Notice is given that an ordinary meeting of the Audit and

Risk Committee will be held on:

|

Date:

Time:

Meeting Room:

Venue:

|

Thursday

18 March 2021

1.30pm

- 4.30pm

Tasman

Council Chamber

189 Queen Street

Richmond

|

|

Audit and Risk Committee

AGENDA

|

MEMBERSHIP

|

Chairperson

|

Cr D Ogilvie

|

Cr C Mackenzie

|

|

|

Cr T Walker

|

|

|

|

Cr C Hill

|

Mr G Naylor

|

|

|

|

|

|

In Attendance:

|

Mike Drummond (Corporate &

Governance Services Manager)

|

Janine Dowding (Chief

Executive)

|

|

|

Christina Ewing (EA to the CGSM)

|

Matt McGlinchey (Finance

Manager)

|

|

|

Charlotte Thomas (Senior

Accountant)

|

Trudi Zawodny (Operational

Governance Manager)

|

(Quorum 3 members)

|

|

|

Contact Telephone: 03 543 8453

Email: christina.ewing@tasman.govt.nz

Website: www.tasman.govt.nz

|

Tasman District Council

Audit and Risk Committee Agenda – 18 March 2021

AGENDA

1 Opening, Welcome

2 Apologies

and Leave of Absence

|

Recommendation

That apologies be

accepted.

|

3 Declarations

of Interest

4 Confirmation

of minutes

|

That the minutes of the Audit and Risk Committee

meeting held on Wednesday, 2 December 2020, be confirmed as a true and

correct record of the meeting.

|

5 Reports of Committee

Nil

6 Presentations

Nil

7 Reports

7.1 Internal

Audit Update Report................................... 5

7.2 Risk

Report............................................................. 49

7.3 Governance

Activity Report................................... 57

7.4 New

Policy.............................................................. 63

8 Confidential

Session

Nil

Tasman District Council

Audit and Risk Committee Agenda – 18 March 2021

7 Reports

7.1 Internal Audit Update Report

Information Only - No

Decision Required

|

Report To:

|

Audit and Risk

Committee

|

|

Meeting Date:

|

18 March 2021

|

|

Report Author:

|

Charlotte Thomas,

Financial Accountant

|

|

Report Number:

|

RFNAU21-03-1

|

1.1 This

report covers a range of internal audit and process matters. The purpose

of the Internal Audit function at Tasman District Council (TDC) is to assist

the Council to achieve its objectives by providing independent and objective

assurance and consulting services to add value and improve the Council’s

operations. The Council’s internal audit function continues to

monitor and respond to emerging risks. The impact

of Covid-19 has extended the timeframes for work programmes for many activities

within the Council, including Finance. Significantly, the delay of the

Annual Report to mid-December 2020 had a flow-on effect into the rest of the

years’ work program for both the external auditor, Audit NZ and the

Council.

1.2 Internal

Audit Plan – There is still a need to develop a risk-based audit plan

with focus areas based on an assurance map. Progress against the current plan

includes Sensitive Expenditure, Refuse Centre and Cybersecurity.

1.3 External

Audit, Annual Report 2020 - Audit New Zealand’s (Audit NZ) management

letter was received, with new recommendations related to asset data

reconciliation.

1.4 External

Audit, Annual Report 2021 – Audit NZ are experiencing significant

delays, no audit plan has been received, and there will be no pre-year end

sample testing. This will require additional resource in September to

meet the 31 October statutory deadline. We have been advised that this is

the same for all councils.

1.5 External

Audit, Long Term Plan 2021-31 - External Audit – A revised increased

cost estimate for WWL, has resulted in a delay to the LTP Consultation, and the

audit opinion is expected to include an emphasis of matter paragraph.

Other than the Waimea Water Limited (WWL) matter, the audit progressed

smoothly, with no significant issues raised.

1.6 Previous

Auditor Recommendations – there has been some progress to implement

these, these will be progressed during 2020-21.

1.7 Cybersecurity

– A review is in progress, scope attached. (Attachment 1).

1.8 MAGIQ

– the future of the Council’s Financial Management System is

under review as part of the digital transformation strategy, included in the

proposed Long Term Plan (LTP) from 1 July 2021.

1.9 Sensitive

Expenditure – a transaction review was performed for six months to 31

December 2020, along with review of benchmark data. Overall results are

positive, however, there is room for improvement. The current policy has

been redrafted and checked against the latest best practice guide, pending

final review.

1.10 Procurement

– Since the approval of the Procurement Policy, work has continued on

developing a suite of contract templates, forms and intranet documentation to

assist in providing consistent procurement practise across Council, and a level

of clarity for our contractors/suppliers. A purchase order terms and

conditions has also being developed, which will become the Council’s

default terms for the purchase of goods/services.

1.11 Taxation

- Finance continues to work with PricewaterhouseCoopers (PwC), the annual

tax update. (Attachment 2).

1.12 Refuse

Centre Review – review completed and draft report received.

Management will consider recommendations and the report will be finalised.

|

That the Audit and Risk Committee:

1.

receives the Internal Audit Update Report.

|

3.1

The purpose of this report is to update the Audit and Risk Committee (ARC) on

the status of Internal Audit within the Council. It is also an opportunity

for the Committee to provide feedback or suggest focus areas for the Internal

Audit Plan 2021.

4 Background

and Discussion

|

Reference

|

Progress since the last Committee Meeting

|

|

1

|

Review Internal Audit Plan

|

|

1.1

1.2

1.3

|

Regular ongoing

work:

· Responding and reporting on emerging audit risks associated with

the Annual Report (section 2);

· Review and implementation of previous recommendations (section 3

below);

· Taxation (section 8, included FBT audit in 2020, and a GST audit

in 2021); and

· Sensitive expenditure.

Specific

additional internal audit planned

2020-21

(as presented at the December 2020 ARC meeting)

· Refuse centre charging - audit completed, section 9.

· Cyber Security – audit in progress, (section 9).

2021-22 plan

· Risk- assurance map, once the risk identification, is complete;

· Fraud risk assessment;

· Procurement – review of implementation against the policy;

· Review of controls over consents issued to Council; and

· Asset data improvements related to Audit NZ findings.

It was suggested

that a risk-assurance mapping exercise is completed. Work has commenced

in this area. A register is being created of relevant audit and

assurance matters; this will then be mapped to the Risk Register.

Once the risk

identification and the assurance map has been completed a risk-based Audit

Plan will be developed.

|

|

2

|

External Audit Update –

|

|

2.1

|

Management

Letter Annual Report 30 June 2020

‘Report

to the Council on the audit of Tasman District Council’

The draft audit

management letter was received on 1 March 2021, the final report will be

tabled at this Committee, if available.

Key points:

· Audit NZ issued unmodified audit opinion dated 18 December 2020,

on the Annual Report 30 June 2020, with an emphasis of matter regarding the

impact of the Covid-19 Pandemic;

· One urgent recommendation related to overpayment to Councillors

(refer to the 2 December ARC meeting);

· Five recommendations related to Assets – Property, Plant and

Equipment; and

· One recommendation to improve debt collection process

(beneficial).

Management

responses, including planned actions are included in the report.

|

|

2.2

|

Long Term

Plan (LTP) 2021-31

The LTP

consultation document was due to be adopted by the Council on 25 February

2021, however, due to the WWL cost overrun announced on 25 February, it was

agreed with Audit NZ this needed to be reflected in the LTP budgets.

Other than the WWL matter, the audit progressed smoothly with no significant

audit issues raised. The consultation document is now scheduled to be adopted

at the 18 March Full Council Meeting, with the final LTP 2021-2031

to be adopted on the 30 June 2021.

The audit

opinion is expected to include an ‘Emphasis of Matter’ paragraph

regarding the Waimea Water Ltd cost assumptions, along with one on the water

reforms.

|

|

2.3

|

Audit Plan

2020-21

Audit NZ is

experiencing significant delays due to the effect of the additional work from

Covid-19 on both the 2020 Annual Reports, and the LTP audits, which are

currently in progress.

As a result, the

Audit Plan has not yet been received. This sets out the key focus areas

and risks, along with the proposed audit timetable. Audit NZ have

communicated that:

- Audit plan is

expected to be received end of April 2021;

- An interim audit

is expected to occur in late May 2021 to review systems and controls, however

a firm commitment of dates is not possible; and

- It is likely there

will be no pre-year end sample testing, which is similar to other councils.

Audit focus

areas are expected to be:

- Management

over-ride of controls (this is mandatory per the auditing standards);

- Land and

buildings valuation 2021;

- Waimea

Water Ltd accounting treatment, including accounting for the forecast cost

overruns.

*Pre-year end

testing is normally completed in April – June. The absence of

this increases the volume of audit work in September. Audit NZ will

assign additional audit resource and will be assigned to meet the statutory

deadline, 31 October 2021. This creates a challenge for the Finance section,

in terms of the increased workload in September.

|

|

3

|

Previous Audit NZ Recommendations

|

|

3.1

|

A Sensitive

Expenditure Policy

The Office of

the Auditor-General issued a new Sensitive Expenditure guide in October 2020,

which the Finance section reviewed against the Councils’

policies. A full update of the policy and guidelines has been

drafted. This is pending review and approval. The guidelines

provides further detail and clarification, with no substantial changes to

current practice.

An update will

be provided at the next Committee meeting, June 2021.

|

|

3.2

|

Training on

Bribery and Corruption. The Serious Fraud

Office has produced a training webinar on anti-corruption training, relevant

to the Council staff and elected members. Finance found this to be

beneficial. This is mandatory for all staff.

A Fraud Risk

Assessment will be included in the 2021-22 Internal Audit work programme.

Next steps are

to ascertain whether all staff have viewed the webinar and consider further

training needs.

|

|

4

|

Cybersecurity

|

|

4.1

|

Cybersecurity

Review

Cybersecurity is

a high priority to the Council, and has recently appointed a dedicated

Cybersecurity Manager. A cybersecurity review is currently in progress,

by Crowe (formally Crowe Horwath). The scope of the review is

attached. The review will evaluate the maturity of the Council’s

processes, policies, procedures, governance and other controls relative to

the US National Institute of Standards and Technology (NIST) Cybersecurity

Framework.

The review will

identify areas for improvement and provide recommendations to address the

areas identified. An external vulnerability assessment is also being

completed as part of this.

The final report

is expected late March 2021, and will be presented at the next Audit &

Risk Committee meeting.

|

|

5

|

Assessment of the current Financial Management

Information System - Issues and Risks

|

|

5.1

|

The risks and issues have been addressed, in respect to

maintaining a reasonable level of internal control.

The future of

MaqiQ will be reviewed as part of the digital strategy and any material

changes will be considered as part of the Digital Innovation Programme

included in the LTP proposals are executed.

The Corporate

and Governance Services Manager has reported that the Council through the

Regional Council Collaboration Group (ReCoCo) is participating in a shared

financial systems implementation feasibility assessment. This assessment will

assist the Council in its future decision making around the functional

requirements for a replacement Financial Management Information System.

Internal audit

will continue to monitor and report against the MagiQ issues and risks.

|

|

6

|

Sensitive Expenditure Review of Transactions

|

|

6.1

|

The Finance

section conducts regular reviews of Sensitive Expenditure to ensure policies

have been complied with, including the ‘one up’ approval process

and expenditure is prudent.

An internal

review of sensitive expenditure including travel, credit cards and employee

expense claims for six months to 31 December found:

- Majority of expenses had good audit trail, including the

descriptions being entered into the accounting system to allow more effective

analysis to occur.

- Travel and accommodation was booked via Orbit, the Council’s

preferred supplier.

- Occasional missing Tax Invoices due to receipts being lost.

- Occasional descriptions, in particular on Purchase Orders of

Councilors, were lacking detail. These will be followed up with the

relevant staff raising and approving the orders.

- Prudence –limits on spend e.g. lunches, are provided to

staff on request and discussed what is reasonable in training, including

inductions and team leader training. All expenses appeared to be

prudent, and within reasonable limits.

A meeting was

held with Orbit, the preferred travel supplier to discuss process, in

particular ensuring value for money. Dashboards were also shared which

showed:

- Hotels – Council average $134 per night vs Orbit Average of

$139.

- Days in advance (14 days+ is best value for money) – Council

bookings over 14 days were 63%, compared with 61% across Orbit,

providing a good base, yet with room for improvement.

This indicates

that the Council is buying reasonably well. Generally, flights are

booked in advance via Orbit. Benchmarking provided and we are

doing better than the average business in terms of pre-booking to achieve

best value for money. There was travel by Councilors that staff booked

less than 14 days in advance including occasional same day travel.

Outcomes

- Need to complete the update of Sensitive Expenditure Policy and

guidelines

- Reminder to all Staff and Councilors of the need to keep receipts,

and to take a photo as soon as they receive the receipt.

- Reminder to staff to record the business purpose in credit cards.

- Reminder to book at least 14 days in advance.

|

|

7

|

Procurement

|

|

7.1

|

Since the

approval of the Procurement Policy, work has continued on developing a suite

of contract templates, forms and intranet documentation to assist in

providing consistent procurement practise across the Council, and a level of

clarity for our contractors/suppliers. A purchase order ‘terms

and conditions’ is also being developed, which will become the

Council’s default terms for the purchase of goods/services.

A review of

Council’s financial delegations has also been conducted (with a focus

on those financial delegations under $20k) and the proposed changes will soon

be sent to Chief Executive for approval. Following approval, the

delegation limit changes will be updated in MagiQ. Refer to Governance

Update Report.

|

|

8

|

Taxation

|

|

8.1

|

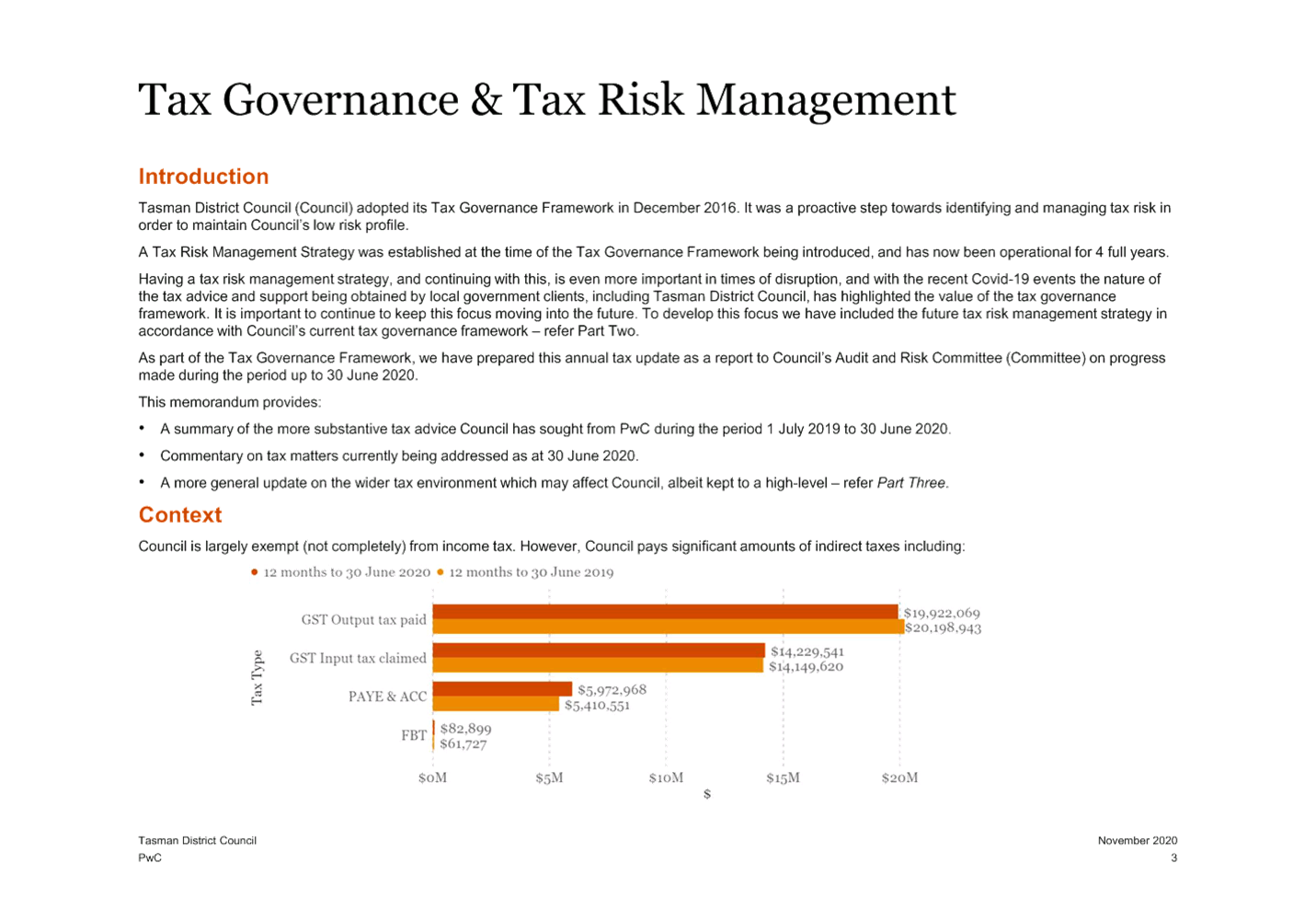

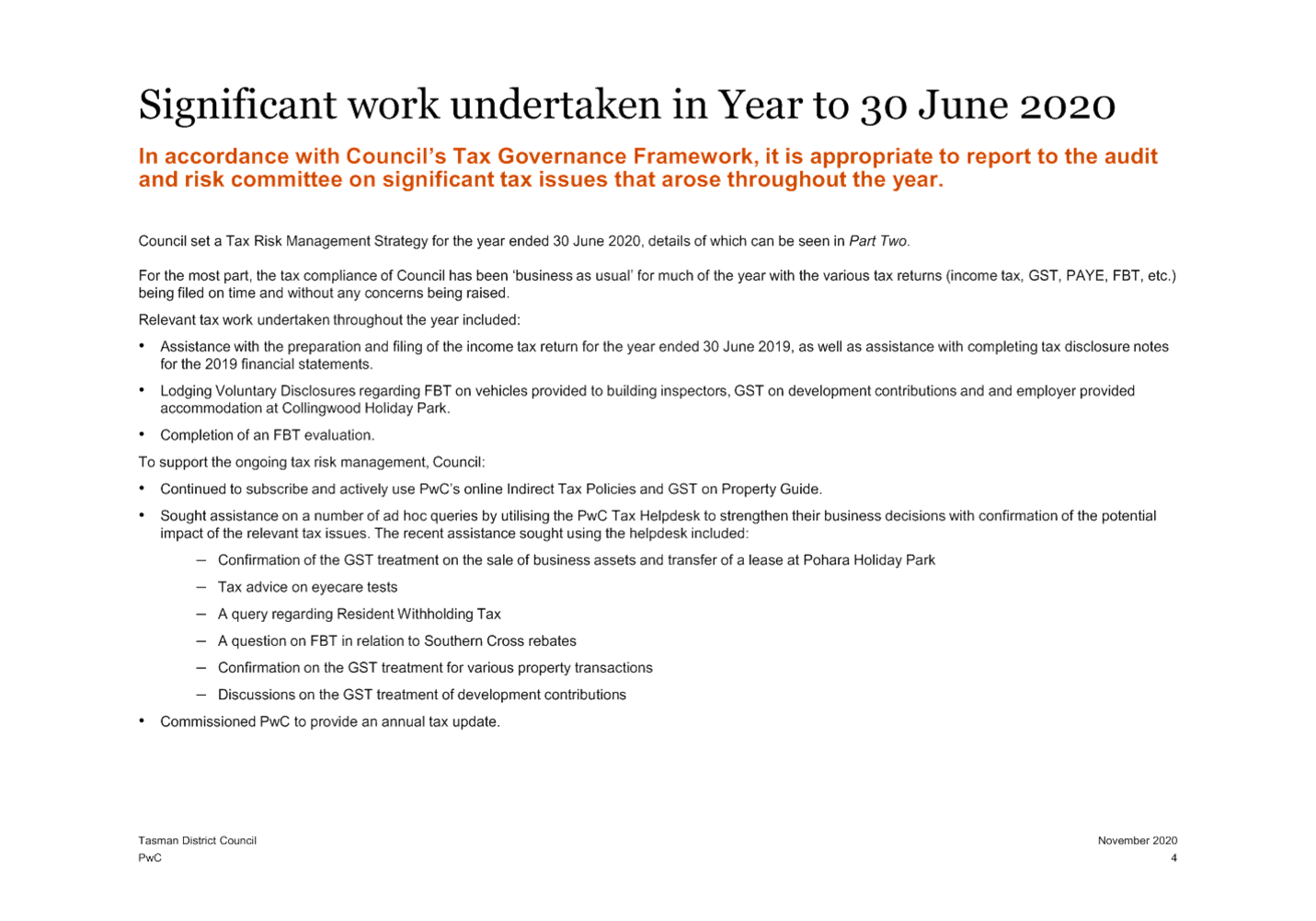

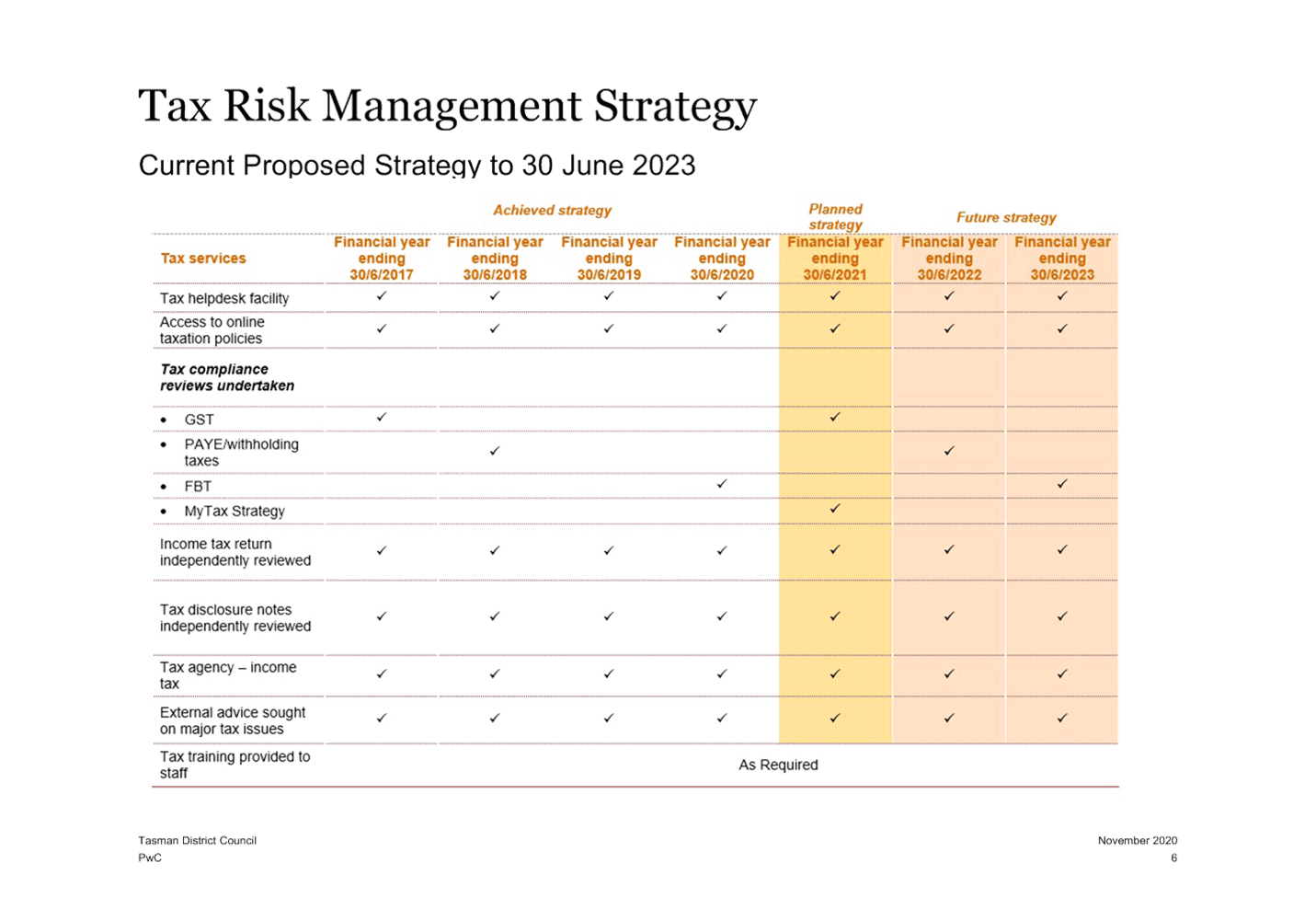

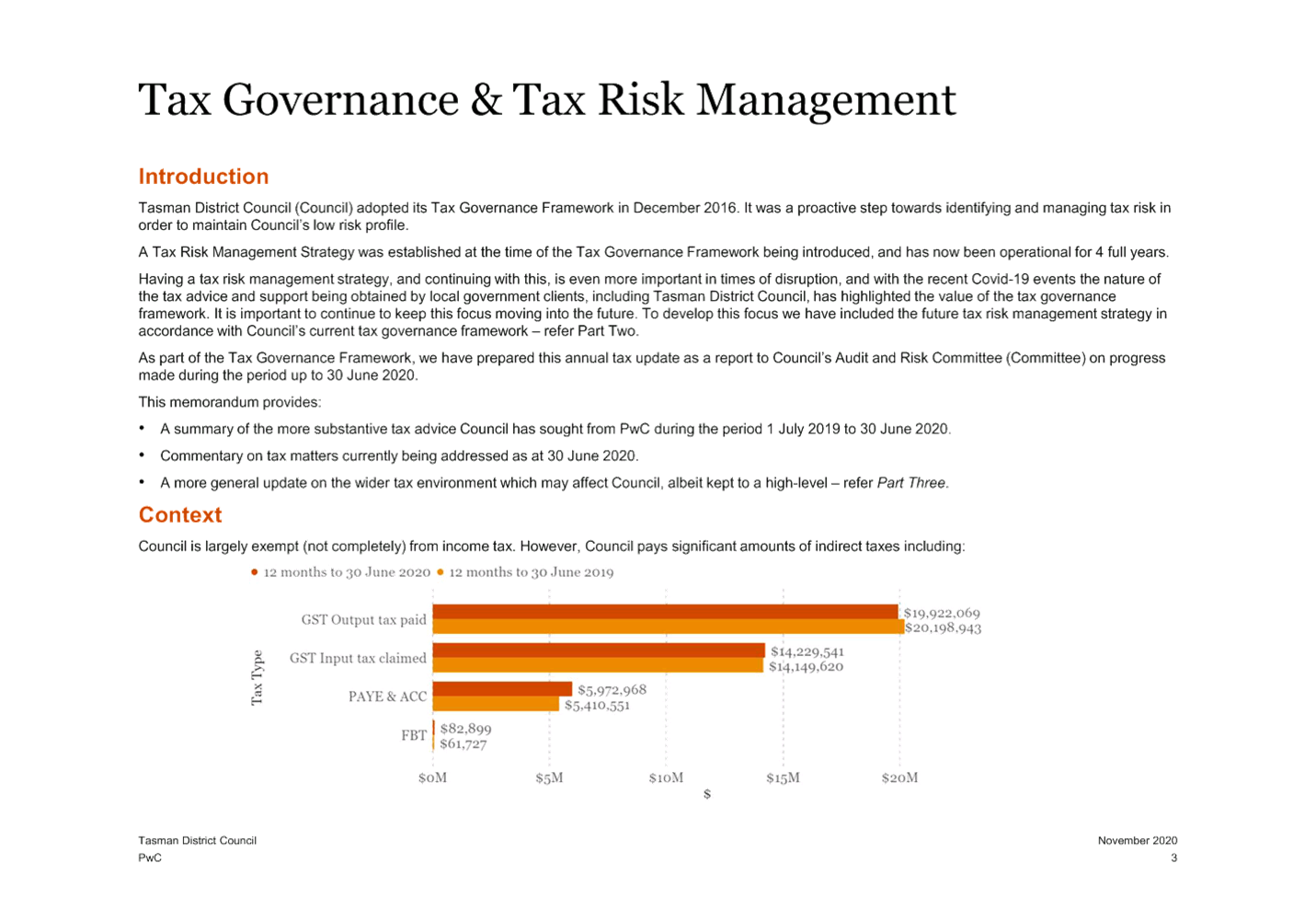

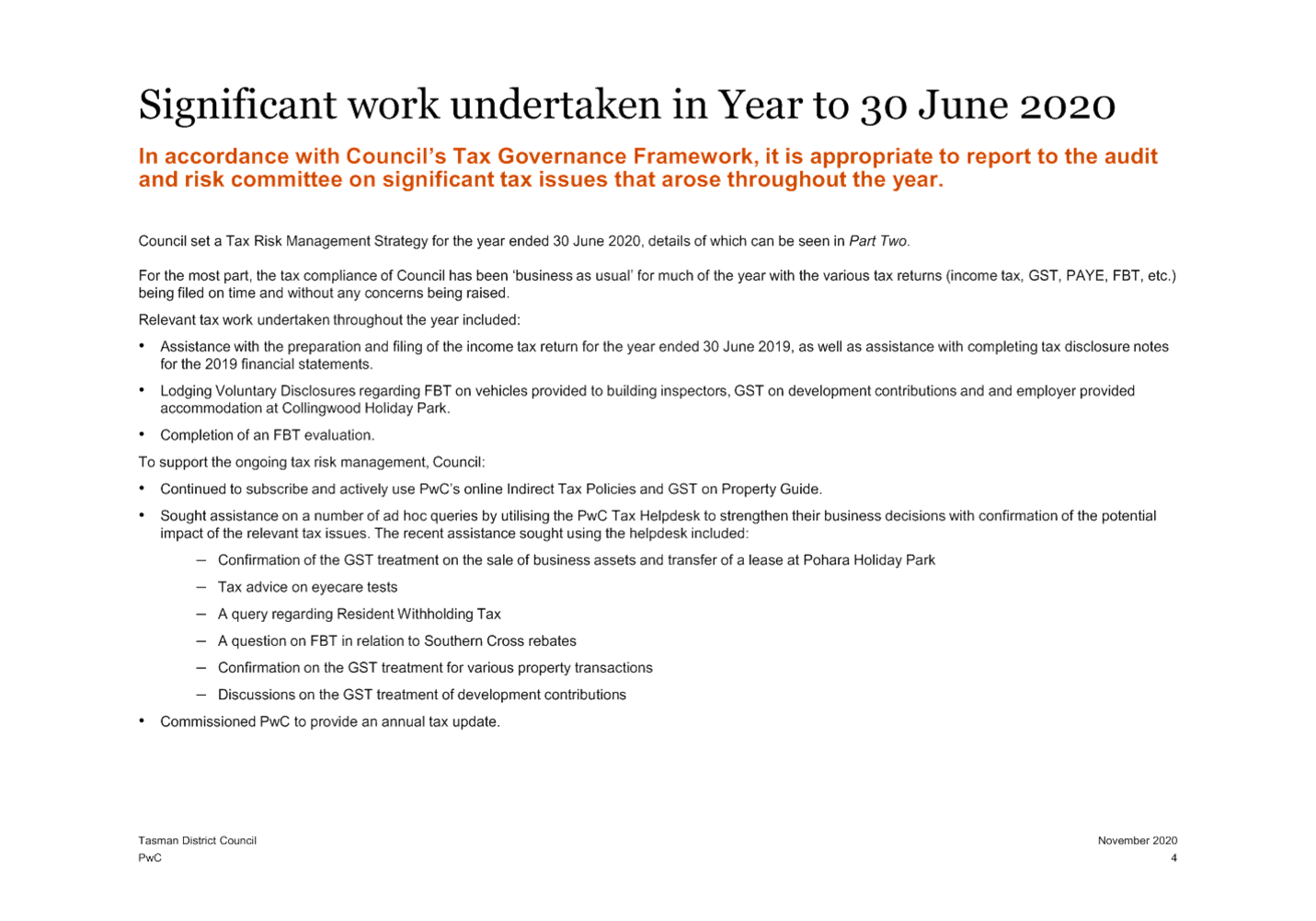

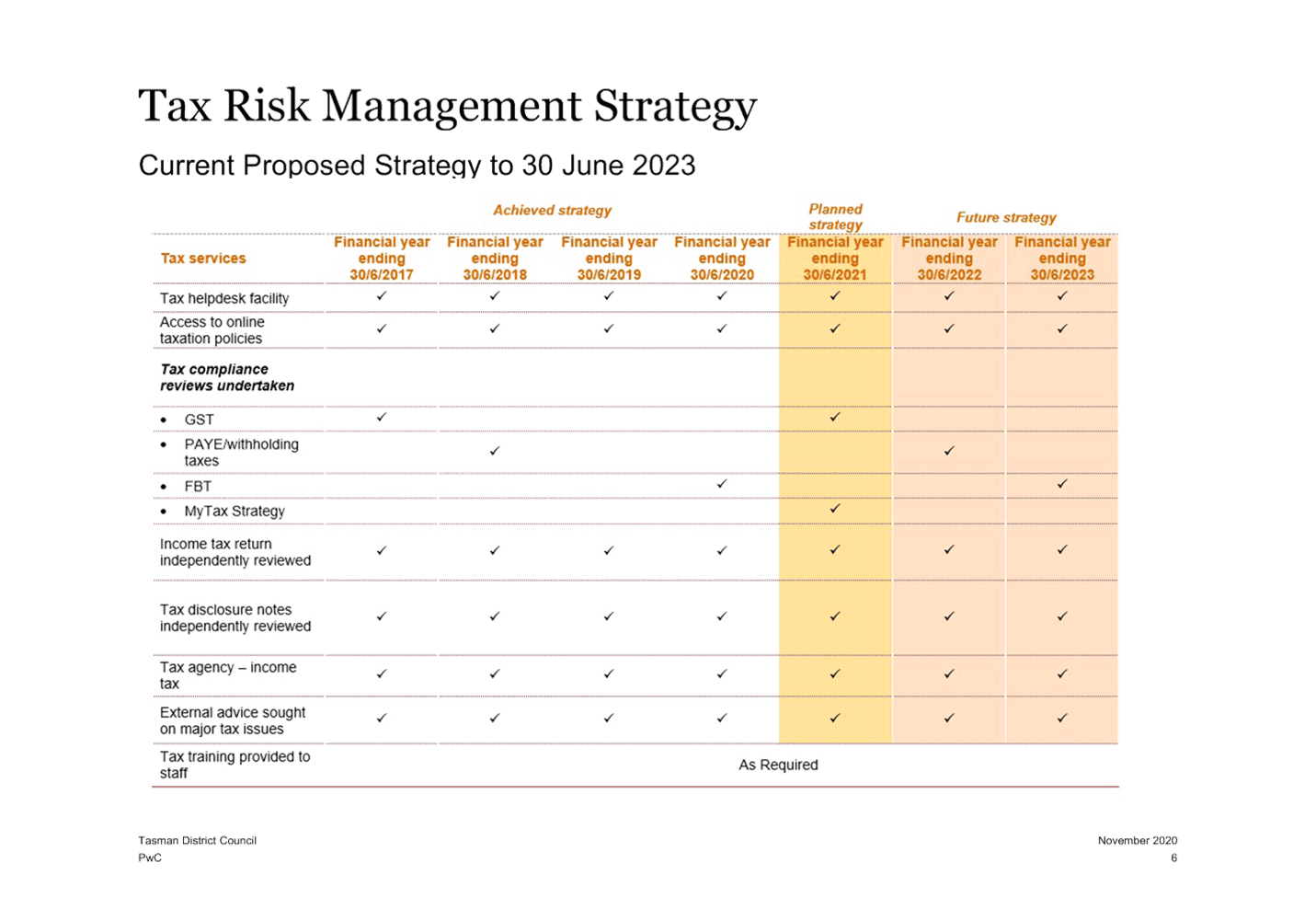

The Council has

a low-risk appetite in regards to taxation matters.

The Councils

Annual Tax update provided by PricewaterhouseCoopers (PwC) is attached, attachment

1, this includes:

- Tax Governance

and Risk Management;

- A summary of significant

work undertaken with Council in the year ended 30 June 2020;

- Tax strategy for

to 30 June 2023;

- Tax

developments.

Management also

received the finalised PwC report on the Council’s compliance with

Fringe Benefit Tax (FBT). The report found that overall the Council has

a very high level of FBT compliance and actively ensures it is paying the

right amount of FBT, which allowed PwC to focus on key areas during their

review. An action plan was provided to the Finance section, which is currently

being implemented. There were no areas of high risk identified. Medium

risk actions relate to motor vehicles, as previously reported to the Audit

and Risk Committee, and broadband reimbursements. The full report is

available to Committee members on request. The Corporate and Governance

Services Manager in conjunction with Nelson City Council and Port Nelson Ltd

have agreed to authorise an application to the IRD for a binding ruling on

aspects of the Holding Company proposal, particularity equity release.

|

|

9

|

Refuse Centre Audit

|

|

9.1

|

Crowe conducted

an internal audit review of charging at refuse centres. Several

recommendations were raised which internal audit shall review progress

against.

The key findings

were:

· Each operator does not have an individual profile on the POS

System;

· Selection on POS System for payment of fees via EFT-POS is not

automated between POS System and EFT-POS machine;

· Public/Non-Commercial Customers have the option to choose to pay

by either volume or weight. This could make analysis of trends for the

TDC difficult as the TDC is charged by weight for waste removal;

· Public/Non-Commercial Customers going over the weighbridge dump

their waste first before paying;

· Charges by volume or some materials, in which a degree of

judgement is involved, is potentially not consistently applied across all

operators;

· Transactions for non-paying services such as recycling drop-off,

not being logged on the odd occasion.

Summary of the

key recommendations are:

· Consistent/mandatory use of weighbridge;

· Each operator has a log in;

· Automation of the POS system;

· Analysis of data for trends.

Detailed

findings have been shared in a report to Management. Next steps are for

the recommendations to be considered by Management and the report finalised.

|

5.1 Key

priorities for the next quarter are the Long Term Plan and preparing for the

Annual Report for 2020-21. Also, continue to progress the matters above.

|

1.⇩

|

Tasman District Council

Cybersecurity Audit Scoping Document

|

13

|

|

2.⇩

|

Tasman District Council Tax Annual

Update 2020

|

21

|

Tasman District Council

Audit and Risk Committee Agenda – 18 March 2021

Tasman District Council Audit and Risk Committee Agenda – 18

March 2021

Tasman District Council Audit and Risk Committee Agenda – 18

March 2021

7.2 Risk Report

Information Only - No Decision

Required

|

Report To:

|

Audit and Risk Committee

|

|

Meeting Date:

|

18 March 2021

|

|

Report Author:

|

Trudi Zawodny, Operational

Governance Manager

|

|

Report Number:

|

RFNAU21-03-2

|

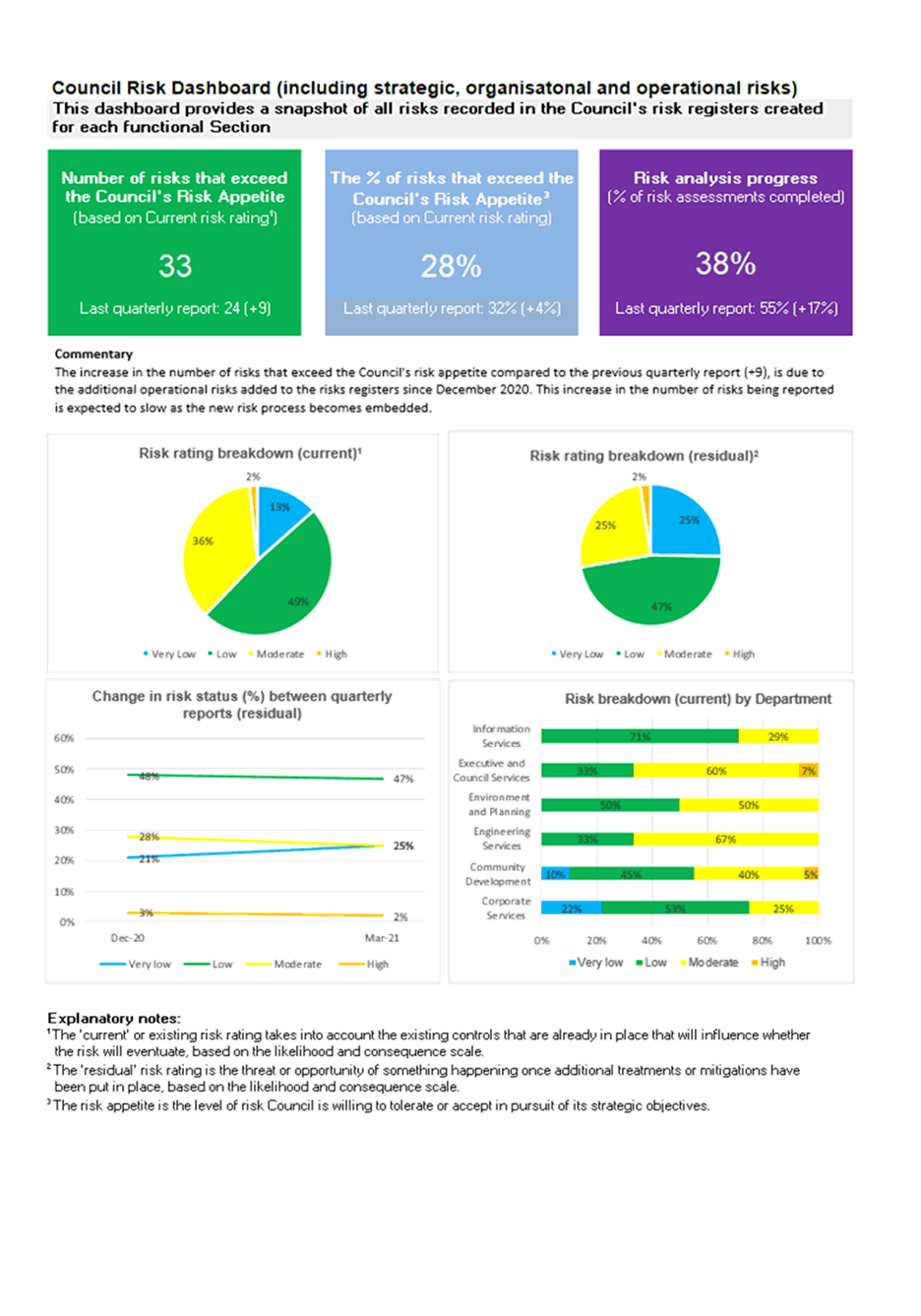

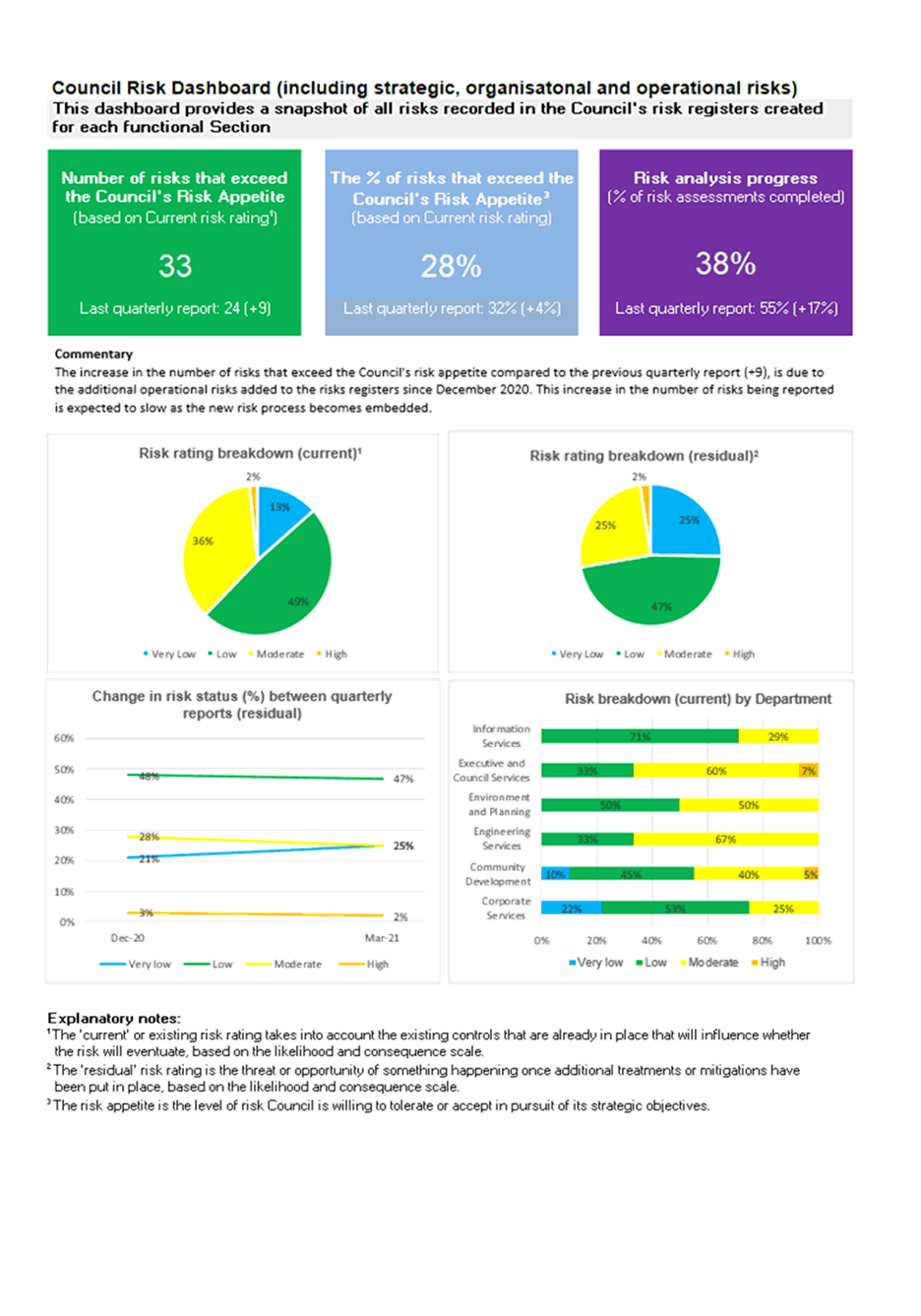

1.1 This

report provides a summary of the Council’s key risks and the current risk

profile of the Council.

1.2 The

risk dashboard is provided in attachment 1.

1.3 There

are 7 Strategic Risks. These are detailed in section 5

|

§ Climate

Change

|

Cyber Attack

|

|

§ Disaster

Event

|

IT Systems

Availability and Performance

|

|

§ Growth

|

Service Delivery

|

|

§ Project

and Programme Activity

|

|

1.4 There

are 3 Organisational Risks. These are detailed in section 6

|

§ Pandemic

|

Council Decisions

and Advice

|

|

§ Legislative

Requirements

|

|

That

the Audit and Risk Committee:

1 receives

the Risk Report RFNAU21-03-2; and it’s

attachment, the Risk Dashboard

3.1 This

report provides a summary of the Council’s key strategic and

organisational risks and the current risk profile.

4 Background

and Discussion

4.1 The

Council monitors 4 risk types. These are:

|

Strategic

|

The risk of an event or impact

that is external to the Council and could impact the

organisation’s strategies and community objectives, included in the

Long Term Plan and Annual Plan.

|

|

Organisational

|

The risk of an event or impact

that is internal or external to the Council and could impact

the whole organisation (such as health and safety)

|

|

Operational

|

The risk of an event or impact

that is internal or external to the Council and could impact

one or more Operational activity.

Operational risks which are part

of 'business as usual' operations will only be included in the Audit and Risk

Report if they are determined significantly by the Leadership Team to be

raised to a higher audience.

|

|

Emerging

|

Emerging risks are risks that may

develop or which already exist and are difficult to quantify but may have a

high consequence, high impact if they materialise.

Emerging risks will require

future analysis but their inclusion in Audit and Risk reporting is intended

as a discussion topic, recognising further work and analysis is required.

|

4.2 The

Council Risk Dashboard (attachment 1) provides a snapshot of all risks

recorded in the Council’s risk registers. These are managed at a

Departmental level.

5.1 Strategic

Risks are defined as the risk of an event or impact that is external

to the Council and could impact the organisation’s strategies and

community objectives, included in the Long Term Plan and Annual Plan.

5.2 The

7 Strategic Risks which the Council are monitoring are:

5.2.1 Climate

Change: Community expectations for the Council to respond to or mitigate

anticipated climate change effects cannot be met due to resource and practical

limitations resulting in reputational damage.

Management Response: This risk is early in its

maturity and requires further analysis to fully understand the consequences of

climate change to the Council if not managed appropriately (financial,

economic, social, environmental). Further controls are also required; however, initial

momentum has started with Council's Tasman Climate Action Plan 2019, zone

changes in the TRMP and upcoming Tasman Environmental Plan, and Council's

Infrastructure and Activity Management Plans.

The current risk rating remains high until additional

controls can be considered and implemented so this risk can be brought within

acceptable tolerance levels.

5.2.2 Disaster

Event: Council's ability to respond to a disaster event (man-made or

natural), and provide community services, is impacted due to human resource

capabilities.

Management Response: The Council's organisation-wide

business continuity plan is complete and was tested as part of the recent

Covid-19 response and lockdown. Additional work is required to finalise and

test business continuity plans for each functional area within the Council,

which is a high importance control and will be revisited in 2021 by functional

managers. An Earthquake Preparedness Plan is the current focus. Earthquake

events are the most likely to create widespread disruption to the Council's

services and impact on the number of staff who are available to work.

The overall residual risk rating remains within acceptable

tolerance levels.

5.2.3 Growth:

Growth in the region occurs quicker than planned which impacts the

Council's finances and the ability to provide infrastructure and services to

high growth areas.

Management Response: Growth and the ability to

accurately model and plan for development in the region is a significant

strategic risk for the Council and its delivery of services. A growth model is

used to track actual and predicted development at least every three years.

Additional controls include updated modelling data, which is intended to

improve growth predictions along with close consultation with developers. While

growth has outstripped predictions in recent years, the Council is comfortable

that it is keeping pace with development and the installation of

infrastructure.

Leadership discussion is required to establish a risk

appetite for significant growth changes as there is no applicable appetite

within the Council's risk appetite statement.

5.2.4 Project

and Programme Activity: A lack of coordinated project and programme

activity across Council results in incomplete projects and/or use of external

funding.

Management Response: The Council has established a

Programme Management Office, which coordinates the management of shovel ready

projects and other Government-funded projects, post-Covid-19. Internal

strategic projects may also be managed later. This new central group will

contribute to PMO capacity and project management experience within the Council

and will provide improved visibility of project activity. Once fully

established and operational the PMO will reduce the risk rating to Low,

however, the ongoing effectiveness of the PMO will need to be monitored.

5.2.5 Cyber

Attack: An

ineffective cybersecurity posture makes it easier for attackers to successfully

breach Council systems, which could impact it financially, legally,

operationally and damage our reputation.

Management Response: Through the Digital Innovation

Programme, Council is taking a more strategic cybersecurity approach. This has

resulted in the establishment of a Cybersecurity Manager role in 2021 that is

now responsible for the creation and execution of a cybersecurity programme to

foster an effective cybersecurity culture. Controls will include the adoption

of a cybersecurity framework, a concerted and ongoing cybersecurity education

programme, implementation of more advanced tooling to identify and eradicate

vulnerabilities more quickly across all platforms, and targeted penetration

testing including physical assets like our utilities. 2021 will be a mix of

focusing on the long term and strategic level, but also putting in quick win

controls.

The current risk rating is Moderate. This has increased

since the previous report as a result of further analysis. Even though

the programme is expected to be very mature by 2023, due to the ever-evolving

cyber threat landscape, it may never be able to reduce the cyberattack risk to

Low.

5.2.6 Service

Delivery: The Council fails to meet public expectations in the delivery of

services, which results in public dissatisfaction and reputational damage.

Management Response: Council's vision and the

strategic outlook is outlined within the Long Term Plan and Annual Plan.

Additional controls such as the newly established PMO along with the more

proactive release of Council information through the website will assist in the

communication of Council services and projects. Council's reputation is heavily

influenced by the responsiveness of all staff to customer interaction.

The overall risk rating of Moderate remains within acceptable

levels.

5.2.7 IT

Systems Availability and Performance: The loss of availability or significant reduction in a

system’s performance may render it ineffective in the delivery of service

to one or many Council functions and therefore affect Councils ability to meet

our staff and communities requirements.

Management Response: The existing control for this

risk is the IT Transformation Business Case, which will deliver new digital

channels and services needed to meet citizen’s demands and expectations,

and the Council requirement for stable systems and platforms to help them

manage their activities efficiently and effectively. The shift from traditional

computing to Cloud Computing and alignment to Microsoft's public cloud

infrastructure will address many of the typical availability concerns and

risks. This enables services and staff to operate independently of the

traditional data-centre.

While delivering services from the cloud and enabling users

to operate from anywhere reduces availability risks, it does not fully

alleviate them. The availability of cloud resources remains a risk. Highly

redundant internet links, regional, national and international links are items

necessary to further mitigate. With the heightened investment, we should be

able to significantly reduce this risk item across the next 5 years. Heightened

investment in IT platforms is required to achieve Public Cloud Computing,

without it the likelihood of future failures remains.

The current risk rating is within tolerance levels and a shift

to Cloud Computing will further lower the risk.

6.1 Organisational

Risks are defined as the risk of an event or impact that is internal or external

to the Council and could impact the whole organisation (such as health

and safety)

6.2 The

3 Organisational Risks which the Council are monitoring are:

6.2.1 Pandemic

- A pandemic occurs (that requires a regional response) resulting in staff

absence which impacts council operations.

Management response: The

central government and DHB guidance heavily influence this risk, however, the

Council has an established pandemic plan that identifies essential and

non-essential activities and how those activities should be managed during a

pandemic (e.g. influenza, measles). Internal decisions will be made by senior

leaders about the re-deployment of staff from non-essential areas to maintain

essential services if required.

There are no further mitigations identified and the residual

risk rating of Moderate remains outside of the Council's risk appetite

recognising Council's low appetite for Health and Safety risk. This risk has

been moved from the Strategic risk profile to the Organisational profile.

6.2.2 Council

decisions and advice - Staff

or Council make a decision or provide advice which may result in a challenge to

that decision, including lodgment of legal proceeding.

Management Response: This risk depends on the

robustness of the Council's statutory decision-making and the degree to which

those receiving the advice or decision, or those affected by the decision.

Council employing competent and qualified staff, having in place training and

peer review processes, and ensuring adequate reasons are given and communicated

to those affected, mitigates the risk. Further work is required to develop and

analyse this risk.

6.2.3 Legislative

requirements: Staff

or Council fail to comply with legislative obligations, which expose the

Council to litigation.

Management

Response: This risk has many interdependencies and impacts across

the Council, including financial, legal, environmental, or health and safety.

Controls include further legal training in delegations, legal processes and

government regulations, which will reduce the overall risk rating to Low and

within tolerance levels.

The current risk

rating is moderate, which exceeds the risk appetite of Low.

Tasman District Council

Audit and Risk Committee Agenda – 18 March 2021

Tasman District Council

Audit and Risk Committee Agenda – 18 March 2021

7.3 Governance Activity Report

Information Only - No Decision

Required

|

Report To:

|

Audit and Risk Committee

|

|

Meeting Date:

|

18 March 2021

|

|

Report Author:

|

Trudi Zawodny, Operational

Governance Manager

|

|

Report Number:

|

RFNAU21-03-3

|

1.1 This

report covers a range of Operational Governance activities. The purpose

of the Operational Governance function is to assist the Council to achieve its

objectives by providing support in a number of areas including responding to

LGOIMA requests, Risk Management Processes and Internal Policy Management.

1.2 Risks

are covered in a separate report.

1.3 The

Delegations Register was last published in December 2020, with the next version

due for publication in end of March 2021.

1.4 LGOIMA

requests for the 12-month period of July 2019 to June 2020 – 93% were

answered within the statutory period. This is consistent with the previous

reporting period.

1.5 Ombudsman

Enquiries – At the start of February the Council had two investigations

underway and one investigation pending with the Office of the Ombudsman. The

Office had closed five investigations.

1.6 Privacy

– there are no reported privacy breaches for the period from April to

June.

That

the Audit and Risk Committee:

1. receives

the Governance Activity Report RFNAU21-03-3;

3.1 This

report provides a summary of the Council’s Governance activities for the

period the 1 August to 31 January 2021

4 Background

and Discussion

4.1 Delegations Register

The Delegations Register was updated in

December 2020 with the following changes:

|

Part Two

|

· None

|

|

Part Three

|

· None

|

|

Part Four

|

· Sale and Supply

of Alcohol Act s196 Power to carry out the function and duties as secretary

of the District Licensing Committee (existing delegation not captured

previously)

· Schedule One

(Financial Delegations) – added Cybersecurity Manager

|

|

Part Five

|

· CN20-10-23

– Updated Joint Councils’ Committee ToR’s

|

The next update to the printable Delegations Register will be made at

the end of March.

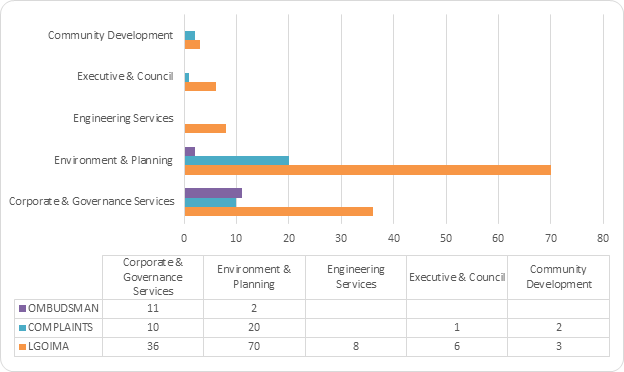

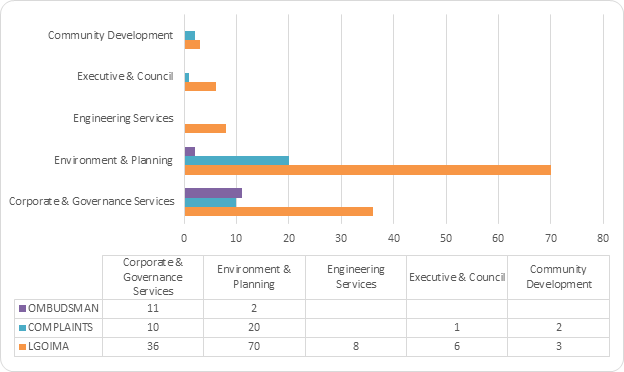

4.2 LGOIMA/COMPLAINTS / OMBUDSMAN

The following data covers the period 1 August 2020 – 31

January 2021

Things to note:

§ There have been 122 LGOIMA requests. 6 remain open

§ 93% of LGOIMA requests were answered within the statutory

timeframes.

§ 32 complaints were received,

with 8 ongoing

§ 63% could be answered within the

Policy timeframes.

§ 13 Ombudsman enquiries were opened

and 2 remain ongoing

§ Extensions

were applied to three cases, due to sourcing of documentation/extensive

collation of information required.

During this

reporting period, the three databases (LGOIMA/Ombudsman and Complaints) were

transferred to Doris and merged into one database.

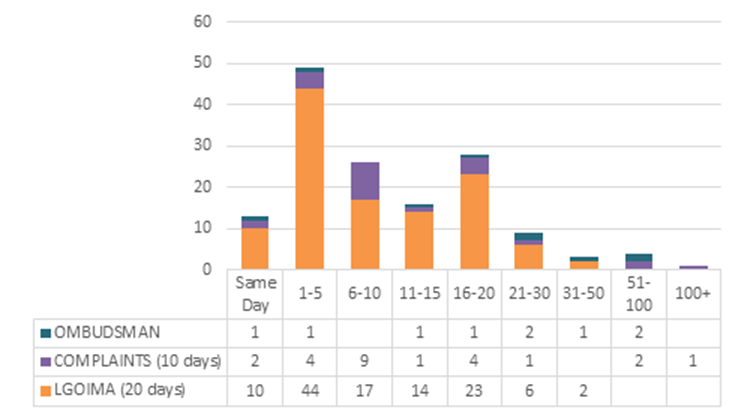

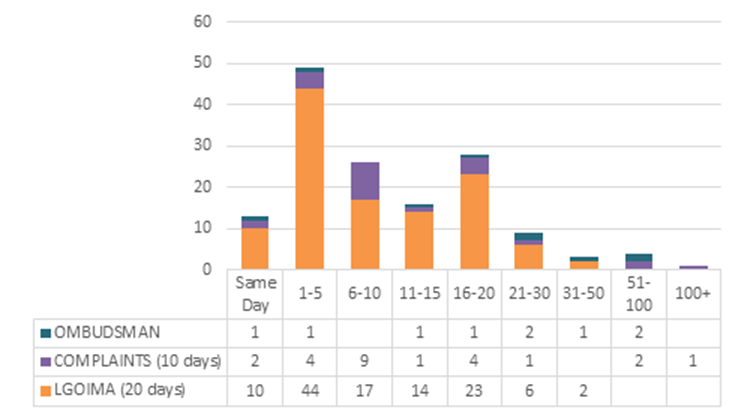

4.2.1 Response Times (Days taken to Complete)

LGOIMA requests

should be responded to within 20 working days. Eight of these requests did not

meet that target for the following reasons:

§ Two extensive collation –extensions were requested

§ One missing documents, which were not located – extension

requested

§ One we did not provide all the information requested with no

explanation, therefore the requester re-opened their enquiry

§ One misclassification – registered as a LGOIMA, whereas it was

a complaint.

§ Three missed deadline with no explanation. 1 x 1 day, 1 x 2

days, and 1 x 9 days

4.3 Ombudsman Investigations Completed

|

Nature of complaint

|

Outcome

|

|

Withholding material

|

Council has agreed to release

some redacted documents.

|

|

Failure to respond to LGOIMAs

|

Ombudsman found that we had not

met our statutory obligations to respond to requests; we have complied with

the direction to respond to his requests.

|

|

Menacing dog

classification

|

Following our response on

21/11/2020, we have received no further communication from the Ombudsman. Assumed

closed.

|

|

Withholding material and

charging

|

Ombudsman found the charge was

unreasonable and some information should be released. The charge was

refunded and information released.

|

|

Ongoing dispute

|

Letter agreed with Ombudsman and

sent. Complainant notified as unreasonable complainant – incoming

emails are now forwarded to LGOIMA inbox.

|

4.4 Complaints escalated to the Chief

Executive

4.4.1 In

alignment with the Council’s Complaints Policy, complaints to the Chief

Executive will only be considered once all opportunity for the complaint to be

resolved by Council Officers has been exhausted. Complaints received

directly to the CE, which have not been previously considered by a Council Officer,

are not reported here.

4.4.2 Four

investigations are underway (two of them are counter complaints against each

other)

4.4.3 The

following complaints have been closed:

|

Nature of complaint

|

Outcome

|

|

Historic building compliance

(own property)

|

Responded reiterating the

previous position.

|

|

Drainage (own property)

|

Responded reiterating the

previous position. Referred complainant to MBIE.

|

|

Building consent (own

property)

|

Responded reiterating the

previous position, and repeating offers to meet with complainant.

|

|

Non-notified building consent

(neighbours property)

|

Responded that we considered our

actions appropriate. An Ombudsman investigation has been initiated.

|

|

Monitoring of Resource Consent

(neighbours property)

|

Responded reiterating the

position that we are satisfied with actions taken by the landowner. Ongoing

correspondence with LT member.

|

|

Threat to a staff member

|

Confidential.

|

|

Committee decision

|

Response provided. The

Complaint has been escalated to a local member of parliament.

|

4.5 Privacy

There have been no privacy breaches

reported for the quarter of October to December

4.6 Policies

The following new internal policies

have been approved:

|

Policy Name

|

Date Approved

|

|

Birthday

Leave

|

July 2020

|

|

E-Bike Policy

|

August 2020

|

|

Remote

Working Policy

|

August 2020

|

|

Unreasonable

Complainant Policy

|

August 2020

|

|

Procurement

Policy

|

October 2020

|

|

Body Worn

Video Camera

|

November 2020

|

4.7 Update on Audit and Risk Committee

Review

4.7.1 The Charter

and Terms of Reference have been adopted and published on the public

website. They will be included in the next update to the Delegations

Register

4.7.2 The number of

meetings has been increased from four to five. Due to the schedule for

2021 already being published, we have locked in the date for the Annual Report

review, rather than it being optional, and created the option for an extra

(sixth) meeting if required.

4.7.3 The Position

Description for the Independent Chair has been confirmed and the recruitment

process has commenced.

4.7.4 The proposed

work-plan is being socialised with contributors and the Committee should start

to see additional reports coming through.

5.1 The

key priorities for the next quarter are:

5.1.1 Review

of the reporting to the Standing Committees.

5.1.2 Review

of the Commercial Committee

5.1.3 Implementation

of agreed changes to delegations for Community Boards

Nil

Tasman District Council

Audit and Risk Committee Agenda – 18 March 2021

7.4 New Policy

Information Only - No Decision

Required

|

Report To:

|

Audit and Risk Committee

|

|

Meeting Date:

|

18 March 2021

|

|

Report Author:

|

Trudi Zawodny, Operational

Governance Manager

|

|

Report Number:

|

RFNAU21-03-4

|

1.1 The

Unreasonable Complainants Policy has been developed to provide Council staff

with guidance on how to manage correspondence from complainants who are making

unreasonable demands on the Council through their frequent and persistent

complaints.

1.2 It

was written following the guidance from the Office of the Ombudsman.

That

the Audit and Risk Committee

1. receives

the New Policy report; and its attachments.

3.1 To

provide the Audit and Risk Committee visibility of internal policies that have

recently been approved.

4 Unreasonable

Complainants Policy

4.1 In

2012 the Office of the Ombudsman produced the “Managing unreasonable complainant conduct

practice manual

“It is

intended to help agencies employ a systematic and consistent approach to

managing their interactions with complainants who exhibit unreasonable

complainant conduct by offering a framework of strategies, and providing sound,

sensible advice on how to better manage responses to these complainants.”

4.2 The

attached Unreasonable Complainants Policy (Policy) is based on the guidance in

the above-mentioned document.

4.3 Through

the drafting process, we sought and incorporated feedback from the Ombudsman on

our Policy, changing some of the language to align with our style.

4.4 This

Policy supplements the Complaints Policy.

4.5 The

Policy has been developed to provide Council staff with guidance on how to

manage correspondence from complainants who are making unreasonable demands on

the Council through their frequent and persistent complaints.

4.6 A

standardised response letter has been developed for staff to use, also based on

the advice from the Office of the Ombudsman. It ensures that responses

are consistent and that Council staff do not miss out on important information

when communicating with recipients.

4.7 The

application of this Policy is undertaken with considerable care, and may only

be authorised by the Chief Executive. It has been applied once since its

implementation. Councillors were advised of this on 24 November

2020. To disclose who this was in relation to as part of this report

would breach their privacy.

5.1 There

is no further action planned.

|

1.⇩

|

CS29 Unreasonable Complainants Policy

|

65

|

Tasman District Council

Audit and Risk Committee Agenda – 18 March 2021