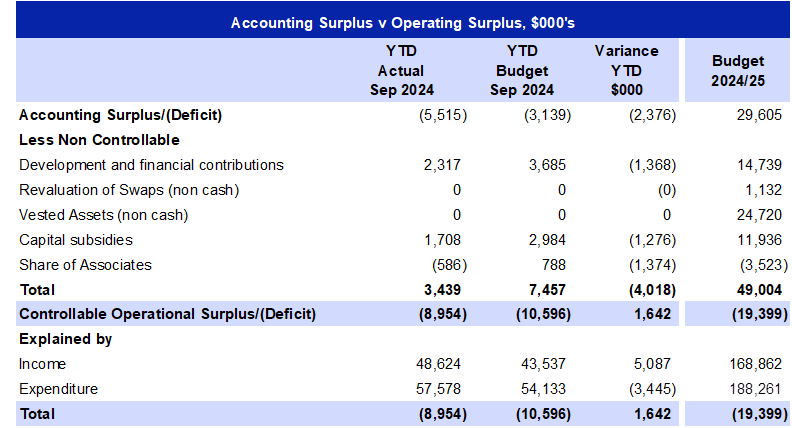

Table 1

2. Recommendation/s

/ Ngā Tūtohunga

That the Tasman

District Council

1. receives

the Quarterly Financial Report for the three months to 30 September 2024; and

2. notes

that there are significant cost pressures on the Council this financial year,

and that Council staff are working on a mitigation plan for this, and the

2025/26 financial year.

3. Background and Discussion

3.1 This is the first

financial report for the 2024/2025 financial year and covers financial

performance for the three months to 30 September 2024.

3.2 Controllable

operating income for September 2024 YTD is $48.6 million. This is a YTD

favourable variance of $5 million against a September 2024 YTD budget of $43.5

million. Receipt of the Infrastructure Holdings Limited (IHL) dividend which

was declared too late for inclusion in the 2023/24 financial year results, and

higher Operating Subsidies are the key drivers.

3.3 Controllable operating expenditure for

September 2024 YTD is $57.6 million. This is an unfavourable variance of $3.4

million on the September 2024 YTD budget of $54.1 million.

3.4 There are considerable financial

pressures that will be discussed in Sections seven and eight.

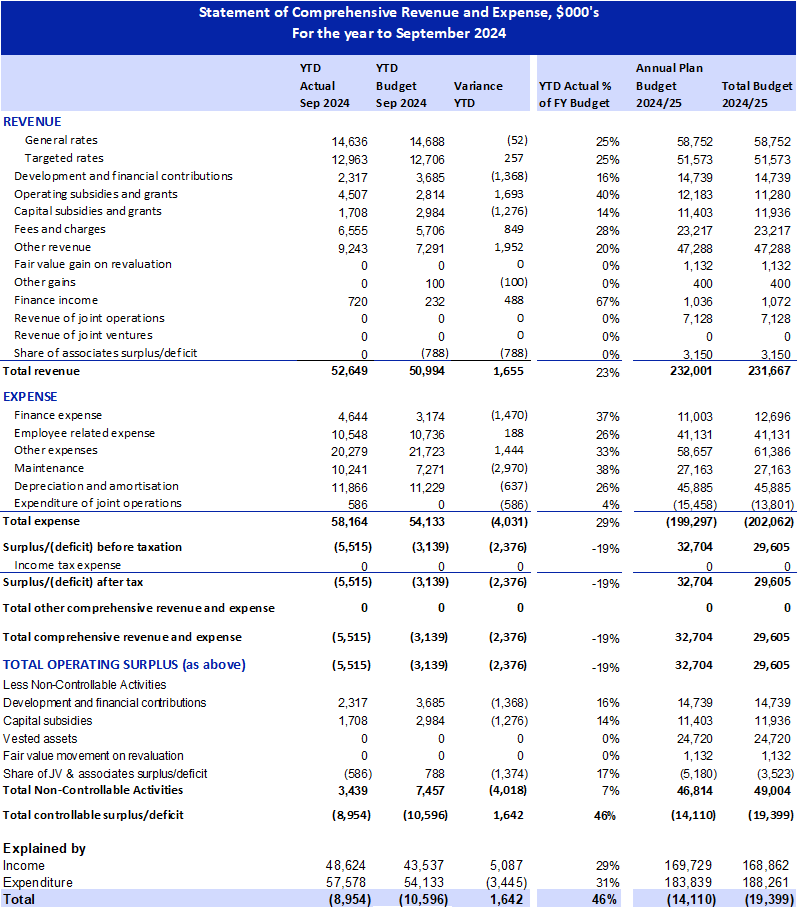

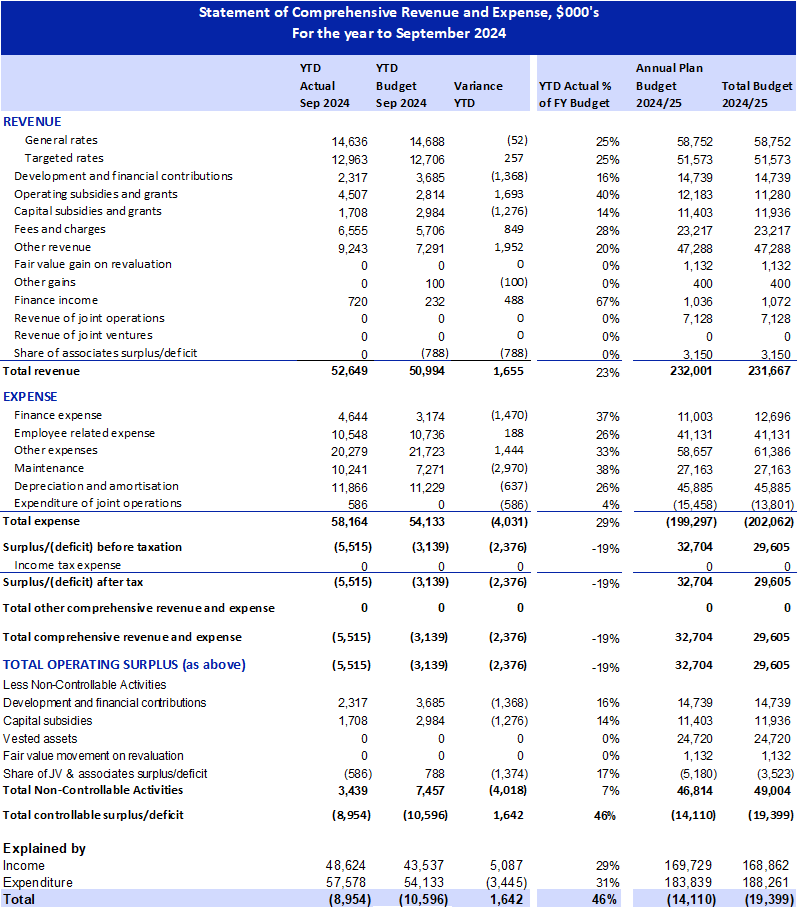

4. Statement of Comprehensive Revenue and

Expense

Table 2

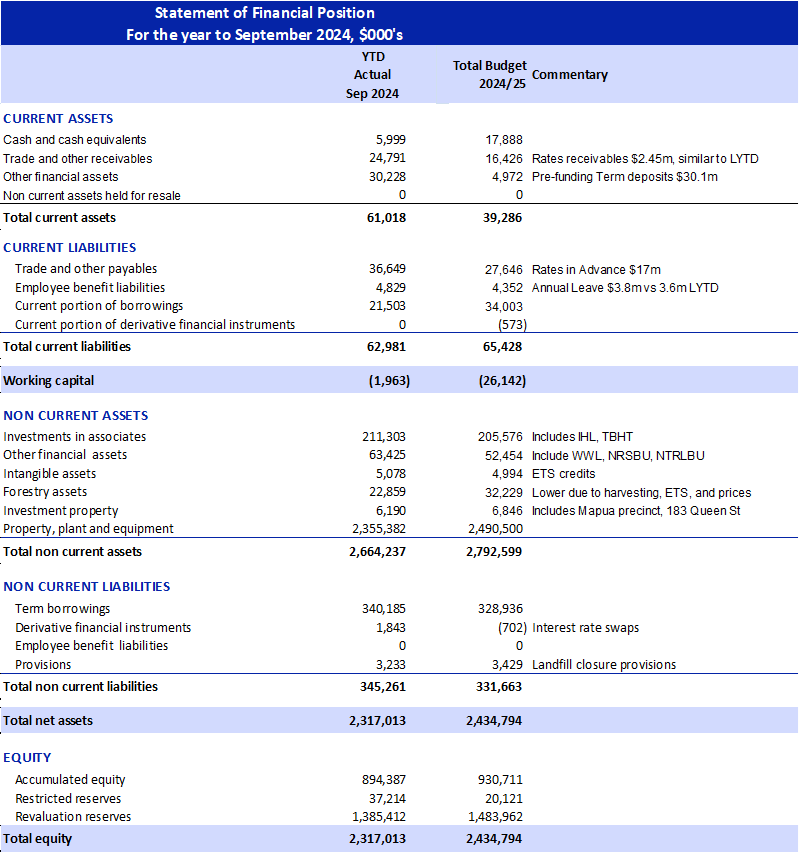

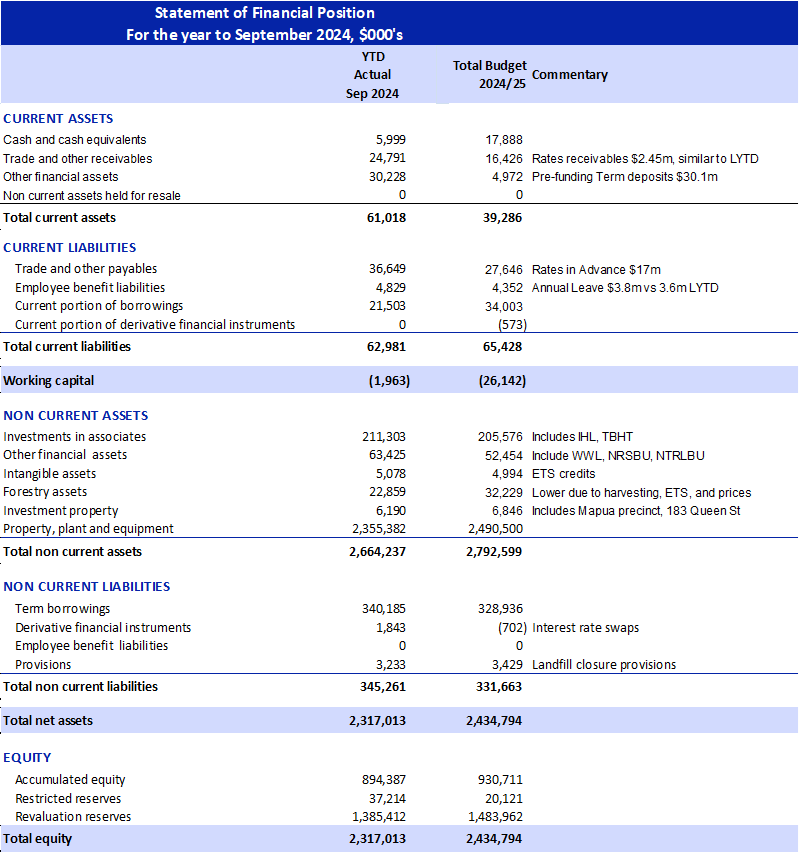

5. Statement of Financial Position

Table 3

6.1 The Council is facing

several significant financial pressures that are a result of both macroeconomic

and others, particular to the Council.

6.2 Net finance expenses (interest costs) are

$982,000 over budget for the quarter, 34% of the full year budget. If this

continues then Net Finance expenses are likely to be approximately

$3.1 million over budget for the year. Part of this is influenced by

declines in interest rates being less, and later than expected. Work is

continuing with our Treasury Advisors, PWC, to understand the drivers of the

variance.

6.3 Sector inflation has been higher for

some items than allowed for in the budget modelling assumptions. Accepted

practice has been to use inflation rates obtained from an economic consultancy

that provides a specialist set of inflation rates for local

government. These have not been sufficient for some categories of cost,

especially maintenance and operations contracting costs.

6.4 Insurance costs are higher this year,

and while not all costs have been advised yet, they are expected to be

approximately 17% higher this year, drivers include the increasing value of the

assets and difficulties obtaining full cover for public liability and

professional indemnity.

6.5 Maintenance costs are tracking at 38%

of full year budget 25% of the way into the year. This is a result of a

combination of some seasonal work that occurred predominately in the first

quarter but is mainly due to insufficient budget to cover higher cost

escalations, and growth. Additionally, some items were inadvertently

reduced/removed in the budget prioritisation process. New Zealand

Transport Agency (NZTA) funding notified August 2024 is less than the LTP

budget which was approved in June 2024.

Transportation

7.1 As mentioned above,

transportation is impacted by higher maintenance costs than budgeted together

with lower NZTA funding. Additionally, insufficient allowance was made for some

items through the budget prioritisation process, which will necessitate further

prioritisation this year.

7.2 The major cost pressure in this area year to

date is maintenance which is tracking at 35.6% for full year budget 25% of the

way through the year – some of this is seasonal, some has other

causes.

7.3 Routine Drainage Maintenance is at 53%

of full year budget – mostly programmed early in the year, this work will

drop back and is expected to end the year on budget.

7.4 General Road Maintenance works at 32%

of full year budget have been a programme focus early in the year and are

expected to end the year on budget.

7.5 Environmental Maintenance including

landslips and protecting against them is at 44% of full year budget. Current

management estimates expect this budget to be overspent at year end.

7.6 Inflation related pressures lead to

contract escalations for maintenance and operations contracts being higher than

allowed for in the budget.

7.7 Insufficient allowance was made in this

year’s budget for several items including:

7.7.1 Database and Asset Management is 130% over full

year budget in the first quarter but will be offset by under-expenditure

elsewhere.

7.7.2 Landscape maintenance was under budgeted by

$150,000 for the full year.

7.7.3 Street cleaning and litter bin servicing costs

were under budgeted $230,000.

7.8 NZTA funding budgets for Tasman

District Council determined by NZTA in August 2024, were less than budgeted in

the LTP by $716,000. This was presented to the Council at the meeting on

24 October 2024, with direction that the locally funded share of expenditure

budgeted can continue, but the portion of expenditure not funded by NZTA should

not occur.

7.9 Responses being considered to higher

than budgeted maintenance costs are to:

7.9.1 Revise the growth in asset network to be included

in 2025/26 annual plan.

7.9.2 Revise the timing of contractual escalations to

better align with budget approval timing.

7.9.3 Prioritise work and expenditure commitments where contractual

flexibility allow.

Water Supply

7.10 The major cost pressure in this area year to date is

maintenance expense which is tracking at 39% for full year budget 25% of the

way through the year. Routine maintenance costs, in particular sampling

and monitoring, were not fully funded and a deliberate decision was made to

reduce reactive maintenance budgets to reduce rates. Other Operations’

expenses had issues, but not to the same extent.

7.11 Some of these pressures are seasonal, with work

being undertaken early in the financial year, some are inflation related, and

some are where insufficient allowance was made in the budget. Through the

Council LTP process some budgets especially in reactive maintenance were

reduced. This position carried with it an element of risk in being able to stay

within budget.

7.12 Impacted areas (excluding Waimea Community Dam) related

costs include:

7.12.1 Reactive Maintenance at

39% of full year budget – there is a higher incidence of this in the

winter months and is expected to end the year on budget. Pipe failures

– asbestos cement and “blue brute” PVC pipes continue to be high

due to a lagging renewal programme. New requirements to comply with the

water regulator Taumata Arowai standards are leading to an increase in reactive

work for water quality issues and reservoirs.

7.12.2 Routine Maintenance works

at 41% of full year budget have not been sufficiently allowed for in the budget

and are expected to end the year approximately $400,000 over budget. A

significant part of these unbudgeted costs is for mandatory sampling and monitoring

to meet the new drinking water standards.

7.12.3 The Drinking Water

Quality Assurance Rules 2022 were implemented from

1 January 2023. These replaced the previous Drinking Water Standards for New

Zealand. The Rules introduced a range of increased minimum monitoring

requirements and at the same time, the Water Services Act (replacing the Health

Act) has elevated the expectations on water suppliers to manage risk. The

combined result has been the need to increase monitoring and risk management

effort.

7.13 Inflation related pressures lead to contract escalations

for maintenance and operations contracts being higher than allowed for in the

budget. The work programme, total out-turn costs, and rate escalations are

agreed with the alliance contractor after the budgets are set.

7.14 Insufficient allowance was made in this year’s

budget for a number of items including:

7.14.1 Reactive maintenance –

reticulation (water leaks), treatment plant (aeration towers) and reservoirs,

however the reservoirs cost ($25,000) were a once off to remove trees

threatening to fall onto the Stagecoach Rd reservoirs.

7.14.2 Routine maintenance -

reticulation - sampling of network around $400,000, sampling to new standards

for treatment plants and reservoirs.

7.15 Responses being considered to higher than budgeted

maintenance costs are to:

7.15.1 Revise the growth in asset

network to be included in 2025/26 annual plan.

7.15.2 Revise the timing of

contractual escalations to better align with budget approval timing.

7.15.3 Prioritise work and expenditure

commitments where contractual flexibility allows.

7.15.4 The Council to approve

reductions to levels of service to cut costs. The Council needs to be specific

as to what routine maintenance activities will be cut to reduce costs with the

understanding that this will lead to non-compliance and possibly prosecutions

and fines. Under the new legislation there is a personal liability for

non-compliance and contamination events.

Wastewater

7.16 Wastewater is a District-wide activity. The major cost pressure in

this area year to date is maintenance expense which is tracking at 32% for full

year budget 25% of the way through the year. Other Operations expenses

are tracking on budget YTD.

7.17 Some of these pressures are inflation related, and some are where

insufficient allowance was made in the budget due to the risk position the

Council took in accepting a reduction in reactive maintenance budgets.

7.18 Impacted areas costs include:

7.18.1 Reactive Maintenance at 28% of full year budget

7.18.2 Routine Maintenance works at 34% of full year budget have not been

sufficiently allowed for in the budget.

7.19 Routine

maintenance work has had a year to date spend of $364,000 versus a budget of

$183,000 an overspend of $116,000.

7.19.1 Of that overspend, $83,000 has been related to the Tākaka

Wastewater Treatment Plant (WWTP), servicing pumps and replacing filter

fabrics.

7.19.2 Other areas

of extra cost include higher sampling in Tākaka and maintaining the Motueka

WWTP, in particular the membrane filtration.

Waste Management and Minimisation

7.20 Waste

Management and Waste Minimisation are District-wide activities, each operating

as closed accounts. Waste management is largely funded by fees and charges,

local disposal levy from the landfill business unit and a smaller amount of

general rate. Waste Minimisation is fully funded by the New Zealand Waste

Disposal Levy.

7.21 The

Kerbside activity provides recycling, and user pays rubbish collection services

to 80% of properties in the District. The activity is funded by a targeted

rate.

7.22 The

major cost pressure in the Waste Management area year to date is operations and

routine and reactive maintenance expenses, which are tracking 12% above budget.

Landfill disposal and transport expenses are significantly below budget (70% of

budget), but these expenses are accompanied by lower income, particularly at

Richmond (57% of budget), with a net adverse variance. Illegal dumping activity

is also tracking significantly above budget.

7.23 Waste

Minimisation is tracking favourably against budget. Income from the New Zealand

Waste Disposal Levy is tracking above forecast and net expenses are tracking

below or on budget.

7.24 Expenses

in the Kerbside recycling and rubbish collection activity are tracking 20%

above budget, driven by contractual costs growing greater than inflation,

property growth greater than forecast and an error in budgeting for operation

of the Materials Recovery Facility (MRF).

Reserves and Facilities

7.25 The Reserves area encompasses Parks and Reserves, Community Housing,

Community Facilities, and Special Purposes Committees.

7.26 The major cost pressure in this area is maintenance expenses,

particularly in Parks and Reserves and Community Facilities. Other

expenses in these areas are tracking materially in line with budget.

7.27 Parks and Reserves has growth in the number of assets being

maintained in the District, combined with rising cost inflation pressures on

contractors that are passed through to the Council. These exceed the growth

allowances made in the budget, with the quantum of contractual cost rate

escalations not being confirmed until after the budget was approved.

7.28 Parks and Reserves maintenance expenditure is currently $220,000

over YTD budget, 28% of full year expenditure. While there are some seasonal

factors as to when work is done, such as turf renovations, maintenance

expenditure is expected to end the financial year over budget by approximately

$440,000.

7.29 Community Facilities maintenance expenditure is also higher than

expected at 36% of full year budget, $271,000 over budget. This is expected to

be over budget by this amount at year end.

7.30 Both Parks and Reserves and Community Facilities have significant

rates and insurance costs early in the year forming a significant amount of

their annual Other Expenditure.

7.31 Responses being considered to higher than budgeted maintenance costs

are to:

7.31.1 Revise the growth in asset network to be included in 2025/26 annual

plan.

7.31.2 Revise the timing of contractual escalations to better align with

budget approval timing.

7.31.3 Prioritise work and expenditure commitments where contractual

flexibility allows.

Building

Assurance

7.32 Building Assurance activities ran at a deficit last financial year

with the drop in new dwelling building consent applications contributing to a

revenue drop that left the activity underfunded.

7.33 This September year to date the activity is in surplus, and if this

continues will have it on track to navigate the lower revenue holiday period,

make sufficient surplus to recover the budgeted portion of last year’s

deficit and finish on budget overall.

7.34 Reasons for this are an increase in volumes in the first quarter,

the increase to fees and charges, and changes to the level of staffing in the

activity.

7.35 New dwelling building consent applications (excluding amendments)

are 78 for the YTD September, versus 59 for the same period last year

Service and Strategy

7.36 Services and Strategy have an unfavourable variance of $114,000 YTD

September in employee expenditure - due to higher than budgeted role occupancy.

7.37 The major expenditure item budgeted in Services and Strategy this

year is the potential grant funding for the regional Museum storage facility.

This is loan funded and including the $1.032 million carry over from last year,

has a full year budget of $3.172 million.

Information Services

7.38 Information Services is at 28.5% of its Other Expenses full year

budget. This is due to licencing fees expense for several core applications

that are paid annually falling in the first quarter. Digital Innovation

Programme costs are ramping up as the CRM project progresses – this

expenditure is deemed operating expenditure under current financial reporting

standards, and is loan funded. If the current level of DIP expenditure

continues this expenditure will end the year over-budget, a turning point from

prior years where there was a carry forward of unexpended budget.

8.1 Treasury

Policy Net Debt is $261.7 million as at 30 September 2024, compared to a

full-year budget of $279.7million. The increase from an opening Net Debt of

$247.8 million is due to the funding of capital expenditure during the first

three months of the year. The quarterly rates’ take impacts on cash flow

movements and, therefore, Net Debt. (Net Debt is gross debt less cash on hand

and other liquid financial assets).

8.1.1 Opening Net Debt 1 July 2024 $247.8 million

8.1.2 Net Debt 30 September 2024 $261.7 million

8.1.3 Net Debt June 2025 per 2024/25 Annual Plan $279.7 million

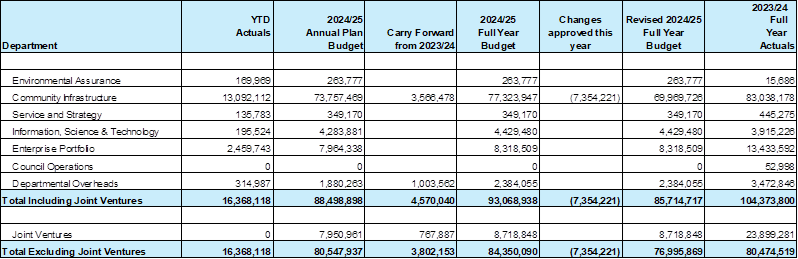

9. Capital Expenditure Analysis

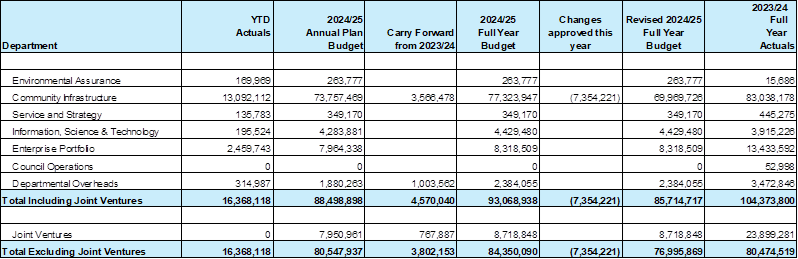

Table 4

9.1 Overall, capital expenditure (including approved changes) is

tracking at 19% of revised full year budget including Joint Ventures. Excluding

Joint Ventures on a similar straight-line basis, the programme is tracking at

21% of revised full year budget.

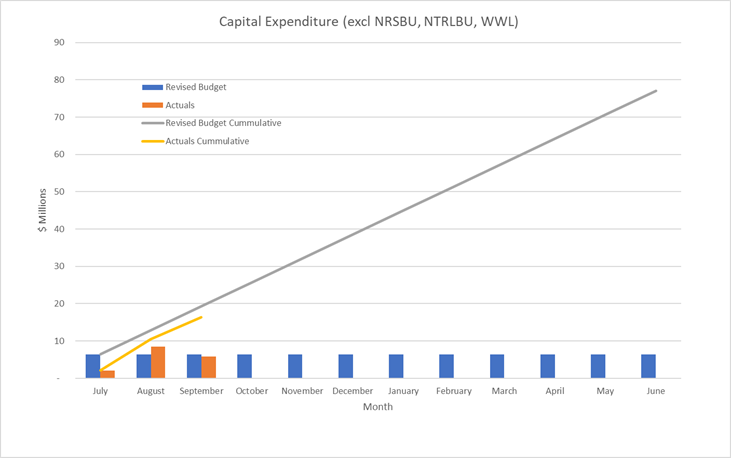

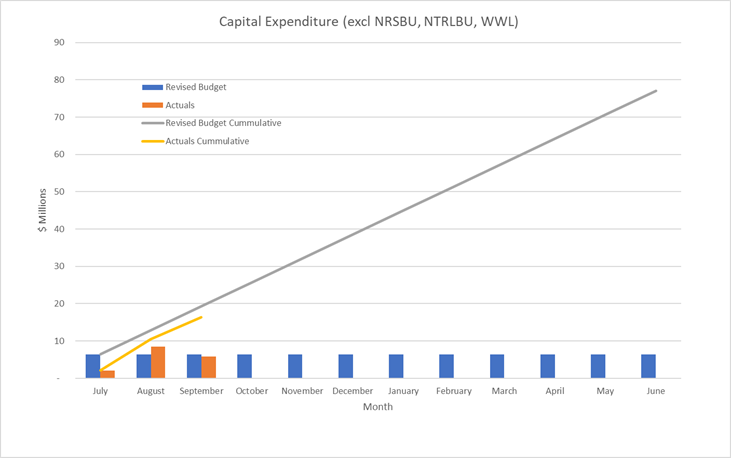

Figure 1

9.2 At its meeting on 24 October 2024, the

Council approved some changes to timing of capital expenditure in the Long-Term-Plan.

These were that $6.2 million of expenditure in future years of the

Long-Term-Plan was approved to be brought forward into the 2024/25 financial

year, while at the same time pushing out $13.6 million from 2024/25 to future

years. These changes are reflected in the revised budget in Table 4 above.

Nil